Related Blogs

- How to accurately estimate the value of your business

- How to Earn More Using Business Forecasting

- The Benefits of Using Activity-Based Budgeting

- Take control of your finances with a top-down budget

- Financial forecasting – an introduction

A startup that needs to grow requires steady cash flow. Therefore, one way to scale is to predict how changes in the market may affect your startup and your business. Specialists make this prediction by making a financial forecast of a company’s financial statements.

A financial statement is a report that shows how your company’s funds are used and shows what’s left after you make purchases and sales. So there are the main basic types of financial statements which include:

- Balance Statement – It shows the assets, liabilities and net worth of the company at a time of the year and indicates the status in which your company is.

Download the Excel template! Learn even more ⟶

- income statement – This type of statement shows how net income is acquired, how much revenue is made from your startup minus what is spent on costs.

Download the Excel template! Learn even more ⟶

- Cash flow account – This type shows how money flows in and out of your business in relation to all activities performed. Moreover, it gives you data on the amount of money left in your business after a specific time of year or major events.

Download the Excel template! Learn even more ⟶

What is financial forecast

Financial forecast is a process in which a company’s solutions and objectives are defined based on the analysis of past, present and anticipated business conditions. Then it is a very powerful instrument that can help you see possible trends and how you can decide to face certain solutions that will lead to the growth of your startup. Unfortunately, you cannot absolutely rely on financial forecasts because your predictions will not be 100% correct.

Undoubtedly, financial forecasting is the science that will give you the right trading direction. Also, financial forecasting is an art. So you have to practice it to be successful. The following steps could be considered the top tips for mastering your financial forecasting skills.

Forecasting steps

2. Identify possible relevant variables such as sales, gross domestic products and hiring plans, as these will guide you on how to collect data.

3. Make assumptions using one of three scenarios:

Therefore, an effective forecast should:

- Show major income and expenses

- Extend in the future for several years

- Stay well presented on budget

- Stay monitored and updated regularly

Download the Excel template! Learn even more ⟶

Role of financial forecasts

So exactly how will a proper forecast help your startup grow? Here are the main advantages when using this method:

- Financial forecasts will help you make decisions and solutions that are beneficial for your startup, earning more profit.

- The forecast is a platform for your startup that will help showcase your ideas dedicated to expanding your organization.

- This prediction will help you stay in line with your preferences regarding your business.

- Forecasts will help you identify startup assets (funds, including properties).

- The forecasts will inform you of any financial problems and show weak spots that you need to pay attention to.

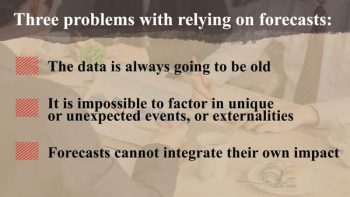

Despite the many advantages listed, forecasts can have disadvantages such as:

- The information collected is generally old

- Assumptions are not a certainty

Practice financial forecasting

Financial forecasting, like budgeting, can be a very useful mechanism for decision-making. On the other hand, when a financial forecast is effective, it helps determine potential future trends and how the changes might impact your startup. Thus, this information is vital to learn. Moreover, forecasts can help you in decision-making, plan preparation, and budgeting, all of which are very valuable phases of a business, especially for startups and small organizations.

Moreover, the possible future trends will help you know which direction to take to improve your strategy and realize the additional profits. Finally, provide the financial forecast frequently to increase your cash and sales. You can check more interesting tips on how you can Make effective financial forecasts by reading our blog. feel free to contact us Today, if you have any other questions!

Download the Excel template! Learn even more ⟶

[right_ad_blog]