- Home

- Sales and revenue

- Running costs

- Financial

Welcome to our blog post on how to build a financial model for a greeting card store! If you are planning to start a greeting card business or are simply looking to improve your existing one, having a solid financial plan in place is crucial. In this article, we’ll walk you through the various aspects of building a financial model for a greeting card store, including sales forecasting, expense tracking, profit margins, threshold analysis profitability, etc. By following the steps outlined here, you will be able to develop a solid financial foundation for your greeting card business and make informed decisions that drive growth and success. Let’s dive!

Store Revenue & Sales Forecast Greeting Cards

As a crucial part of the greeting card business plan, revenue and sales forecast include important factors that must be considered for a greeting card store’s financial plan.

Revenue and sales forecast depends on several factors, such as launch date, ramp-up time, walk-in traffic and growth assumptions, customer and purchase assumptions, and sales seasonality . These factors directly affect greeting card store expenses , profit margins , and marketing strategies .

To achieve Greeting Card ROI Calculation , owners and investors can use data analysis tools, such as Greeting Card Sales Forecasting Model , Breakeven Analysis, and Cash Flow Projection for better financial decision making.

Greeting Card Store Launch Date

The launch date of your greeting card store is important because it sets the tone for your business. It is essential that you have a plan in place for your store launch date. This plan should include details on how you will market your business, your sales forecasts, your expenses and your expected profit margins.

Your financial plan for your greeting card store should include a sales forecast. This outlines how much revenue you expect to generate in the first year of business. Additionally, you will need to conduct a Break-Even Analysis to determine how long it will take you to recoup your initial costs and start generating a profit.

Tips & Tricks:

- Determine your target market and create a marketing strategy that will appeal to them.

- Craft through all costs associated with running your store, including rent, utilities, and inventory when creating your financial plan.

- Create a cash flow projection to ensure you have enough cash to cover your expenses during the initial start-up phase.

- Calculate your Return Return To see how much profit you can expect from your business.

By choosing the right launch date and having a solid financial plan in place, you can improve your chances of building a successful greeting card store. Remember to factor in all expenses and create a realistic sales forecast. With careful planning and execution, you can achieve your goals and run a successful greeting card store.

Greeting card ramp-up time

When starting a greeting card store, it is essential to have a solid financial plan in place to ensure success. This includes a sales forecast , expense projection , and cash flow analysis . However, a crucial factor that is often overlooked is the ramp-up time to reach the sales plateau.

- Conduct market research to determine industry-specific ramp-up periods.

- Offer incentives to customers during the ramp-up phase to increase sales.

- Prepare for a slower sales period during the ramp-up phase by reducing expenses.

Tips & Tricks

Ramp-up time is the period it takes for a business to reach a profitable level of sales . During this time, a business may have higher expenses than revenues, making it crucial to have sufficient funding or resources. The ramp-up period may vary depending on factors such as location, competition, and the company’s marketing strategy .

To determine the ramp-up time for a greeting card store, it is important to research the industry and gather data from similar businesses. Based on this research, the average ramp-up period for a greeting card store is around six months.

By forecasting the ramp-up time as part of the overall business plan , a greeting card store can prepare for the slower sales period and adjust its expenses accordingly. With a well thought out financial plan and realistic sales forecasts, a greeting card store can achieve a return return within a reasonable time frame.

All in all, factoring in ramp-up time is an essential part of sales forecasting for a greeting card store. With proper planning, research, and resources, a business can successfully navigate the ramp-up phase to achieve long-term profitability and success.

Greeting cards store walk-in traffic entries

In the first few weeks after opening, the greeting card store saw a steep increase in visitors. However, after the sales platform, the average daily in-in traffic began to stabilize. By tracking traffic each week, the company was able to determine the average daily traffic of visitors on weekdays. Mondays had the lowest average with 50 visitors, while Saturdays had the highest daily average with 150 visitors.

Tracking walk-in traffic is an essential part of building a financial model for the greeting card store. Knowing the average daily visitors allows the business to calculate the break-even point and profit margin. It also helps in creating the sales forecast, cash flow projection, ROI calculation and marketing strategy.

When creating the financial plan for the greeting card store, the company predicted an average traffic growth factor of 5% per year. Using this input, the model calculates future weekday traffic for the next five years. This prediction helps in planning and preparing for future expansion and hiring.

Tips & Tricks:

- Offering attractive weekday discounts can encourage customers to visit during off-pit hours, increasing walk-in traffic and sales.

- Promoting your store on social media can increase awareness and drive new visitors to your store.

In conclusion, tracking and predicting walk-in traffic is a vital aspect of building a financial model for the greeting card store. By understanding the average daily traffic and growth factor, the business can plan for the future, make informed decisions, and improve overall business profitability.

Greeting cards store sales conversion visits and sales inputs

When opening a greeting card store, it is important to consider the number of store visits that will convert into new customers. Based on industry data, the average conversion rate is around 30%. However, this can be affected by various factors such as marketing, location, and sales tactics.

It is also important to consider the percentage of repeat customers the store will have. Repeat customers are essential to maintain a stable source of income. On average, a greeting card store can expect around 40% of their customer base to be repeat customers.

Additionally, it is important to estimate the average amount of purchases that each repeat customer will make per month. This may vary depending on factors such as customer loyalty and discounts offered, but on average, each repeat customer should make around 3 purchases per month.

These inputs are important in building a complete financial plan for a greeting card store. They help with sales forecasts, break-even analysis, cash flow projections, marketing strategies, and return on investment calculations.

Tips & Tricks

- Offer loyalty programs or discounts for repeat customers to encourage continued business.

- Ensure marketing efforts are targeted to the right demographics to maximize store visits and conversions.

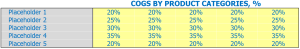

Store Sales Mix Entrees greeting cards

In our greeting card store, we sell a variety of products belonging to specific categories. Sales mix by product category is a critical metric that helps us understand how much of each product category we sell, and in turn, which categories drive the most revenue.

We have identified five product categories to use in our sales mix assumptions:

- birthday cards

- thank you cards

- birthday cards

- Graduation Cards

- Christmas card

Here’s how we’ve planned our sales mix by product category over the next five years:

| product category | Year 1 | Year | Year 3 | Year 4 | 5th year |

|---|---|---|---|---|---|

| birthday cards | 15% | 17% | 18% | 20% | 22% |

| thank you cards | 20% | 19% | 18% | 17% | 16% |

| birthday cards | 10% | 12% | 14% | 16% | 18% |

| Graduation Cards | 8% | 9% | 11% | 13% | 15% |

| Christmas card | 47% | 43% | 39% | 34% | 29% |

Tips & Tricks:

- Regularly review your sales mix by product category to identify opportunities for product growth or diversification.

- Set realistic sales mix assumptions based on historical data and market trends.

- Use sales mix assumptions to inform your inventory management, pricing strategy, and marketing campaigns.

Greeting cards store average sale amount entries

When running a greeting card store, it is important to have a good financial plan in place to maximize profits. One of the important inputs for this plan is the average sales amount of each product category. By grouping products into categories, it becomes easier to estimate the average sale amount for each category and use that to estimate the average ticket size. For example, a store might have categories for Birthday Cards, Thank You Cards, Sympathy Cards, and more.

- Regularly analyze your sales data to update your assumptions about average sales amounts by product category.

Tips & Tricks:

Let’s say the store owner assumes that the average sale amount for birthday cards is , for thank you cards is , and for sympathy cards is . If the store’s sales mix (the percentage of sales from each category) is 50% birthday cards, 30% thank you cards, and 20% sympathy cards, the model calculates the average ticket size:

Average Ticket Size = (% of Birthday Card Sales x Avg. Birthday Card Amount Sale) + (% of Thank You Card Sales x Avg. Sympathy Card Sale)

In this example, the average ticket size would be:

Average ticket size = (50% x ) + (30% x ) + (20% x ) = .70

Using the average sale amount of each product category and the sales mix, the greeting card store can make informed decisions on pricing, inventory, and marketing strategies that will maximize profits.

Store Greeting Card Sales Seasonality

When it comes to forecasting sales for your greeting card store, it’s important to consider the seasonality of the industry. Throughout the year, sales may vary significantly due to holidays, special occasions and other events.

For example, February is usually a busy month due to Valentine’s Day. Sales during this period can be double or even triple the average sales per day. On the other hand, July and August tend to be slower months with sales being perhaps only 50% of average sales per day.

Tips & Tricks:

- Take advantage of holiday sales and promotions to drive traffic to your store

- Plan ahead for slower months focusing on cost reduction measures

- Be aware of any local events that could impact sales, such as a nearby graduation or wedding season

By analyzing and understanding these seasonal trends, you can create a more accurate sales forecast and develop a financial plan for your greeting card store. This will help you determine your break-even point, cash flow projection, ROI calculation, and profit margin.

Greeting cards Store Operational Fresh Forecast

Operational expense forecasts are an important part of the financial plan for a greeting card store. It provides an estimate of the necessary expenses needed to operate the store. These expenses include the cost of goods sold by the products %, wages and salaries of employees, rent, lease or mortgage payment, utilities and other operating expenses.

| Operating Expenses | Amount (per month) in USD |

|---|---|

| Cost of Goods Sold by Products% | ,000 – ,000 |

| Salaries and wages of employees | ,000 – ,000 |

| Rent, lease or mortgage payment | ,500 – ,000 |

| Public services | 0 – ,000 |

| Other running costs | ,500 – ,000 |

| Total | ,400 – ,000 |

By creating an operational expense forecast, a greeting card store can determine its cost structure, break-even panel, and profit margins. It is essential to have a clear idea of the expenses required for the store to operate and generate Greeting Card Revenue Model while developing a Greeting Card Business Plan and Greeting Card Stores Marketing Strategy .

Greeting Cards Store Cost of Goods Sold

Cost of Goods Sold (COGS) is a major expense for a greeting card store. To calculate COG, you subtract the amount of inventory at the end of the period from the beginning inventory and add the cost of inventory purchases during that period.

Assuming we are a greeting card store, the COG percentage for our business can be broken down into several categories. For example:

- Greeting cards: 60%

- Gift wraps: 15%

- Stationery: 10%

- Gift items: 10%

Assumption COGS percentage may vary from store to store. However, our percentage amounts are a rough estimate and we should adjust our budget accordingly.

Tips & Tricks:

- Regularly review your COGS assumption percentages to keep your budget up to date.

- Partner with wholesalers to get discounts when buying inventory.

- Make sure your COGs are in line with your pricing strategy to maintain a good profit margin.

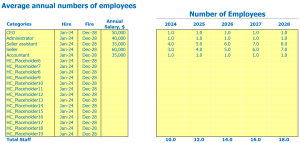

Greeting cards store salaries and wages of employees

When developing the financial plan for a greeting card store, it is important to consider the cost of salaries and employee wages. This includes determining the number of staff needed, their positions and the amount of payment each year for a period of 12 months. For example, a starting cashier position might be paid ,000 per year while a store manager might earn ,000 per year. It is assumed that these positions will be hired within the first year of operation to ensure smooth store operations.

Tips & Tricks:

- Consider offering performance bonuses or incentives to motivate staff.

- Train staff members on effective customer service strategies to increase sales.

- Review local wage laws and ensure that all employees are paid competitively and fairly.

- Consider hiring part-time staff or outsourcing certain tasks to reduce overall labor costs.

Based on the assumptions above, it is estimated that two full-time staff members will be required for store operations: a store manager and a cashier. This will be further evaluated based on greeting card store sales forecast, greeting card store expenses, greeting card store break even analysis, store cash flow projection of greeting cards, greeting card store marketing strategy and greeting card revenue model. The amount allocated to employee wages and salaries will impact the store’s profit margin and ROI calculation.

Slow Store, Rent, or Mortgage Payment Greeting Cards

When opening a greeting card store, one of the most important expenses to consider is the rent, lease, or mortgage payment. This expense will have a significant impact on your store’s overall financial plan and profit margin.

The assumption you make about these expenses will depend on whether you choose to rent commercial space or buy one. When renting, you will need to consider factors such as location, size, and rental terms. In contrast, the purchase of commercial space requires a lump sum or down payment, interest rates and mortgage payment terms.

Tips and tricks:

- Buy the best mortgage rates if you choose to buy commercial space as this will impact your monthly mortgage payment.

- Consider additional expenses such as utilities and insurance when budgeting for rent or mortgage payments.

- Choose a prime location with high foot traffic to maximize sales potential and cover rent or mortgage expenses.

Your greeting card business plan should incorporate a detailed financial plan that outlines all expenses associated with running the store, including rent or mortgage payments, marketing strategy, sales forecasts, expenses, profit margin, break-even analysis and cash flow projection. Understanding these metrics allows you to calculate your store’s ROI, which will help you make informed decisions about the future of your business.

greeting card utilities

When it comes to running a greeting card store, utilities are an essential expense to consider. Utilities can include expenses for electricity, water, internet, heating, and air conditioning.

It is essential to make assumptions about the cost of utilities when creating a financial plan for a greeting card store. For example, let’s say the average monthly utility cost for a similarly sized business is ,000. The assumption would be that the greeting card store utilities would cost roughly the same amount.

Advice:

- Cut costs by using energy efficient light bulbs and appliances.

- Create a schedule to turn off lights and equipment when not in use.

- Consider negotiating a better rate with utility companies.

By carefully considering utility expenses, a greeting card store can create a realistic financial plan. The financial plan is vital when it comes to forecasting sales, determining the break-even point and projecting cash flow needs.

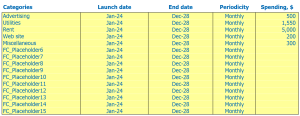

Greeting cards store other running costs

Aside from direct expenses like inventory and rent, greeting card store owners need to consider other running costs. These include:

- Marketing: This includes the cost of advertising, promotions and creating marketing materials like flyers, posters and brochures.

- Utilities: Expenses like electricity, water, and gas bills can add up for a physical store.

- Insurance: Greeting card shop owners need to protect themselves against potential lawsuits and damages.

- Recruitment: Hire employees to help with store operations such as sales management and inventory management.

For example, if a greeting card store spends 0 on monthly rent and 0 on inventory, they can estimate an additional 0 for marketing, 0 for utilities, 0 for insurance, and ,000 for staff. Considering all these expenses, greeting card store owners can build a financial plan for greeting card store which includes greeting card revenue model , greeting card store profit margin , revenue forecast , greeting card store sales , greeting card store breakeven analysis , greeting card store cash flow projection , and greeting card store return on investment calculation to ensure their business is profitable.

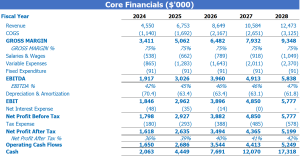

Store Financial Forecast Greeting Cards

Financial forecasting is an essential part of the greeting card store’s financial model, which provides a comprehensive financial plan for the operation of the store. These forecasts include a profit and loss statement, sources and uses of the report, cash flow projection, break-even analysis, sales forecast, marketing strategy, and ROI calculation. This forecast is crucial for making informed financial decisions and determining the success of the store.

Greeting cards are profitability

Once we’ve created a financial plan for our greeting card store, it’s time to analyze the expected profitability. This can be done by reviewing the profit and loss (P&L) statement, which shows our income, expenses and net profit.

The P&L statement is a useful tool to visualize the profitability of our store. We can calculate metrics such as gross profit, EBITDA margin, and net profit margin. These metrics are important in indicating how well our store is doing financially.

It’s also helpful to do a break-even analysis, sales forecast, cash flow projection, and ROI calculation on your business plan. These will help you assess the overall sustainability of a greeting card revenue model and make necessary changes to increase store profitability.

Tips & Tricks:

- Regularly review and update the P&L statement to effectively track store performance.

- Try to minimize expenses to increase your store’s profitability.

- Adopt a comprehensive marketing strategy to attract more customers and increase sales.

By following these steps, we can increase our profit margin from our greeting card store and achieve financial success.

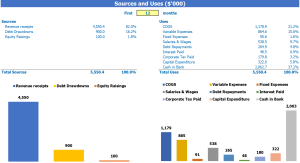

Greeting cards store sources and uses of the graphic

The sources and uses of funds in the financial model in Excel for Greeting Cards Store provides users with an organized summary of where capital comes from sources and how that capital will be spent in uses.

It is important for the total amounts of sources and uses to be equal to each other. Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

Tips & Tricks:

- Try to realistically estimate your greeting card store sales forecast to avoid underestimating or overestimating potential revenue.

- Consider all greeting card store expenses carefully, including start-up costs and ongoing expenses such as rent, utilities, payroll, and marketing expenses.

- Your greeting card store marketing strategy will play a crucial role in generating buzz and attracting customers, the costs of these costs in your financial plan for the greeting card store.

- Take the time to calculate your greeting card store ROI calculation, break-even analysis, and cash flow projection to make sure you’re on the right path to profitability.

In conclusion, building a financial model for a greeting card store is crucial to its success. It allows the business owner to understand the financial feasibility of their idea and to make informed decisions. A greeting card store’s financial plan includes various elements such as sales forecast, expenses, profit margin, and ROI calculation. By accurately analyzing these factors and creating a solid financial plan, a greeting card store can ensure profitability and sustainability. Besides, having a well-defined marketing strategy and cash flow projection is also essential to be successful in this business. Finally, performing a break-even analysis is essential to avoid any potential financial setbacks.