Related Blogs

- How to Create a Cash Flow Budget

- Creating an activity-based budget with Microsoft Excel

- Common Financial Terms Every Startup Founder Should Know

- Setting up a flexible budgeting system

- What to look for in an entrepreneur when investing

Before we continue, let’s briefly define capital budgeting.

Definition of capital budgeting

Capital budgeting is the process by which companies plan a major investment. It can also be defined as an elaborate plan to help any business find the necessary financing. You can use it more to make investments in plants, machinery or food industry for a specific period of time which is usually longer than the time set on a budget.

Even though capital budgeting is valuable, if you don’t know the food industry well enough to operate the plan, it can be a difficult and time-consuming project for you. This is how entrepreneurs face different challenges when it comes to Delivered to financial cost management and structures.

Download the Excel template! Learn even more ⟶

There are many capital budgeting goals. One of the most important is to help different shareholders realize the value of the company. Applying this to the financial management process will greatly contribute to business profitability in current and future economies. Knowing how to implement capital budgeting to their business is very important for businesses of any size.

Download the Excel template! Learn even more ⟶

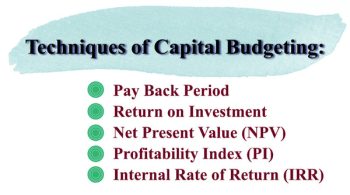

Let’s check out the following capital budgeting methods that can include:

1. Recovery period

This term refers to a specific period, required to regain all capital, invest. Usually we measure payback periods in years. A typical example would be: if it takes three years to produce the initial ,000 investment fund, the payback period is a three-year payback period. It is recommended for a company to Keep its cooldown period as short as possible, as it is a progress indicator.

2. Accounting rate of return

3. Net present value

4. Average accounting return

What you need to know to determine capital expenditures

Also consider the following key points when determining capital expenditures:

- Think about how likely you are to succeed

- Control budget and debt ceiling

- Think of a segment, like an industry or a competing company

- Consider tax rate and time value of money

- Think risk, liquidity, merger analysis

- Plan a long-term business strategy

- Think non-profit investing, like insurance

- Avoid errors and forecast errors

- Make capital budgeting decisions

- Include cost reduction program

- Undertake an advertising campaign

- Get new facilities or expand

Download the Excel template! Learn even more ⟶

As defined above, capital budgeting will help a business find financing for any project the business wants to create. Making decisions when investing in the best projects can sometimes be problematic. However, the above points offer solutions to this problem. This means that the right projects invested in will help the business grow exponentially.

[right_ad_blog]