A newcomer to the world of financing, crowdfunding is shaking up many codes. This practice, which consists of appealing to the financial contribution of a large number of people, is opposed to the ideologies of financial institutions, which do not see it in a good light either. Since its appearance in the 1800s, this form of investment has mobilized millions of people and drained hundreds of billions of dollars. Will crowdfunding overshadow traditional banking institutions? Is it a fad or a sustainable investment method?

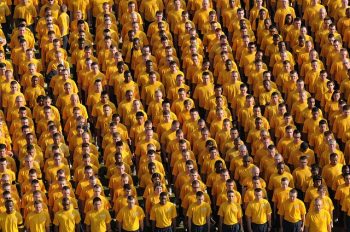

Crowdfunding involves getting a crowd of people to pay a small amount of money to invest in an idea or product, with the promise that when that idea comes to fruition, they will be the first to get access to it. The project can be anything from innovative technology to a video game to an invention.

The key is to engage these people in your idea, convince them to invest a small amount of money for a small reward, and then have them share the project because they feel they have purchased something special and want that the others take note of it. The best crowdfunding projects get people talking about them and the investment following.

By appealing to the public and not to banking institutions, the beneficiaries of fundraising have a better chance of obtaining the financing they want. Indeed, most banking institutions have very strict rules regarding loans. Projects are scrutinized by specialists who do not always see the potential of new technologies.

Investors, for their part, have the chance to participate in projects that are close to their hearts. They find it rewarding and usually have no regrets. This is especially true for community projects that require donations. With this method of financing, no project is left behind; which allows an unbridled creativity.

Since their appearance, crowdfunding platforms have come under great suspicion from regulators and banking institutions. The latter have, through lobbying and legislation, succeeded in putting restraints on crowdfunding. In the vast majority of countries, investment options are very limited. For each project to be financed, each individual can only invest very small sums. Added to this is the risk involved in investing in a startup.

The specialists are formal: 90% of startups fail. Therefore, relying on crowdfunding as an investment method can be counterproductive. In addition, the vast majority of entrepreneurs who use this method of raising funds do not pay investors dividends. Generally, they receive in return goods in kind. A musician will donate concert tickets or CDs from his album, while a technology startup will offer you a subscription to his services. Crowdfunding is therefore not for those who want a hard cash return on investment.

Crowdfunding is not just a fad, as its roots go back centuries. In the past, writers would raise funds before their books were published and give the scoop to investors. It is a powerful tool for funding community and humanitarian projects. This mode of investing allows investors to put their money into things that matter to them. However, do not expect to collect millions because of the many laws that restrict it.