- Home

- Sales and revenue

- Running costs

- Financial

Welcome to our blog post on how to build a financial model for a grocery store. As a business owner, having a complete understanding of your store’s financial situation is crucial in order to make informed decisions. Developing a financial model for a grocery store involves analyzing revenues, expenses, and profit margins. In this article, we’ll discuss grocery store financial analysis and planning, covering everything from financial forecasting to financial performance metrics.

Ferces and sales of groceries and sales

When it comes to a grocery store’s financial model, revenue and sales forecasts play a crucial role. This involves estimating time to ramp up sales after launch, projecting walk-in traffic and growth assumptions, as well as estimating customer and purchase assumptions. Additionally, accounting for any seasonal shifts in sales is also key to creating accurate revenue forecasts. These elements help create robust revenue and sales forecasts that will form an important part of a grocery store’s financial analysis, planning, and projections.

Grocery store launch date

The launch date of your grocery business is very important. This is the day you will open the doors to your customers and start generating revenue. Having a well-planned launch date can help ensure a successful start to your business.

The grocery store financial model model provides a guess for the start month of businesses. You need to choose the date when your grocery business will start operating. You can assume that you launch your business in the middle of the year while the financial model begins in January. This can be useful if you need to prepare and plan activities and costs related to launching your grocery store.

Tips & Tricks

- Consider your target market and the ideal time for their buying habits when deciding your launch date.

- Be sure to factor in enough time for advertising and marketing leading up to your launch.

- Include a grand opening event to attract customers and create buzz.

By starting with a solid launch date and a financial model that considers your grocery store revenue and profitability, you can set yourself up for long-term success in the grocery industry.

Grocery Ramp Up Time

Sales ramp-up time is the period it takes for a grocery store’s sales to grow from zero to a maximum level. Given the fierce competition in the grocery industry, ramp-up time is an essential metric to determine when forecasting sales.

Planning for a ramp-up time is critical to determining when your grocery store sales will reach their peak point or plateau. For example, if your grocery store model involves a significant amount of marketing, you may start with zero sales and it will take time to get customers in the door. Typically, for grocery stores, the sales ramp-up period is eight months. However, some industry changes, such as trends or a competitor entering the market, may make this time shorter or longer.

Tips & Tricks:

- Research your market, know your demographics

- Monitor sales and adjust accordingly

- Having patience and understanding growth takes time

Ramp-up time for a grocery store is a critical metric to determine when forecasting sales. It requires careful financial analysis, planning, and projections of grocery store financial statements, metrics, and ratios. Additionally, it is critical to monitor financial performance throughout the ramp-up time and adapt along the way.

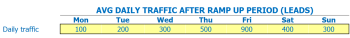

Grocery appointment traffic entries

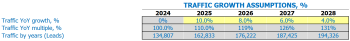

After the ramp-up period, an average grocery store sees 500 walk-in visitors per day. The number increases to 600 on weekends and drops to 400–450 on weekdays. The revenue model of the grocery store depends on this factor as it determines the number of people browsing and buying items in the store.

The traffic growth factor is about 2%, and it assumes slow growth. For example, a store with 500 daily appointment traffic will have around 550 daily visitors the following year. These financial projections for the grocery store are essential because they allow the store owner to calculate future traffic by the week for five years.

Tips & Tricks:

- Increase brand awareness to increase walk-in traffic

- Offer promotions to encourage new customers and returning customers

- Consider the location and ease of access to the store

- Track sales and customer feedback to adjust the revenue model accordingly

The financial analysis of the grocery store aims to identify areas of the business that may need improvement. Financial metrics such as gross profit and net profit margin help compare past, current, and projected performance. By reviewing the financial statements of the grocery store, the owner can equate the financial planning with the actual bottom line of the business. This information will help the owner measure the financial performance of the store.

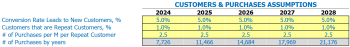

Grocery visits to sales conversion and sales entries

When analyzing a grocery store’s revenue model, two important inputs are the conversion rate of visitors to new customers and the percentage of repeat customers. For example, if a grocery store has 100 visitors in one day and 20 of them make a purchase, the conversion rate is 20%.

It is also important to consider the percentage of repeat customers. Let’s say 50% of the 20 customers who made a purchase return to the store at least once a month. This means that there are 10 regular customers per month. If the average repeat customer spends 0 per month, the total revenue generated by repeat customers is ,000 per month.

Tips & Tricks:

- Track customer loyalty programs to determine the percentage of repeat customers.

- Offer promotions and discounts to encourage new customers to come back.

- Implement effective marketing strategies to attract new customers and increase conversion rates.

These inputs are important when building a financial model for a grocery store. By understanding the conversion rate and percentage of repeat customers, you can predict future sales and plan for financial growth. Additionally, tracking these metrics can help identify areas for improvement in the store’s marketing and customer retention strategies.

Overall, maintaining a high conversion rate and loyal customer base is crucial to a grocery store’s financial performance.

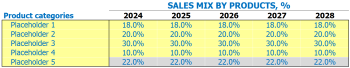

Grocery sales mix starters

Putting sales mix assumptions at the product category level will be much easier to understand. Therefore, we have divided all products into 5 different categories. These categories include fish, meat, vegetables, fruits and dairy products. We entered the percentage sales mix for each product category for each of the 5-year forecasts.

Grocery revenue modelThe revenue model of the grocery store depends on the sales volume and the selling price of each product. Sales mix and product category are the main inputs in forecasting grocery store revenue. We may use financial statements, metrics, and ratio analysis to assess the financial performance of the grocery store.Grocery financial planningTo plan grocery store finances, we need to look at financial statements, forecasts, and projections. Based on the grocery store finance analysis, we can decide on different financial planning strategies. Some of these strategies may include increasing sales, reducing costs, or improving margins.Financial analysis of the grocery storeThe financial analysis provides insight into the financial performance of the grocery store. The analysis can include metrics such as sales growth rate, gross profit margin, and net income margin. By analyzing these metrics, we can identify areas of grocery store finances that need improvement.Tips & Tricks

Tips for improving grocery store finances

- Offer discounts to increase sales volume

- Focus on selling high margin products

- Optimize inventory management to reduce costs

- Regularly analyze financial statements to identify trends

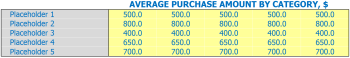

Grocery Average sale amount of entrees

When it comes to financial planning and forecasting for your grocery store, it’s important to have accurate and detailed inputs, especially when estimating your store’s average ticket size. A key contributor is the average sale amount for each product category.

In our store we sell a wide variety of products, from fresh to packaged products. Each product belongs to a specific category, such as “fruits and vegetables” or “snacks and sweets”. We enter our assumptions for average sales amounts at the product category level rather than at the individual product level. This allows us to streamline our financial planning process and make more accurate projections.

For example, let’s say we have a product category called “dairy and eggs”. When we circle assumptions for average sale amounts, we take into account potential fluctuations in the prices of individual products within that category. We might estimate that the average sales amount for dairy and eggs will be .50 per unit for the first year, and then adjust that estimate based on actual sales data.

When estimating our average ticket size, we use a calculation that takes into account our sales mix (percentage of each product category sold) and the average sale amount for each category. Using the example above, if dairy and eggs make up 20% of our sales mix and have an average sales amount of .50 per unit, our average ticket size for dairy and eggs egg products would be .70.

Tips & Tricks:

- Regularly review and update your assumptions for average sales amounts to ensure forecast accuracy.

- Consider product category trends when creating hypotheses – for example, organic products may have a higher sales amount than conventional products.

- Comparing your actual sales data to your predicted financial metrics can help you refine your assumptions and improve accuracy over time.

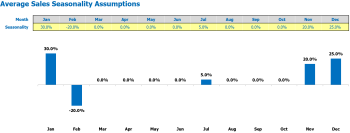

Seasonality of grocery sales

When analyzing a grocery store’s financial performance, it’s important to consider seasonal factors that can impact sales revenue. The hypothesis is that grocery sales are largely influenced by customers’ food consumption patterns throughout the year. For example, sales may be higher during Thanksgiving and Christmas due to increased grocery demand.

However, there may be other seasonal factors that affect grocery sales, such as weather, holidays, or event happening in the area. It is important to examine each factor to determine how it may influence the store’s revenue model.

Tips and tricks

- Review historical sales: Examine past sales patterns to identify recurring seasonal trends and factors.

- Use data analytics: Use sales data to forecast sales and adjust inventory levels to optimize profits.

- Plan Marketing Promotions: Implement marketing strategies to capitalize on seasonal trends and increase sales.

When analyzing sales seasonality for a grocery store, it is important to look at the monthly average sales per day and calculate the percentage of variance. This calculation can help identify if there are significant changes in sales patterns throughout the year.

For example, if the average daily sales for January are ,000 and the average daily sales for December are ,000, the sales have doubled, showing a strong seasonal trend for the holiday season.

Understanding sales seasonality can be useful for grocery store financial forecasting, planning, and analysis. It enables better inventory management, cost control and revenue growth.

Analyzing a grocery store’s financial performance can be complex, but understanding the impact of sales seasonality is a critical consideration for any successful grocery store profit model. By using financial metrics, ratios, and projections based on accurate financial statements, grocery stores can improve their financial planning and forecasting, which leads to better overall financial performance.

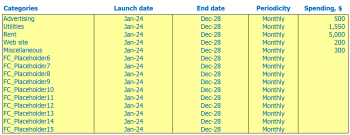

Grocery store operating expense forecast

In order to create a successful grocery store financial model , it is important to forecast operational expenses. These expenses include, but are not limited to, Cost of Goods Sold by Products%, salaries and wages of employees, rent, lease or mortgage payment, utilities, and other operating expenses .

| Costs | Amount (per month) |

|---|---|

| Cost of Goods Sold by Products% | ,000 – ,000 |

| Salaries and wages of employees | ,000 – ,000 |

| Rent, lease or mortgage payment | ,000 – ,000 |

| Public services | ,000 – ,000 |

| Other running costs | ,000 – ,000 |

| Total | ,000 – 3,000 |

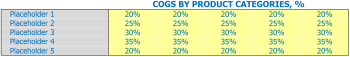

Grocery cost of goods sold

Cost of Goods Sold (COGS) is the direct cost of producing goods sold by a business. COGS is an important metric that can help grocery store owners determine the profitability of their business.

The assumptions used to calculate COGs include the cost of raw materials, labor, packaging, and shipping. For example, if a grocery store sells fresh produce, the cost of goods sold will include the cost of purchasing fruits and vegetables, as well as the cost of paying employees to store and prepare the produce. The COG percentage varies depending on the revenue model and product categories of the grocery store, but generally it is around 60-70%.

Tips & Tricks:

- Regularly analyze your financial statements to ensure that your COGs are in line with industry benchmarks.

- Consider implementing strategies to lower your COGs, such as sourcing cheaper raw materials or negotiating better prices with suppliers.

- Use financial forecasting and planning tools to project future cogs and revenue, allowing you to make informed decisions about your grocery store’s financial performance.

Calculating COGs is essential for any grocery store owner who wants to run a successful and profitable business. By understanding the cost of producing goods, grocery store owners can make informed decisions about pricing and inventory management.

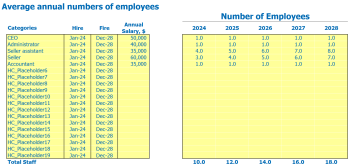

Grocery Store Employee Salaries and Wages

When it comes to running a successful grocery store, it’s important to have a good understanding of your employee wages and salaries. The assumptions you make in this area can have a significant impact on the financial analysis and planning of your grocery store. Consider the following when making your assumptions:

- Staff Members/Positions: Will you have a store manager, department managers, cashiers, actors, and customer service reps? Determine the positions you need and give them clear titles.

- Hiring Schedule: When will each person/position be hired? For example, you may need your store manager and department managers before you can start hiring other employees.

- Annual Salary: How much should each person/category earn for the 12 month period? For example, your store manager might earn ,000 per year, while your cashiers might earn ,000 per year.

- Full-time equivalent staff (FTE): How many full-time equivalent staff do you need each year? Consider part-time employees when making this calculation.

Keeping these assumptions in mind can help you make realistic projections for your grocery store’s financial performance. By understanding your employees’ wages and salaries, you can create a grocery store profit model that takes into account all of the expenses necessary to run your business.

Tips & Tricks:

- Research standards on employee wages and salaries to ensure you are offering competitive compensation.

- Consider offering benefits to attract and retain top talent. This could include health insurance, pension plans and paid vacations.

- Develop a comprehensive training program to ensure your staff are competent and capable of providing excellent customer service.

Grocery rent, rental or mortgage payment

When creating a Grocery Financial Analysis , it is important to consider expenses related to rent, lease, or mortgage payment . These expenses can significantly affect the financial performance of a grocery store and should be carefully considered during Financial Planning, Forecasting and Projections .

Assumptions regarding rent, lease, or mortgage payment may vary depending on location, size, and type of grocery store. For example, a small independent grocery store in a rural area may have lower rent than a large grocery store in a large urban area. It is important to consider these factors when analyzing grocery store revenue model, profit model, financial statements, metrics, and ratios .

Tips & Tricks:

- When negotiating a lease or mortgage agreement, it can be beneficial to have a lawyer or accountant review the terms to make sure they are favorable to the grocery store.

- Consider the length of the lease or mortgage term and any possible renewal options when making financial projections.

- When comparing rent or mortgage payments to income, analyze the ratios to determine if they are within industry standards or if adjustments need to be made.

Grocery utilities

The financial analysis of the grocery store requires careful consideration of various aspects of the business. One of the key factors in determining a grocery financial model is utilities. This includes costs associated with electricity, water, gas and other utility expenses necessary to run the store.

It is important to make realistic assumptions about utility costs when creating grocery store financial projections . For example, utility costs are expected to vary from season to season due to fluctuating weather conditions. Additionally, costs can increase or decrease depending on how often certain equipment and devices are used. By carefully reviewing past usage and making reasonable assumptions, it is possible to create an accurate grocery store financial statement .

Tips & Tricks:

- Track utility costs carefully and regularly

- Be aware of seasonal fluctuations in usage

- Consider investing in energy-efficient equipment to reduce costs

Overall, the financial performance of a grocery store depends on a variety of factors, including Grocery Financial Metrics , Grocery Financial Ratios , and Grocery Revenue Models . By leading to Grocery Financial Planning and Forecasting, business owners can better understand how to manage expenses and increase profitability over time.

Groceries other running costs

Besides the standard costs, there are several other expenses a grocery budget should include. An example is the cost of marketing and advertising. This could include promotional materials, social media marketing and paid advertising such as television or radio advertisements. Another example is the cost of security, especially in high crime areas. A grocery store may need to invest in security cameras, alarms, and security personnel to keep the store and its customers safe.

Other running costs may also include rent, utilities, and insurance. Rent costs are generally manageable with an understanding of local real estate markets and the ability to negotiate with landlords. Utilities, on the other hand, are variable costs that can be influenced by heating and cooling needs, lighting, and water usage. Insurance costs are also important to consider, as these can vary widely depending on the size of the store and the specific risks it faces.

Overall, these other operating costs can play a significant role in the financial performance of the grocery store . As such, it is essential to include them in the financial model and to ensure that they are taken into account in the projections and analyses.

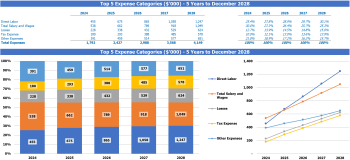

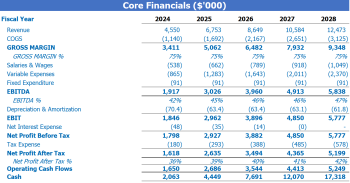

Grocery Financial Forecast

Grocery store financial forecasting is an essential part of financial planning for the business operations of any grocery store. It allows store owners to make informed decisions about their grocery store’s profit model. Using grocery store financial statements and financial metrics, such as grocery store revenue models, financial ratios, and profit and loss statements, forecasting the future results of a grocery store’s financial performance. An analysis of the sources and reports used is another tool that store owners can use to effectively plan their finances.

Grocery profitability

Once we’ve built our Grocery Financial Projections for Revenue and Expenses, it’s time to check the Profit and Loss (P&L) from Revenue to Net Profit. This exercise helps to visualize the profitability of the store.

The grocery store revenue model and the grocery store profit model are closely related. The Grocery store financial analysis reveals information about the Grocery store financial performance , which helps with Grocery store financial planning and Grocery store financial forecasting .

- Regularly monitor your financial statements and grocery store financial metrics to identify areas for improvement.

- Use grocery store financial ratios Evaluate financial performance against industry benchmarks.

Tips & Tricks

By analyzing the financial statements of the grocery store , such as the P&L balance sheet and Financial metrics of the grocery store and Financial performance of the grocery store .

A periodic review of finances, coupled with sound financial planning and forecasting techniques, can help make grocery store financial projections more reliable.

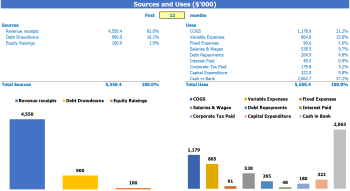

Grocery sources and use of the chart

The Sources and Uses of Funds in Excel’s Grocery Financial Model provides users with an organized summary of where capital comes from sources and how that capital will be spent in uses. It is important for the total amounts of sources and uses to be equal to each other. Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

Some tips and tricks to improve the grocery revenue model include understanding customer demographics, improving marketing strategies, making the supply chain more efficient, having a strong inventory management system , creating a strong brand identity through a strong digital presence, having a competitive pricing structure and creating excellent customer experiences. To optimize a grocery store’s profit model, it is essential to adopt innovative sales strategies, develop a professional website, go cashless or contactless payment options, adopt modern payment systems such as mobile payment systems, to invest in technology for efficient and long-term operations and long-term financial planning.

Creating a solid financial model is essential for any grocery store owner who wants to maximize profit and minimize risk. By combining Grocery Financial Analysis with a complex Grocery Financial Planning , business owners can gain insight into their grocery store revenue model and create realistic Grocery Financial Projections . Monitoring Grocery Financial Performance Over Time and Using Grocery Financial Ratios and Grocery Financial Metrics Measuring success can help grocery store owners make informed decisions for their business.