In France, the stock markets are often shunned by individuals. Less than one in eight French households hold shares, either directly or through investment funds. This for several reasons: generally the stock market is perceived as too risky, too complicated or not profitable enough.

However, it is a mistake to neglect this investment (especially in a world where interest rates are very low) because until proven otherwise, equities have been the best long-term investment (all categories combined) that an individual can hold with an average annual return of 10% per year.

We will see all this in more detail in this article, and we will also see how much an investor can hope to earn concretely with the stock market by applying an extremely simple investment strategy.

But first, let’s raise some shots first.

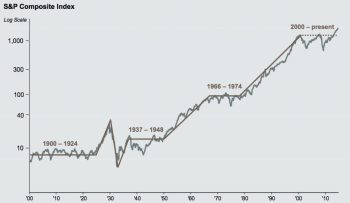

In the short term or if you want to play the speculator, I won’t tell you the opposite: it’s risky. But focusing on the short term on the stock market is a bit like watching the waves and forgetting the direction of the tide. And the direction of the tide here it is:

I really like this graph because I think it puts things into perspective. More than a century of financial data is there to prove that it is extremely rare to lose money over an investment period of more than 10 years; and that you generally have to invest at the worst time (i.e. right in the middle of a major stock market peak), for this to happen.

The scholarship can be as simple or as complicated as one wishes. It is not necessary to know how to dissect the balance sheets of companies to be able to benefit from the high returns of the stock markets. In fact, you don’t even have to buy stocks if you don’t want to.

The graph posted just above represents the American index Standard & Poor’s. As you can see its long term performance is more than appreciable (10% per year on average to be precise so far). And it turns out that today you can buy a fund with just one click that will take care of holding the 500 companies that make up this index today, all for ridiculous management fees (less than 0.2% per year) .

These funds (very safe and low cost) are called trackers (I refer you to the article at the link for more details). In concrete terms, their role is to faithfully replicate a stock market index for you. This can be the American S&P index or the French CAC 40 index if you prefer more local stocks.

Absolutely not. In fact, numerous studies have proven that the accounts that made the most buy/sell back transactions obtained on average the worst performances and that the investors who had a buy/hold strategy obtained on average the best.

This is because it is extremely difficult to become a successful trader whereas it is quite easy to buy stocks and hold them, or simply buy a stock index tracker as we mentioned above.

Correction: to earn money in large quantities and quickly on the stock market, you must already have money. To build wealth, on the other hand, you don’t need to start with a lot.

We will see it in the following example which will answer the question posed at the beginning of the article: how much can you really earn with the stock market? (without being an expert)

Suppose you don’t really have any savings. Let’s say you have just 1000 euros aside in reserve in your bank account.

Suppose you decide today to invest these 1000 euros on the stock exchange and that you decide to take control of your finances to manage to invest 1000 euros every year from now on. Everyone can save 1000 euros in one year, that’s about 85 euros to put aside each month.

How much do you think you would have by investing only 85 euros per month in the stock market? (nb: in this example we are using the average annual rate of return of the S&P 500 index which is historically 10% per year before inflation, as the investopedia site can confirm to you. It is therefore not an abstract estimate, but what you would have actually obtained with the annual average returns of the S&P 500 index).

The answer :

We therefore arrive at a heritage of half a million euros built with only 85 euros per month.

Pretty good if you ask me my opinion. And certainly enough to put you permanently out of need for your old age and live your retirement in opulence rather than in precariousness (all at the cost of a minimum financial effort).

Now let’s say you find this too long, let’s double all the numbers.

You invest 2000 euros initially, then 2000 euros every year.

Congratulations, you have become a millionaire by simply saving one month’s salary a year and without any special stock market knowledge. Now, the big question that I usually get asked next:

Because it requires 3 important things: a long-term vision, discipline, and confidence in the equity markets.

When I present these figures in general I receive 3 major criticisms:

An extremely valid point. But as long as there is a functioning global economy, mechanically, equity markets will continue to rise, driven by innovation, new businesses and human creativity. And if there is one thing on which I am ready to bet in the long term in a personal capacity, it is human creativity.

A classic. Want to know how to get a Greek god physique? It is enough to eat a balanced diet, to go to the sport 3 times a week, and to lift heavy loads. Simple at first sight. But in reality, how many people do it?

Something can be simple on paper but not easy to apply with discipline. This is the case in sport as in investing: discipline and regularity are the key, and this constitutes a significant barrier for the majority of people.

And I want a private yacht and marry a Victoria’s Secret model! Unfortunately the world does not operate according to our wishes but according to its own rules. To be able to take advantage of them, you have to understand them and act accordingly.

As the famous investor Benjamin Graham said, in the stock market one generally has the choice between getting rich slowly (by investing in a disciplined manner) or becoming poor quickly (by speculating).

That’s not to say there isn’t a way to speed things up. Actually there are two, but both will require some effort from you.

You’ll either need to increase the amounts you invest each year (as we saw earlier, this has a huge positive effect on your speed of getting rich) or learn how to pick the best stocks in the market so you can enjoy returns above the stock market indices over time.

Indeed, 10% per year being the average performance of the market, you will actually have in the lot of shares that will have risen by 30% per year while others will have fallen by 5% every year. If you manage to even avoid the worst ones, your returns will improve considerably. Be careful though, I’m not going to lie to you: selecting the best titles is not easy.

However, this is the strategy that I have chosen to use on a personal basis because I believe that the returns that it is possible to generate amply justify the additional effort of research and selection of securities (for example, some of the stocks I hold have so far had average returns of 12%, 14%, 17% per year).

I’m not saying that this strategy is the right one for everyone far from it, I’m just saying that in my opinion, it’s worth thinking about. And if necessary, you can always opt for the solution of simply buying a tracker and retiring with half a million in the bank.

Not so bad right?