- Creating a Clear Path for Improved Business Performance: A Guide to Business Plan Monitoring

- Creating a Strategic Plan for Your Business

- Unlocking the Power of Financial Statement Analysis

- Common Mistakes to Avoid When Writing a Business Plan

- How to Secure Funding for Your Business Plan

The cash burn rate is part of every financial model. So, we have designed 450+ Financial Model Templates Designed in Excel or Google Sheet for different companies which are ready to use and you just need to type the inputs in the yellow cells and you will get the desired financial model. You can also check out Ecommerce Financial Model Templates , SaaS Financial Model Templates.

After reading this article, you should be able to learn:

- What is Cash Burn Rate?

- How to calculate the cash burn rate?

- Cash Burn Rate Limits

- FREQUENTLY ASKED QUESTIONS

What cash burn rate?

The cash burn rate describes the rate at which a company spends its cash available for operations before generating revenue from its business activities. This rate is usually stated as cash expenditure per month. Generally, in startup, is not able to generate funds during its creation stages. The venture capitalist and seed funders provides funds to these businesses based on the burn rate of the business.

The burn rate is used as a tracking tool by investors and managers to forecast their monthly cash requirements before they start cash generation.

There are two types of burn rate i.e.

This rate represents the amount of operating expenses that the company incurs on a monthly basis. This rate is based on the assumption that start-up activities have not yet generated positive cash flows.

The net burn rate is used in case the business generates revenue from its operations. It indicates the rate at which the company is depleting its money. It is calculated by deducting operating expenses from the revenue generated.

Similar to the burn rate, days cash on hand also indicates the number of days that the company can continue to operate with its available cash balance in the business.

How to calculate cash burn rate?

The burn rate is calculated using simple cash flows over a period using the following formula:

Burn Rate = (Initial Cash Balance – Closing Cash Balance) / number of months

For example, a company has its own fund of 0,000. Additional capital of ,000,000 is injected by an investor. During a one-quarter period, the company incurred operating expenses of 0,000.

For accurate burn rate calculation, you must select long enough periods to account for periodic fluctuations. In case the business incurs expenses of 0,000 in one month and 0,000 the next month. The burn rate calculated for the two months may not truly reflect business expenses.

As explained above, there are two types of burn rate which can be calculated as follows:

- Gross burn rate:

The gross burn rate is calculated by adding all of a company’s operational expenses for a given period.Gross burn rate = operating expenses / number of months

- Net burn rate:

The net burn rate is calculated by taking into account the cash generated by business during the period. Cash inflows are deducted from cash outflows;Net Burn Rate = (Cash Generated – Cash Out) / number of months

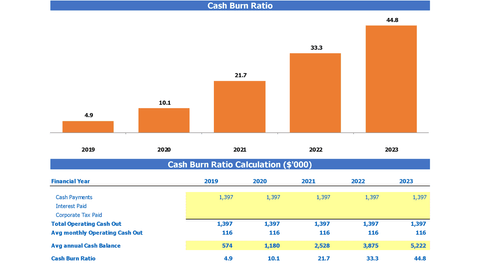

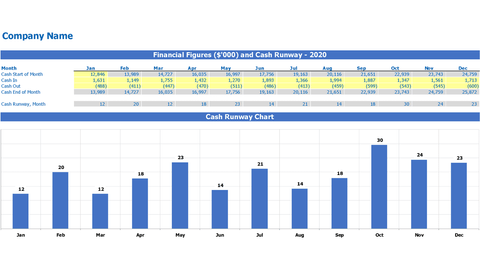

IMPORTANT POINT: We have designed a free Excel/Google sheet Cash Burn Rate Calculator & Cash Ratio Excel Template Calculator where you just need to put your assumptions in the yellow cells. The templates help you assess and manage a cash runoff ratio to ensure your business has enough cash for further growth and provides an executive dashboard to visualize the results of the tool.

Download Cash Burn Rate Calculator in Excel

Download Excel Cash Ratio Excel Template Calculator in Excel

Importance of cash burn rate

The burn rate is an effective tool indicating the business owner and manager regarding the sufficiency of funds available to fund their operations before generating their own revenue or raising additional finance from investors.

The burn rate also indicates management’s ability to utilize its available funds. In the event that a company has a higher burn rate, this could indicate that the company is spending too much and on the other hand too low rates warn the investor of the reluctance of the management towards the investment. and growth.

Established businesses should also regularly monitor their burn rate if they are faced with operational losses. It will help management assess their ability to pursue concerns and take steps to improve revenue.

The cash burn rate has also been used to calculate the cash trail which indicates how well the business will continue to operate with the existing cash balance before fully exhausting available funds.

Cash Runway is calculated as follows:

Cash Pisteway = Available Cash Rate / Burn Rate

Cash burn rate and cash trail are very critical for startups to have an eye on its spending and crafting strategy to achieve the goals of the organization.

The burn rate is also an indicator of business sustainability. If the burn rate is too high than the cash generation cycle of the business, it can create challenges for the business to continue in business. On the other hand, too low cash burn rate also indicates that the company is not using its funds to grow in business and remain competitive.

Ways to Improve Burn Rate

In the event that a company realizes that its burn rate is too high, or a start-up company needs to keep its burn rate at a reasonable level to avoid the risk of cash outflow Reasonable burn rate:

- Financial Analysis: Analyzing the company’s financial reports for a specific period of time will help identify trends in spending and management can determine the reasons for increasing or decreasing trends.

- Cost reduction: Cost reduction is the most important factor in controlling the burn rate. By analyzing operating expenses and cost of sales, companies can control its burn rate.

- Revenue Enhancement: For established businesses, the cash burn rate and cash trail can be improved by identifying ways to improve revenue to generate sufficient funds to cover the operational expenses of the business.

- Other Factors: Other factors that can help improve the burn rate include increasing the cash collection cycle, relocating debt, delaying major purchases, negotiating with creditors for a longer credit period .

Burn Rate Limitations

Despite the fact that the burn rate is an essential indicator for companies to assess its durability, the burn rate has some inherent limitations which are explained as follows:

- Burn Rate Inderst Business Manager regarding spend rate, however, there is no benchmark for a reasonable burn rate.

- The burn rate cannot be analyzed in isolation and one must thoroughly review and analyze the business plan of the company to assess whether the rate is reasonable or not.

- Expenses are assessed in total rather than on an individual basis. Some expenses are highly relevant and cannot be avoided to continue operations or expand business operations.

- This does not indicate what type of expense should be limited to maintaining a better burn rate given industry standards and operating style.

FREQUENTLY ASKED QUESTIONS

Q. Is there a standard burn rate?

A. There is no such standard burn rate. The company’s business plan should be analyzed to comment on the reasonableness of the burn rate.

Q. Can the burn rate be negative?

A. Profit generating companies may have a negative net burn rate because it generates more money than it spends.

Q. Can the entity manage its burn rate?

A. Yes, management can take different actions to manage their burn rate which can include cost reduction, revenue improvement, deferral payments, etc.

Q. What does a high burn rate indicate?

A. High burn rate indicates that a company is spending too much faster to generate funds. This can negatively impact the sustainability and continuity of the business as a concern.

[right_ad_blog]