- Home

- Sales and revenue

- Running costs

- Financial

Starting a bike shop is a great way to turn your passion for cycling into a profitable business. However, it takes more than a love for bikes to make a successful bike shop. One of the essential elements for any successful business is to develop a solid financial plan. A good bike retail financial model can help you understand the costs of running a bike shop, forecast bike shop revenue , and give insights into maximizing profits. In this blog post, we’ll walk you through the process of building a financial model for a bike shop that will help you make informed decisions about your business.

Bike specs and sales forecasts

In a bike shop financial model, revenue and sales forecasting is a crucial part as it helps to project the expected revenue of the shop. The forecasts look at various parameters such as launch date, ramp-up time, walk-in traffic and growth assumptions, customer and purchase assumptions, and sales seasonality.

Bike shop launch date

Deciding when to launch your bike shop is crucial to the success of your business. It requires careful planning and analysis to determine the best time to enter the market.

Why is the launch date very important? It sets the tone for your business and impacts your financial projections. A well-invented launch can generate buzz and revenue, while a poorly timed launch can lead to losses and missed opportunities.

The bicycle shop financial model template provides a guess for the start month of businesses. However, you should choose a launch date that fits your specific needs and goals. Consider factors such as seasonality, competition, and market trends when deciding on a launch date for your bike store.

Tips & Tricks:

- Research your local market to determine the best time to launch.

- Think about seasonal fluctuations in demand and how they can impact your business.

- Consider planning a soft launch before your grand opening to build interest and test your operations.

All in all, choosing the right launch date for your bike shop can make all the difference. Take the time to analyze your options and make an informed decision that sets your business up for success.

Ramp-up time

Forecasting a bike shop’s sales is a crucial aspect of financial planning. However, an important factor that should not be overlooked is the ramp-up time to the sales plateau. It is the time it takes for a business to reach a constant level of sales.

What is the ramp-up period for your business? This is how long your business will need to reach the sales plateau. In your industry, this may be xxx months.

Tips & Tricks

- Research your industry to understand typical ramp-up periods.

- Tive on the costs associated with ramping up to the sales plateau.

- Consider implementing marketing strategies to accelerate the ramp-up process.

Projections for a bike shop should incorporate ramp-up time to ensure there is sufficient cash flow during the early stages of the business. Understanding this ramp-up time will help with budgeting and forecasting, giving the business a realistic idea of when to expect consistent sales and when to expect ROI.

By factoring in ramp-up time, a bike shop can create a solid financial plan that takes into account initial start-up costs and the time it takes to reach profitability.

Bike Shop Appointment Traffic Entrances

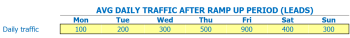

After analyzing data from the ramp-up period at the bike shop, we determined that walk-in traffic varied significantly on weekdays. For example, Mondays averaged 50 customers while Fridays averaged 100. This is important when building a financial model because it allows us to forecast revenue for each day of the week.

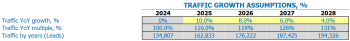

In addition to tracking current weekday traffic, the bike shop also projected the walk-in traffic growth factor for years to come. By analyzing past trends, it has been estimated that walk-in traffic will increase by 5% each year. This allows for more accurate revenue forecasting and budgeting.

Tips & Tricks

- Consider investing in slower traffic marketing efforts on weekdays to increase walk-in traffic.

- Be sure to account for seasonality and holidays in traffic forecasts.

- Continuously monitor and adjust traffic forecasts to ensure accurate financial modeling.

Using the average weekday walk-in traffic numbers and the growth factor, the bike shop was able to create a comprehensive financial model that projected revenue for the next five years. This information has been crucial in making informed business decisions and strategically planning for the future.

Bike shop visits for sales conversion and repeat sales entries

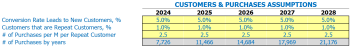

The success of a bike shop largely depends on its ability to convert visitors into new customers and retain previous customers. In order to build an accurate financial model for a bike shop, it is crucial to make assumptions about conversion rates and repeat sales.

The percentage of visitors who become new customers can vary greatly depending on factors such as marketing efforts, store locations and customer service. For example, if a bike shop gets 100 visitors per month and converts 30% into new customers, that would result in 30 new customers per month.

The percentage of repeat customers can also vary, but a common assumption is that around 20% of new customers will become repeat customers. This means that of the 30 new customers in the example above, 6 of them are likely to make additional purchases in the future.

Assuming that each repeat customer will make an average of two purchases per month, the bike shop can anticipate 12 additional purchases per month from repeat customers. This illustrates the importance of creating repeat business as it can have a big impact on a bike shop’s revenue.

Tips & Tricks

- Offer loyalty programs to drive repeat business

- Provide exceptional customer service to increase conversion rates

- Regularly track and analyze sales data to identify trends and adjust assumptions accordingly

By making reasonable assumptions about conversion rates and repeat sales, a bike shop can create a financial model that accurately reflects its revenue forecast. This financial model can then be used to create a budget, forecast future sales, and make informed business decisions.

Bike sales mix entries

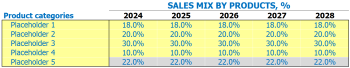

Your bike shop sells different bike shop products and each product belongs to a specific product category. Entering Sales Mix Assumption on Product Category Leverage will be much easier to understand.

For example, suppose your bike shop sells five different types of bikes: mountain bikes, road bikes, hybrid bikes, BMX bikes, and e-bikes. These bikes can be categorized into product categories like high-end, mid-range, and low-end.

When entering the Sales Mix Assumptions , you would enter up to 5 product category names to use in the sales mix. For the bike store, these would include names like mountain bikes, road bikes, hybrid bikes, BMX bikes, and e-bikes.

Next, enter the percentage sales mix for each of the 5 years provided by the product category. This would include the quantity of each product category sold in a given year.

Tips & Tricks:

- Use historical sales data to help predict the future sales mix.

- Follow cycling industry trends to stay on top of changes in product category demand.

- Adjust sales mix assumptions as necessary to account for changes in the market.

- Include a buffer in your sales mix assumptions to account for unexpected changes in demand.

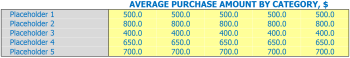

Bike shop Admission sale amount

In our bike store we offer a variety of products ranging from bikes to accessories. Each product belongs to a specific product category. To simplify our financial planning, we enter assumptions at the product category level rather than for each individual product. This allows for an easier estimate of our average sale amount over the years.

For example, suppose the average sale amount for a particular product category, such as bicycle accessories, is for our first year. In the second year, we believe the average sale amount of bike accessories will increase to . By setting this assumption for each product category and year, we can estimate our average ticket size, which is the total revenue generated by the total number of transactions.

Using the same example, if the bike accessories product category represents 20% of the overall sales mix, and we expect 1,000 transactions in our first year, we can estimate that our revenue for bike accessories bicycle will be ,000. By repeating this process for each product category, the model can calculate the average ticket size for our bike store.

Tips & Tricks:

- Group products into relevant product categories for easier financial planning.

- Make assumptions for each product category and year to estimate the average sale amount and average ticket size.

- Use sales to attribute revenue to each product category.

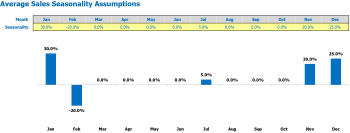

Seasonality of bicycle workshop sales

Seasonality is an important factor to consider when analyzing the financial health of a bike shop. It refers to sales fluctuations that occur throughout the year due to factors such as weather, holidays, and events. Understanding these fluctuations can help with budgeting, forecasting and planning.

For example, during the summer months, sales for a bike shop may increase due to more people outdoors and participation in activities such as cycling. On the other hand, during the winter months, sales may decrease due to colder temperatures and less interest in outdoor activities. To account for this, a bike shop’s financial projections should include assumptions for seasonal factors.

Seasonal assumptions should be based on historical data and trends. For example, a bike shop might look at the average sales per day for each month over the past two to three years. They can then use this data to calculate the percentage deviation from the average monthly sales per day for each month of the coming year.

Tips & Tricks

- Consider major holidays and events that can impact sales

- Monitor weather forecasts closely to adjust projections accordingly

- Be careful when making assumptions for seasonal factors and regularly review and adjust projections as needed

Overall, understanding and considering seasonality is crucial to the financial success of a bike shop. By carefully analyzing historical data and creating accurate projections for seasonal factors, a bike shop can better budget, forecast and plan for the future.

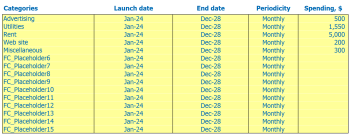

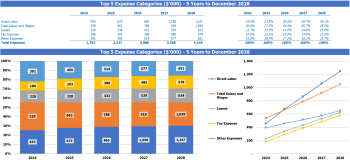

Bike Shop Operational Expense Forecast

In order to create a successful bike shop financial model, it is crucial to forecast operational expenses. We have to consider various costs such as the cost of goods sold by the products %, wages and salaries of employees, rent, lease or mortgage payment, utilities and other operating costs.

| Cost of goods sold by products % | ,000 – ,000 |

| Salaries and wages of employees | ,000 – ,000 |

| Rent, lease or mortgage payment | ,000 – ,000 |

| Public services | ,500 – ,000 |

| Other running costs | ,000 – ,000 |

| Total | ,500 – ,000 |

By forecasting operational expenses, we can better plan for the future and ensure that the bike shop remains financially stable. It is important to regularly update and adjust these expenses based on the current financial situation and changes in the business.

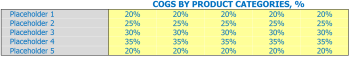

Cost of Goods Sold

Cost of Goods Sold (COGS) is a crucial factor in a bike shop’s financial plan . It refers to the amount you spend to buy or produce the products you sell.

For example, if you sell bicycles, you need to consider the cost of frames, wheels, gears, brakes, and other components. This cost will include the cogs for the bikes. Similarly, if you sell accessories like helmets or bike locks, you need to consider the cost of buying from the supplier or the cost of production.

COGS is usually calculated as a percentage of your total revenue. It may vary depending on the product category. For example, the COG percentage for bicycles may be higher than the COG percentage for accessories, because the cost of producing bicycles is usually higher than the cost of producing accessories.

Tips & Tricks:

- Have a clear understanding of your product categories to accurately estimate COGs.

- Consider the seasonality of your business and the impact it may have on COGs. For example, if you sell winter sports equipment, the cost of goods sold may be higher during the off-season due to low demand.

- Analyze your competitors’ pricing strategy to define the best pricing strategy for your products.

- Use historical data to project COGs and review them regularly to make necessary adjustments.

An accurate COGS assumption can help you estimate your Bike Shop Financial Analysis , Bike Shop Financial Projections, Bike Retail Financial Model, Bike Shop Revenue Forecast, Bike Shop Financial Statements bike shop , retail financial planning , bike shop profit and loss reporting , bike shop cash flow analysis , and bike shop budgeting and forecasting in a more viable way .

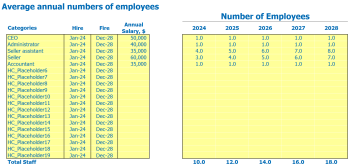

Wages and Salaries of Bike Shop Employees

When creating a bike shop financial plan , it is important to have a clear understanding of employee wages and salaries. To start, it is helpful to name your staff members by their positions. For example, you might have a Stores Manager, Sales Associate, Mechanic, and Assistant Administrator.

Next, decide when each person or position will be hired. Will you need a full staff at the start of your business, or will you gradually add employees as your income grows?

It is important to determine how much each person/category should earn for the 12 month (annual) period. This should be a fair and competitive salary that aligns with the job market in your area.

Based on your projected sales and workload, you need to determine how many full-time equivalent (FTE) staff members you need each year. It is important to consider whether some positions may be part-time or whether you will need more staff during peak sales seasons.

Tips & Tricks:

- Research job salaries in your area to ensure you offer competitive compensation

- Consider budgeting for employee benefits such as health and retirement plans

- Provide a training program for new employees to ensure they are familiar with your products and services

Bike shop rent, lease, or mortgage payment

One of the main expenses of any bike shop financial plan is paying rent, lease, or mortgage. Generally, a rent payment is made on a monthly basis for the use of space, while a lease usually involves a longer-term commitment, often with a fixed term of several years. Alternatively, a mortgage payment involves purchasing the property and making periodic payments on the loan.

Assumptions about rent, lease, or mortgage payment can have a significant impact on the overall Bike Shop Financial Analysis . For example:

- If the bike shop is located in a prime location where rental prices are high, rent payments will comprise a larger portion of the budget.

- If the bike shop has a long-term lease or mortgage, payments may be more stable and it may be easier to forecast rent-related expenses over time.

- If the bike shop is in a high-risk area or is expected to face financial challenges in the near future, opting for short-term rental arrangements may be a better option as it allows more flexibility regarding development. commercial conditions.

Tips & Tricks:

- Consider negotiating rent, lease or mortgage agreements with landlords to minimize expenses and free up capital for other purposes.

- Explore the options of subletting or subletting part of your space to other businesses or individuals to help offset rent costs.

- Try to take advantage of seasonal downturns or economic downturns to negotiate lower rent payments or renegotiate rental terms with landlords.

Assumptions surrounding bike shop financial projections regarding rent, lease, and mortgage payment can have a major impact on the overall financial health and stability of a bike shop. As such, it’s crucial that bike shop owners and managers carefully consider their options and choose a payment method that aligns with their long-term goals and objectives.

Bike shop utilities

Utilities are a vital component of a bike shop’s financial plan , as they can have a significant impact on overall business expenses. The main utilities that a bike shop might need are electricity, gas, water and internet.

For a bicycle retail financial model , electricity bills should be analyzed carefully as they can vary depending on the size, location of the shop and the owner’s energy saving methods. . Gas is mainly used for heating during the colder months, and it is often priced per use. Water is another critical utility, primarily for cleaning purposes, and its cost can vary depending on consumption. Finally, the Internet is an essential utility for communication, research and marketing; Its price usually depends on the speed and bandwidth required.

Tips & Tricks:

- Replace incandescent bulbs with LED bulbs as they use less energy and have a longer lifespan.

- Install energy efficient appliances like refrigerators and air conditioners to save on electricity bills.

- Implement strict water-saving methods like using low-flow fixtures and fixing leaks immediately.

In Bike Shop Financial Analysis , it is crucial to forecast utility expenses and include them in the Bike Shop Revenue Forecast . It is also necessary to factor in any potential rate increases or new setup fees in the Retail Financial Planning . Accurately forecasted utility expenses can be an important contributor to a successful Bike Shop Budgeting and Forecasting .

Also, including utility expenses in the Bike Shop Cash Flow Analysis and the Bike Shop Profit and Loss Statement Can provide information about the shop’s financial health and limitation unnecessary expenses.

Overall, considering utilities and their associated costs is key to maintaining a profitable bike shop and ensuring smooth day-to-day operations.

Bike shop other running costs

When constructing a bike shop financial plan , it is important to consider not only direct costs, but also other running costs. These can include expenses such as rent, utilities, insurance and advertising.

Rent is a major consideration for any business and a bicycle retail financial model should factor in the cost of renting or owning a storefront. Utilities, such as electricity and water, also add up over time and should be budgeted accordingly.

Insurance is another essential expense for a bike shop because it protects both the business and its customers. A financial analysis of the bike shop should take into account the cost of liability insurance, property insurance and any other relevant coverage.

Finally, advertising is necessary for a bike shop to attract new customers and retain existing ones. A Financial projections for the cycling workshop should include a budget for marketing and promoting the business, whether through paid advertising or other methods such as social media or email newsletters. mail.

By factoring in these other running costs, a bike shop financial statement can provide a more accurate picture of the shop’s finances and help plan for the future. Thorough retail financial planning will ensure that the shop can appropriately budget for expenses and generate a bike shop profit and loss statement that reflects the actual costs and profits of management of a bicycle company.

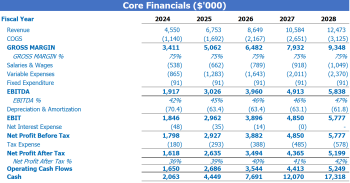

Bike Shop Financial Forecast

Financial forecasting is an essential part of any business planning, especially in the bike shop industry. A comprehensive financial model helps create a plan and roadmap for implementing strategic plans. An essential part of a bike shop financial model is the profit and loss statement. Additionally, having a sources and uses report is crucial when designing a reliable financial projection. Through accurate forecasting of (Insert LSI keywords if necessary) , bike shops can establish solid financial plans that align with their business goals, resulting in successful results.

Profitability of the bike workshop

Once we’ve built our revenue and expense projections for our bike shop, it’s time to check the profit and loss statement. This statement reflects our revenues less expenses, which help us determine the profitability of our business.

Our profit and loss statement will help us see our gross profit and EBITDA margin. Gross profit is calculated by subtracting the cost of goods sold from our revenue. The EBITDA margin shows us our earnings before interest, taxes, depreciation and amortization as a percentage of our total revenue.

Tips & Tricks:

- Keep an eye on your gross profit margin to ensure that you are pricing your products effectively.

- Focus on increasing your EBITDA margin by reducing expenses and increasing revenue.

By monitoring our profit and loss statement and establishing regular adjustments, we can ensure the success and longevity of our bike store.

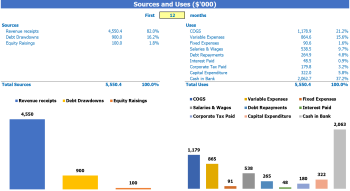

Bike Shop sources and uses the chart

The Sources and Uses of Funds in Excel’s Financial Model for Bike Shop provides users with an organized summary of where capital will come from sources and how that capital will be spent in uses. It is important for the total amounts of sources and uses to be equal to each other. Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

A tip for creating an effective sources and uses statement is to be concise and clear about each sources and uses item. This means providing enough detail to allow the reader to understand exactly where the funds are coming from and how they will be used. Some of the best ways to do this include using categories, subheadings, and bullet points.

Another important aspect of the sources and uses statement is to ensure that it is complete and includes all sources and uses of funds, both expected and unexpected. This can include things like funding from investors or lenders, proceeds from the sale of assets, or cash on hand from current operating activities.

Tips & Tricks:

- Use concise and clear language

- Include all sources and uses, both expected and unexpected

- Use categories and bullets to organize

By creating complete and clear sources and use statements, businesses can better understand their financing needs, ensure efficient use of their capital, and achieve their growth and sustainability goals.

Building a financial model for your bike shop is a crucial step towards your success. By creating a bike shop financial plan that includes Bike Shop Financial Analysis , Bike Shop Financial Projections , Bike Retail Financial Model , Bike Shop Revenue Forecast , Statements Bike Shop Financials , Retail Financial Planning , Bike Shop Profit and Loss Statement , Bike Shop Cash Flow Analysis , and Bike Shop Budgeting and Forecasting , you will be able to take informed business decisions and improve the financial health of your store. Remember to regularly update your financial model based on your actual results and always seek advice from financial professionals if necessary.