The rich of this world do this in extraordinary ways:

They know how to convince their banker to finance a real estate project.

Investing in real estate is one of the best ways to get rich.

Indeed, you invest with other people’s money…

…to increase your wealth.

But you might be wondering:

“How do you pass the fiery ordeal of a face-to-face meeting with the banker with flying colors?”

We are going to see a very detailed list of 14 ultra-effective techniques for a successful interview with a banker.

Let’s go.

But first :

A figure that will surely be right to put you in a position of strength.

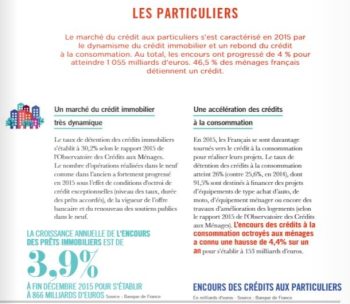

According to the French Banking Federation (the reference body in terms of financing), there have never been so few loans granted in 2014 .

In its annual report, here are the conclusions that this organization draws:

The rate of loans granted to individuals set a new record in 2014, at its lowest for 25 years. Since 2008, more than 1.7 million households have left the credit market .

French Banking Federation

27th annual report – January 2015

Look :

The number of French people with credit is at its lowest level, at 46.5% of the population in 2014 against nearly 53% in 2001.

But that’s not all :

Interest rates have never been so low, they have been falling steadily for several years.

What does this mean for us?

Simply the following:

CONCLUSION OF THE FRENCH BANKING FEDERATION REPORT

Loans are getting cheaper and cheaper, and yet every year bankers grant fewer and fewer loans.

Knowing this, getting credit already seems easier, right?

Talking to your banker suddenly becomes easier.

Today, few investors follow the actions of central banks exactly…

…and therefore the influence they may have on the rates offered by your banker.

Fortunately, there is a tool that allows you to stop worrying about all that.

This is the rate analyzer.

By simply entering your region and the duration of your loan, you can have an immediate idea of the quality of the rate offered to you.

For example, here with a global analysis of the whole of France.

This is not necessarily super representative, so we can also filter by region:

And there you have it, in one click you can get a precise idea of the competitiveness of the rate offered by your bank.

Faced with super-low rates and declining credit distribution, it’s time to take control of your assets!

Click here to tweet this message

Now that we know the state of the market, let’s get down to business.

How to talk to your banker and get the best terms for a home loan?

Listen :

In banking, time is money. The more your interlocutor grants loans, the more he receives commissions.

He therefore needs to go quickly, and all the easy files are gold bars for him: it’s easy money that he can touch.

As soon as he sees a very good file that can easily be approved by his boss, he will support your financing at all costs!

So the only way to really make a difference is to avoid rookie mistakes:

Relieve your banker by giving him what he expects right away.

That way, no back and forth emails or phone calls, endless procedures…

You arrive with what he wants, except for the document:

He will finally be delighted to have a client for whom you don’t have to do 10 follow-ups to get a document…

…and in exchange, your file will be categorized “easy”, because you bring all the supporting documents immediately.

Essential parts for maintenance, in 3 categories

Personal situation

Financial flows & assets

The project & its benefits

(pass yourself as a pro!)

Let’s face the truth right away:

To maximize your chances of success, the banker must trust you .

To obtain this confidence, only one technique: reassure him by showing him that you know what you are talking about.

From there, 2 specific cases emerge:

You have already invested before

Nothing could be simpler: generate a cover page with all the goods you own, highlighting the key figures: amount of the loan, rent, rental vacancy rate, as well as detailed accounting.

You have already proven yourself: the hard part has been done! Simply show your qualities as an investor and the banker will be won over.

You are new to real estate

The first time is always complicated: here your personal skills will count for little. It is above all the solidity of the project that will allow you to seduce the banker.

INSEE studies on rental demand, an accurate financial report, created with a tool like RendementLocatif, will make your job easier.

It’s up to you to prove yourself: your first investment is the most important.

Showing that you know how to make money always reassures a banker!

Click to tweet this message

Rather than letting the banker surprise you with your financing before the interview, use this ultra-simple technique to go faster.

There she is :

Send an email to the banker a few days before your interview, with all the documents concerning you attached.

In the body of the email, keep it very simple: only indicate the most important, namely the amount you want to borrow and the number of years of repayment, the location of the property, its area.

This small gesture that seems like nothing demonstrates 2 things:

Thus, he can analyze your file even before the interview: ideal for him and for you!

To make it easier for you, here is an example of an email to send to the banker. It’s short, goes to the essentials and puts you in the best conditions for the future.

Example of the first email to send to your banker to convince him to finance your project

For many of us, doing the forecast accounting for our property can be long and often a source of error.

Above all, you don’t want to give half-hearted financial forecasts during the interview with your banker.

So rather than going through a handmade Excel sheet, you can automate this.

No need to understand precisely how the different tax regimes work.

A very well-made tool directly calculates the profitability of the property studied.

The advantage is that you no longer need to spend time evaluating the financial aspect of the property.

RentalRental does it for you.

The following ? Print the report given by the tool and insert it in your file.

The tool is very easy to use:

By entering some basic information (price, area, city and rent), you get something like this:

The direct profitability of your property! A quick click on Print and your financial section is complete!

Of course, the data used can be adjusted, and this is also one of the strengths of the tool:

All the data can be modified at will, RendementLocatif can therefore also be adapted to your tax system and the specific charges of your property.

During any negotiation, it is necessary to know the concessions that you could be inclined to make in exchange for obtaining a better rate. Here they are :

Same thing as for the opening of a product: the banker will receive a small sum for the opening of a life insurance contract. In addition, life insurance allows collateral (the funds are guaranteed to the banker) which provides additional security to the banker in case you cannot repay.

Administrative fees are a great invention that allows the banker to charge unfounded fees.

In truth, these are above all an excuse not to waste your time dealing with complex files.

It is thus a security which allows the bank to ensure that the banker does not work too intensely for a file which in the end will not bring in enough.

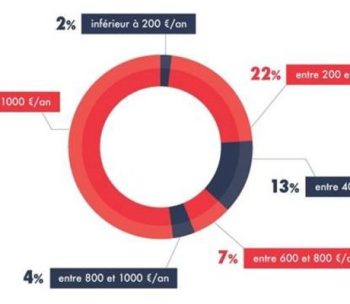

With the addition of these fixed application fees, which range from 500 to 1,500 euros, the agency is sure to make the most of the time spent by the banker studying your file.

The good news is that if your file is complete and does not need a lot of time to be studied, the banker does not have to spend hours on your file.

And so you can easily cancel the application fee.

Since my file is complete and does not require any special attention, can you make a move on the application fees?

Ideal sentence to negotiate your application fees

Similarly, if you are a long-time customer, you are in a position of strength: being a loyal customer, requesting the cancellation of these fees can be a way for the banker to reward your loyalty.

A home loan always comes with the signing of an insurance contract against the loan.

Indeed, if tomorrow you die in a car accident, the debt will remain due.

This is where the insurance comes into play: it will reimburse the outstanding capital on your behalf if for some extraordinary reason you are unable to continue making payments.

The problem is that banks often sell a combo: mortgage + insurance.

And since it is easier to sign for this combo than to seek the loan and the insurance individually, the banks make nice margins on these insurances.

Conclusion: taking a little time to look for insurance other than that of your bank will save you a lot of money.

For a mortgage, opt for delegation loan insurance! (that’s thousands of euros saved)

This insurance generally covers 3 elements:

To find the best delegation insurance, the easiest way is to go through an online comparator.

After entering the information relating to your property, the tool will give you an estimate of the price to pay through the insurance company at the most attractive price.

You can then compare it with the proposal from your bank.

Here is an online comparator that will allow you to find borrower insurance online:

To access

to the site, just go to the HyperAssur site. The interface is really easier to access:

Then, the site asks you to enter information about your personal profile:

Once this information has been entered, you have access to a panel of competitive offers:

And here you are in a few clicks and you get a competitive rate!

Note: the prices you see here are those for premium type insurance, i.e. with the greatest coverage! If this amount seems too expensive, or if you agree to be less covered, you can always select standard cover:

What if I have already taken out a home loan and want to opt for cheaper borrower insurance?

When you go to see the banker, he will want guarantees in case you are unable to repay him.

To obtain these guarantees, he has 4 possibilities:

Apart from the individual operation of each of these options, what really matters is the cost of each of these solutions.

The broker MeilleurTaux has undertaken a study on the subject. Here are the conclusions:

Consequently, in the case of a loan of €150,000:

Conclusion: which guarantee to choose?

If your banker asks you for a borrower guarantee and you are not a civil servant, opt for the surety company. It is the cheapest guarantee.

If you repay your loan in advance, it’s a dead loss for the banker:

Indeed, by returning the money earlier than expected, you do not pay interest on the capital repaid before the due date.

In other words, if your monthly payment is €500 and you repay €800 this month, the banker will not earn interest on the additional €300 you return to him.

The disappearing interest is less money that the bank will not touch.

To limit this practice, the banks have set up early repayment indemnities in their contracts: thus, the bank will charge you a fee if you repay in advance, discouraging you in passing from repaying more each month than what is registered. in the schedule.

The good news is that all of this is negotiable.

Indeed, the banker has a good margin of maneuver on these costs and he can completely have your file validated by removing these IRAs (prepayment allowances).

Comprechoisir.com, for example, gave 3 ways to negotiate them.

As a last resort, if he really doesn’t want to let go, offer him the following deal:

How about modularity in IRAs? The closer you get to the maturity of the loan, the higher the IRA rate to pay.

A strategy to lower your IRAs

You will at least have the advantage of benefiting from a reduced rate during the first years of the loan , allowing you to resell the property without being penalized by heavy penalties to be paid to the banker.

Often going around several banks can make it possible to do good business.

A lower rate, better terms, no IRA…

All those little savings add up and increase your bottom line.

Here is a lender for rental property that we do not often think of:

The rates it offers are often a little above the market, but Crédit Foncier has the advantage of knowing the issues of rental investors well, and of being able to respond to them more easily (reduction of administrative costs , IRA…).

If really after several visits, you cannot find a banker who wants to lend you, then the option you have left is to go through a broker. He will replace you in the fundraising work.

Thanks to its strong banking address book, it will present your file to a panel of banks in its network.

He will then come back to you with the best financing offer.

This service is usually free. The broker is remunerated through a commission paid by the bank.

How to choose a real estate broker?

Here are three reputable brokers:

The banker is a generalist: he deals with a range of diversified products, both current accounts, savings, various loans (consumption, real estate, etc.).

To reassure him, it is interesting to show him why the property you want to buy is exceptional.

This includes in particular:

How to set up these 3 components?

It’s extremely simple, if you follow the right methods.

I have already mentioned the subject in a dedicated article, “3 pillars for making a profitable real estate investment”, I come back specifically to these 3 methods and how to apply them easily.

With this in place, you have all the ingredients to seduce your banker: a study of rental demand ensures that the property will be rented easily; a positive cash flow guarantees that you will be able to repay the monthly payment of the loan; and a well-chosen tax system shows that you are a keen investor who knows what he is talking about.

Bingo!

Earlier, I mentioned Crédit Foncier.

What is good with them is that their name is ambiguous: they specialize in mortgages.

They are therefore much more familiar with the housing market and its characteristics than the neighborhood banker of a general agency.

Your file will therefore have a much better chance of being understood and appreciated at its fair value.

If you do not want to domicile your income or open new current accounts to obtain a mortgage, this organization is perfect: they generally do not ask for it!

So try to submit your file to Crédit Foncier, and you will have to deal with a bank specializing in real estate investment.

When applying for a loan, you really only have 3 choices as the repayment period:

15 years old

High monthly payment, short term 20 years

Average monthly payment, average duration 25 years

Low monthly payment, high duration

Let’s now simulate the difference between these 3 durations.

CBank, through Philippe Guilbert, has studied the issue in depth.

Let’s take a monthly payment of 1,000 euros. Over 15, 20 and 25 years, here are the results of the study:

Note: the capital gain financed in year N is the capital financed in year N – the capital financed in year N-1. The cost of capital financed in year N is the cost of financing in year N – the cost of financing in year N-1.

In other words, extending its loan term from 15 to 20 years saves approximately €35,000 in financed capital, against an increase in the cost of financing of nearly €25,000.

On the other hand, extending its loan period from 20 to 25 years only results in a gain of €22,335 in financed capital, but increases the cost of financing by an incredible €35,000!!

Conclusion: at 20 years of borrowing, we arrive at an inflection point, during which the cost of financing is more or less equal to the capital gain financed.

20 years is therefore the maximum duration recommended for a rental loan.

One of the magics of real estate in France is that you can buy a rental property without down payment.

Indeed, it is not necessary to have a starting capital to invest in real estate.

This is for example not the case in the United States, where it makes a contribution of 20% to obtain correct rates.

Now, in France, it is possible to go even further by asking the bank to finance the costs of the notary and those of the real estate agent.

Notary fees are around 8% of the price of a property. Those of the real estate agency are however not regulated and depend on each agency.

The trick here is to ask the banker for the financing of the property, but also for the notary and real estate agent fees.

This is called 110% financing.

A very simple Internet tool makes it possible to quickly obtain these costs.

My favorite is Particulier A Particulier.

It is ultra-simple and very fast.

We then immediately obtain the answer, with precise details of each cost item:

And now it’s that easy to get an estimate of notary fees!

If you had to remember just one thing…

Real estate is perfect for those who wish to get rich: without contribution, it is possible thanks to the leverage effect to borrow large sums to buy rental properties.

The whole problem lies in access to this financing: it is by showing your qualities as an investor, your seriousness and your motivation, supplanted by a concrete file, that you manage to obtain financing for your future acquisitions.

Showing the banker that you know how to make money, by reassuring him about the payment of monthly installments thanks in particular to concrete profitability, will allow you to obtain his blessing in order to enrich yourself.