- Home

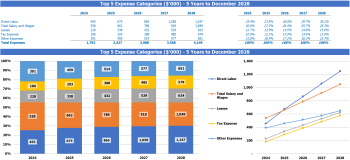

- Sales and revenue

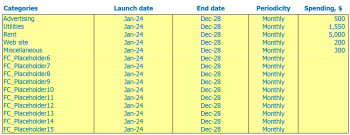

- Running costs

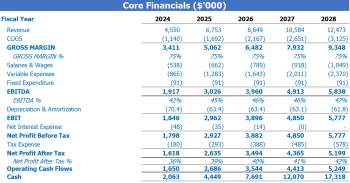

- Financial

Building supply stores are essential to the construction industry, providing materials and supplies for the completion of construction projects. However, to be successful in this industry, one needs to have a solid financial plan in place. This can be achieved through the development of a comprehensive financial model. With a financial model, building supply store owners can map out a roadmap for achieving their financial goals, including generating revenue, maximizing profits, and improving cash flow. In this blog post, we will provide a step-by-step guide on how to create a financial model that can help you create a building material store financial forecast and make informed decisions based on building material store financial analysis. building .

Ferces and sales forecasts of the building materials store

A building materials store’s financial plan should include a revenue and sales forecast that predicts expected revenue and sales growth over a period of time, including launch date, ramp-up time , walk-in traffic and growth assumptions, customer and buy assumptions, and sales seasonality. The forecast should also consider the building material store’s profit model, financial projections, budget plan, income statement, balance sheet, financial forecast, and financial analysis.

Building materials store launch date

Choosing the right launch date for your building supply store is crucial to its success. It prepares the way for your business operations and financial performance later. The building store financial model provides a month of assumption for the start of businesses. When setting your launch date, be sure to consider the following:

- Market trends

- Peak seasons

- Application Cycles

Knowing the right time to launch your business helps you build buzz, attract customers, and build brand awareness before your competition steals the show.

Tips & Tricks

- Understand your target market and their behaviors.

- Pick a date that provides plenty of time for planning and pre-launch preparation.

- Schedule the launch date for a time when customers are most likely to purchase building materials.

Building Store Ramp Up Time

When starting a new business or launching a new product, it is important to consider the time to rise from the sales plateau when forecasting sales. This period represents the time it takes for your business to reach a steady level of sales and establish a predictable pattern.

What is the ramp-up period for your building materials store? This is how long your business will need to reach the sales plateau. In the building materials industry, the ramp-up period may vary depending on various factors such as your store’s geographic location, competitive landscape, product mix, and marketing efforts. Typically, a new building supply store can take about six to twelve months to increase sales and reach a sales plateau.

Tips & Tricks:

- Conduct market research to understand local demand for building materials and identify customer segments with the highest potential.

- Offer promotions and discounts to attract new customers and build loyalty.

- Optimize your inventory management to ensure you have the right products in stock at the right time.

- Invest in digital marketing to increase your online visibility and reach a wider audience.

By using financial projections, such as a budget plan, income statement, balance sheet, and cash flow analysis, you can estimate sales ramp-up time and forecast your building materials store’s financial performance over time. over time. This financial analysis can help you make informed decisions and refine your strategy to maximize revenue and profitability.

Privileges of traffic in building materials

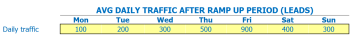

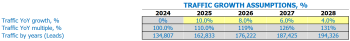

After months of ramping up our building supply store, we noticed a steady increase in daily walk-in traffic. In order to create a solid financial model for our business, it is important to track and analyze this traffic data.

On Mondays, we have an average of 100 visitors per day. Tuesdays and Wednesdays bring a little more traffic, with an average of 120 visitors per day. Thursdays see an increase in traffic, with an average of 150 visitors per day. Fridays and Saturdays are our busiest days, with an average of 200 visitors per day. Sundays are our slowest day, with an average of 80 visitors per day.

It is important to note that these traffic patterns may vary depending on location and seasonality. We will continue to monitor this data and adjust our financial projections accordingly.

Tips & Tricks

- Use foot traffic data to make informed decisions on staffing levels and inventory management

- Consider implementing promotions or sales on slower traffic days to drive more business

- Analyze weekly traffic data trends to make strategic decisions for the future of the business

Looking to the future, we expect a growth factor of 5% per year in our walk-in traffic. Using this input, our financial model will calculate future weekday walk-in traffic for the next five years. This information will be crucial in our financial planning and budgeting processes, as well as our overall business strategy.

Visits to building material stores for sales conversion and sales inputs

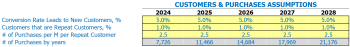

When developing a financial model for a building supply store, conversion from visit to sale and repeat sales are two critical inputs that need to be considered. The visit-to-sale conversion rate represents the percentage of store visitors who end up making a purchase.

For example, if the store gets 1,000 visitors in a month and makes 100 sales in that same period, the visit-to-sale conversion rate would be 10%. This percentage is used to predict future sales and revenue.

Repeat sales, on the other hand, represent the percentage of customers who return to the store to make additional purchases. This is important to know for forecasting long-term revenue and profitability. Based on historical data or industry standards, repeat customer percentage can be estimated and used to predict future sales.

In addition to repeat customer percentage, it is also important to estimate the average amount of purchases each repeat customer will have per month. This metric helps in understanding the amount of revenue the store can expect to generate from existing customers on a monthly basis.

Tips & Tricks:

- Regularly track and analyze visit-to-sale conversion and repeat sales data to make informed business decisions.

- Be sure to provide excellent customer service to increase the likelihood of repeat customers.

By understanding the conversion rate and repeat customer metrics, a financial plan for a building supply store can be developed that is based on realistic assumptions regarding sales conversion visits and repeat sales. This analysis should include building material store revenue model, building material store profit model, building material store cash flow analysis, building material store financial projections, plan Building Materials Store Budget, Building Materials Store Income Statement, Building Materials Store Balance Sheet, Building Materials Store Financial Forecast and Building Materials Store Financial Analysis for informed decision making.

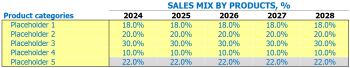

Building Material Mixes Mix Inputs

Your building supply store sells a variety of products, including Lumber, Roofing, Paint, Plumbing, and Electrical Supplies . Each of these products belongs to a specific product category:

- Lumber: including dimensional lumber, plywood and cedar planks

- Roofing: including asphalt shingles, metal roofing and rubber membrane

- Painting: including interior and exterior paints, spray paints and painting tools

- Plumbing: including PVC pipes, fittings, faucets and valves

- Electrical equipment: including electrical wires, switches, circuit breakers and sockets

Entering the sales mix hypothesis on the product category lever will make it much easier to understand which products are driving your business. Here is the mix of sales by product category assumptions:

- Lumber: 40% (year 1), 42% (year 2), 43% (year 3), 44% (year 4), 45% (year 5)

- Roof: 20% (year 1), 19% (year 2), 18% (year 3), 17% (year 4), 16% (year 5)

- Paint: 15% (year 1), 14% (year 2), 13% (year 3), 12% (year 4), 11% (year 5)

- Plumbing: 15% (year 1), 14% (year 2), 13% (year 3), 12% (year 4), 11% (year 5)

- Electrical equipment: 10% (year 1), 11% (year 2), 13% (year 3), 15% (year 4), 17% (year 5)

Tips & Tricks:

- To improve your building supply store’s revenue model, be sure to monitor your inventory levels and product demand by category.

- Offer discounts, promotions, or discount offers to entice customers to buy products in underperforming categories.

- Consider expanding your product offerings in categories that are popular or have high profit margins.

- Use financial planning tools like a budget plan, income statement, balance sheet, and cash flow analysis to assess the financial health of your business.

- Regularly update your financial projections and financial forecasts to reflect changes in your sales mix and business operations.

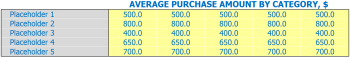

Building Materials Amount of average sales amount entries

In our building materials store, we sell a wide variety of products ranging from lumber and roofing to hardware and tools. To make it easier to enter assumptions and calculate estimates, we categorize each product into specific product categories such as lumber, roofing and hardware.

When we wrap assumptions in our financial plan, we use the average sales amount by product category and year. For example, we estimate that the average sale amount for wood will be 0 in year one and 0 in year two. This assumption makes it much simpler to calculate the average ticket size by considering the sales mix and the average sales amount of each product category.

Assuming our sales mix is 40% wood, 30% roofing, and 30% hardware, the model will calculate the average ticket size:

(0.4 x 0) + (0.3 x 0) + (0.3 x 0) = 0

Tips & Tricks

- When entering assumptions for your financial projections, try to categorize your products or services to help estimate the sales mix and average sales amount.

- Be sure to update your estimates as needed, especially if there are changes in market or industry trends.

- Consider using software or other tools such as Excel to help with your financial analysis and forecasting.

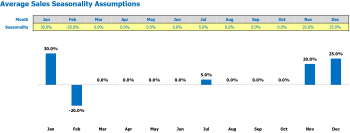

Seasonality of building materials store sales

When it comes to a building supply store’s revenue model, understanding the seasonality of sales is of paramount importance. Customer buying patterns may vary during the calendar year, leading to fluctuations in sales. Therefore, a solid financial plan for the building materials store should include the sales seasonality assumptions.

For example, when constructing financial forecasts, it might be reasonable to assume that the winter months experience lower sales than the summer months. If the average sales per day for the year are 00, sales in January could be assumed to be 70% of the monthly average or 0. Likewise, the winter months could be assumed to have lower sales compared to the summer months.

Tips & Tricks:

- Study past sales data (monthly and yearly) to understand sales seasonality.

- Incorporate seasonal factors into financial projections, but also be prepared for unexpected events that could cause deviations from assumptions.

- Be proactive in managing cash flow in accordance with seasonal fluctuations in sales.

The above assumptions should be supported by historical sales data or market research if available. Analyzing sales seasonality helps create a budget plan, income statement, balance sheet, cash flow analysis, and financial projections for building material stores that are realistic and provide a clearer picture of profitability of the company throughout the year.

Building Material Store Operational costs Forecast

Operational expense forecasts are an integral part of the building supply store’s financial model. It includes various operating expenses such as cost of goods sold by products %, wages and salaries of employees, rent, lease or mortgage payment, utilities, and other operating expenses. A detailed analysis of operational expenses helps businesses forecast their finances accurately.

| Operating Expenses | Amount (per month) in USD |

|---|---|

| Cost of goods sold by products % | 2,000 to 10,000 |

| Salaries and wages of employees | 5,000 to 20,000 |

| Rent, lease or mortgage payment | 4,000 to 15,000 |

| Public services | 500 to 3,000 |

| Other running costs | 2,000 to 5,000 |

| Total | 13,500 to 53,000 |

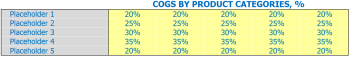

Building supply store Cost of goods sold

In a building supply store, the cost of goods sold (COGS) represents the total cost of goods sold during a given period. This includes the cost of the materials used to make the products and the labor costs required to produce them. COGs for a building supply store can be broken down into different product categories such as lumber, roofing, flooring, and drywall.

Assumptions: COGS assumes that materials were purchased at a certain price and labor was paid at a certain rate. It also assumes that there is no waste or spoilage, and that all products produced were sold at full price.

For example, say cogs for wood are assumed to be 75% of retail price. If the retail price of a piece of wood is , the cogs for that piece of wood would be .50.

Tips & Tricks:

- Regularly monitor your COGs to ensure that you are pricing your products appropriately.

- Consider negotiating with your suppliers to get better prices on your materials.

- Use an inventory management system to track how much inventory you have on hand and when you need to reorder.

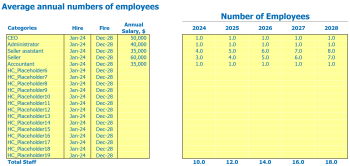

Building Materials Store Salaries and Salaries of Employees

At our building materials store, we understand the importance of attracting and retaining talented employees. The Financial Plan for our building supply store Includes a budget for wages and salaries that will help us build a strong and dedicated team.

We plan to hire a range of staff, including sales associates, customer service representatives and warehouse workers. We will also need a Store Manager and an Assistant Manager to oversee operations. Each position will have a specific salary range based on experience and responsibilities.

Here are some assumptions for our employee wages and salaries:

- Business Associates: Hired year-round, earn an average of ,000 per year, need 6 full-time equivalent (FTE) staff

- Customer Service Representatives: Hired year-round, earn an average of ,000 per year, needs 4 ETC staff

- Warehouse workers: hired seasonally, earn an average of ,000 per year, needs 7 FTE staff

- Store Manager: Hired full year, earns an average of ,000 per year

- Assistant Manager: Hired year-round, earns an average of ,000 per year

Tips & Tricks:

- Consider offering performance-based bonuses or profit-sharing opportunities to incentivize and retain employees.

- Review salaries annually to ensure they remain competitive with industry standards.

- Calculate the costs of your employee benefits, such as health insurance or pension plans, when creating your building supply store financial projections .

By recognizing the importance of employee salaries and wages in our Building Materials Store Revenue Model , we are confident in our ability to attract and retain talented staff members who are dedicated to providing excellent customer service and to contribute to the success of our company.

Payment of building materials store, rental or mortgage payment

When creating a financial plan for a building supply store, one of the most important aspects is determining how much to spend on the store location. This includes the cost of rent, a lease or mortgage payment if the store is owned.

For example, if the store owner decides to lease a location, they may need to consider factors such as the length of the lease, whether there are renewal options, and whether there are additional fees at the above the monthly rent payment.

Alternatively, if the store owner decides to purchase the building, they may need to consider expenses such as property taxes, insurance and maintenance costs.

Tips & Tricks:

- Research the local real estate market to determine what an appropriate rent, lease, or mortgage payment would be for a building supply store.

- Consider negotiating the terms of a lease or mortgage agreement to get the best deal possible.

- Consider potential cost factors such as property taxes and maintenance when deciding whether to lease or buy a store.

Building Supply Store Utilities

When creating a financial plan for a building supply store, it is important to include a thorough analysis of utility expenses. This will help in building store financial analyzes and financial forecasts.

Utilities can include expenses such as electricity, gas, water, and waste management. To accurately forecast these expenses, it is important to review past bills and usage trends. For example, if the store is located in a hot climate, electricity bills may be higher in the summer due to increased use of air conditioning.

Tips & Tricks:

- Consider investing in energy-saving appliances or light bulbs to reduce electricity costs

- Track usage closely to identify unexpected spikes or trends

- Don’t forget to include any fees or taxes

By analyzing and forecasting utility expenses, building supply store owners can create a more accurate financial plan. This will aid in budget planning, financial projections and ultimately lead to a more successful profit model for the store.

Construction store Other running costs

In addition to the major expenses outlined above, several other running costs must be considered when building a financial model for a building supply store. These may include:

- Marketing and advertising expenses to promote the business and attract customers

- Insurance premiums To protect the store and its assets

- Rental fees for equipment, vehicles or storage space

- Sales commissions paid to staff who sell products

It is important to consider these expenses when creating a financial plan for a building supply store. By including all costs, you can accurately forecast revenue, profit, cash flow, income statement, balance sheet, financial forecast, financial analysis, and budget plan .

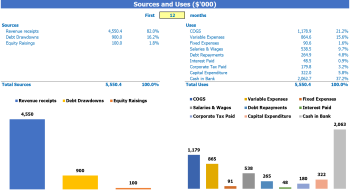

Building materials store financial forecast

Financial forecasting is a crucial part of the building supply store’s financial model, allowing business owners to predict future cash flow, profit, and loss. A profit and loss (P&L) statement and a Sources and Use report are two essential components of the forecast. The P&L shows the company’s expected sales, expenses, and net income, while the sources and usage report outlines funding requirements and potential funding sources.

Cost-effective building materifications

Once we have created revenue and expense projections, it is essential to check the profit and loss (P&L) from revenue to net profit. This helps visualize profitability, such as gross profit or EBITDA margin. Financial analysis of building materials store is incomplete without analyzing P&L reports for profitability.

A Financial plan for the building supply store Must include a cash flow analysis, including expenses such as rent, payroll, utility bills, inventory costs, and any other associated costs to run the daily operations. This helps monitor the inflow and outflow of money, which is essential for the success of any business.

Tips & Tricks:

- Monitor cash flow frequently and update projections regularly.

- Reduce expenses where possible without compromising the quality of products and services.

The next step Building Supply Store Financial Projections is to create a budget plan to forecast income and expenses. This allows planning for the future in terms of resources, manpower and revenue. This plan should include both growth and contingency maneuvers to stay current with the changing industry landscape and mitigate unexpected expenses.

In addition, the construction store balance sheet is an essential element in monitoring the profits and losses of a company. This includes evaluating current assets and liabilities to make necessary and informed financial decisions.

Sources and use of building materials stores

Sources and uses of funds in Excel’s financial model for building materials store provides users with an organized summary of where capital will come from sources and how that capital will be spent in uses. It is important for the total amounts of sources and uses to be equal to each other. Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

When considering the Building Supply Store Revenue Model , it is important to have a solid and comprehensive financial plan. This would include a Building Materials Store Profit Model , a Building Materials Store Cash Flow Analysis , a Building Materials Store Financial Forecast, a Building Materials Store Financial Analysis, a Building Materials Store Financial Projections, Building Materials Store Budget Plan, Building Materials Stores Income Statement , and Building Materials Stores Balance Sheet .

Tips & Tricks

- Be sure to regularly update and review all financial statements and projections.

- Consider various scenarios and potential market changes when creating financial forecasts.

- Consult financial experts and advisors for additional advice and support.

In conclusion , building a financial model is crucial for any business, especially for a building supply store. It helps to understand the revenue, profit, cash flow and financial forecast of the store. Creating a financial plan can provide insight into business expenses and income and help make informed decisions. A budget plan can help track expenses and ensure the store is profitable. The income statement and balance sheet can provide a snapshot of the store’s financial health, while financial projections can provide insight into the future of the business. By performing a financial analysis, the store can assess its performance and make necessary adjustments. Building a solid financial model can give the store confidence in its future and help it grow and succeed.