- What is Financial Modeling and How Can It Help You Manage Your Portfolio?

- Financial Modeling for Beginners

- Crafting an Effective Executive Summary for Your Pitch Deck

- Understanding the Benefits of Cash Flow Forecasting

- What Is the Difference Between Zero Based Budgeting and Traditional Budgeting?

“Making more money won’t solve your problems if cash flow management is your problem.”

– Robert Kiyosaki, American investor and author

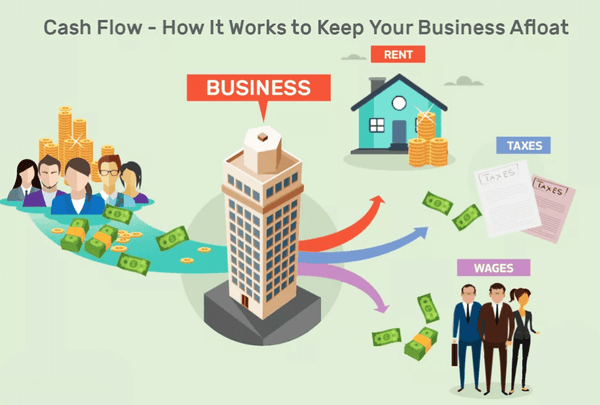

As Robert Kiyosaki Boards, startup entrepreneurs, big players, and visionaries need to stay on top of their cash flow by monitoring their statements monthly or even weekly. In order to keep an eye on the pulse of a business, you need to check all the numbers and know exactly how much is coming in and how much is going out of the business. Make more than you spend? It’s awesome. Nevertheless, many profitable small businesses fail due to poor cash flow management.

Download the Excel template! Learn even more ⟶

What is this thing you call cash flow

Everyone needs money for essential business growth. If you are creating a new project, cash flow is at the heart of any business. It is based on the inflows and outflows of a net amount of cash and cash equivalents during the reference period, for example, a fiscal year. Cash flow is used to assess the company’s revenue, how liquid it can be, and to highlight whether the company’s solvency remains stable.

Budgeting and strict measurement can really help stabilize cash flow management. One of the main reasons a startup fails is because new entrepreneurs don’t understand cash flow management. If you consistently spend more than you earn, you have a cash flow problem. Here are some tips that entrepreneurs can use to boost cash flow and strengthen a company’s liquidity.

Ways to successfully manage your business cash flow

Download the Excel template! Learn even more ⟶

Cash flow management helps you To monitor, analyze and adjust your company’s cash. What you need to do first is make a cash flow projection for the next week, month, or year. Accurate projection and good analysis will be the key moves for you and will help you notice and prevent big problems from happening.

Certainly, at some point, you expect or will see that you have a lack of money to pay your bills. Of course, making mistakes doesn’t mean you’re a failure as a business owner. It just means that you are a normal entrepreneur who tries and learns in life, and you cannot perfectly predict the future. The following steps reflect a common daily trading process that can help you bridge the gap.

How to do cash flow management

You need to monitor your cash flow properly and regularly

Try using online accounting software services that make it easy to reconcile your accounts, generate reports, etc. As the data is mostly secured in the cloud of such a service, you can easily stay on top of your cash flow no matter where you are.

Improve financial control of payroll

Receive the instant you provide service and you will never have payment problem.

However, there are other specific techniques that can help you accelerate your receivables and improve cash balance:

- Get faster payouts by offering offers to customers

- Require a customer to make payment at checkout

- Send invoices promptly when work is completed or products are delivered; Follow up when payment is late

- Don’t let travel issues slow down your billing

- Get paid faster using mobile payment apps

Free up cash flow by reducing costs

Being cash positive and market share is actually successfully managed through the downturn by cutting costs. Have you looked into cutting costs on utilities or equipment you don’t use?

Look for a cash flow solution with a line of credit

Since cash is king, you need to have a good understanding of your cash flow. Once in a while, a line of credit can fill the gap.

Protect your cash flow to cover unexpected costs by leasing your equipment instead of buying it

To keep your business moving, you can cut costs by leasing equipment, appliances, and other things. Learn more about Startup costs in our article. Ensuring your cash flow is always on top and properly managed is key to your success. Don’t let a few missteps land you in a huge budget shortfall.

Download the Excel template! Learn even more ⟶

Conclusion

Don’t forget to improve cash flow for your business. A number of businesses struggle with late payments, control of assets, profits and revenue due to poor management. These are the most general sources of start-up cash flow problems.

Read more articles in the blog To learn how to prevent these misfortunes from interfering with your business cash flow. Check out our latest blog posts now or Contact us!

[right_ad_blog]