- Home

- Sales and revenue

- Running costs

- Financial

Welcome to our guide on how to build a financial model for an aftermarket store. As a business owner, having a clear understanding of your financial situation is essential to making informed decisions for the growth of your business. Building a financial model for your aftermarket store can provide you with a roadmap of how your business will perform financially in the future. In this guide, we will cover everything you need to know about financial projections for spare parts store, revenue model, business plan, cash flow analysis, profitability analysis, break-even analysis, income statement, balance sheet, financial forecasts and financial planning .

Spare parts racks Revenues and sales forecasts

Revenue and sales forecasts are a crucial part of the aftermarket parts store business plan as it provides an idea of the expected financial performance. Based on the aftermarket store’s financial projections, the revenue model is designed to project the sales forecast through the launch date of the business and beyond.

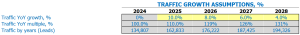

The sales ramp-up time is divided into several months, and it is based on the store’s potential growth rate. Walk-in traffic and growth assumptions are considered to estimate the store’s initial revenue projections. Customer and purchasing assumptions play a critical role in estimating expected revenue during each month. The sales seasonality factor is also involved in the financial forecast, which provides a more realistic picture of what you can expect.

Launch date of the spare parts store

The launch date of your spare parts store is crucial for its success. This is the day when your business becomes visible to customers and starts generating revenue. It is important to carefully consider the launch date and plan accordingly to ensure smooth operations from day one.

Financial projections for an aftermarket store can only be made once the launch date has been determined. Revenue model, cash flow analysis, profitability analysis, income statement, balance sheet, break-even analysis, financial forecasting as well as financial planning depend on it.

Tips & Tricks:

- Consider the holiday season as it may affect demand for spare parts

- Consider embarking on a slower season to test the waters ahead of the busy season

- Ensure that all necessary permits and licenses are obtained before the launch date

The delay of the launch date can have a negative impact on the business plan and the financial projections. Similarly, launching too early without proper planning can lead to inefficiencies and unnecessary costs. Therefore, it is important to set a realistic launch date and prepare accordingly.

Spare parts ramp-up time

When planning a successful spare parts store, it is crucial to consider the ramp-up time to the sales plateau. It means the time it takes for your business to reach its maximum sales potential.

This ramp-up period varies between different industries, and a solid financial forecasting plan will help determine the appropriate timeframe for your business. In the aftermarket store industry, it usually takes 6-12 months to reach sales plateau.

Tips & Tricks:

- Research your industry to determine the average ramp-up time.

- Set realistic sales goals for the first few months to gauge progress.

- Track and analyze all financial statements including Income Statement, Balance Sheet, Cash Flow Analysis, Break-even Analysis and Break-Even Analysis to make informed decisions.

- Regularly review and update your Financial Projections, Revenue Model and Business Plan to reflect changes in the market.

Spare parts store walk-in traffic entries

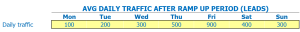

After the ramp-up period, daily walk-in traffic for spare parts stores averages 50 visitors on weekdays and 70 visitors on weekends. These inputs are important because they determine the customer and sales forecasts for the business plan.

The average walk-up traffic growth factor per year is 5%. Using this factor, the financial model can project an increase in traffic for years to come, allowing an accurate forecast of potential income and expenses.

By entering the daily traffic count and growth factor into the financial model, future cash flows, income statements and balance sheets can be calculated. The aftermarket store financial projections will use these assumptions as crucial inputs in constructing the company’s financial planning.

Tips & Tricks

- Keep track of daily walk-in traffic numbers to adjust financial models accordingly.

- Consider external factors such as holidays and events that may impact walk-in traffic.

- Regularly analyze data to adjust assumptions and ensure accurate financial forecasts.

Spare parts stores sales conversion visits and sales inputs

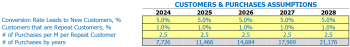

When forecasting finances for an aftermarket parts store business plan, it is important to consider visitor-to-customer conversion rates. This is the percentage of visitors who become new customers. For example, if 100 people visit the store and 10 of them make a purchase, the visitor-to-customer conversion rate is 10%.

The repeat sales rate is also an important assumption to consider when building a revenue model for the aftermarket store. This is the percentage of customers who return to make a purchase again. For example, if 20% of customers return and make a purchase the following month, the repeat sale rate is 20%.

Tips & Tricks:

- Consider offering customer loyalty programs to increase repeat sales.

- Communicate regularly with customers via email marketing, social media and other channels to remind them of store offers.

- Ensure high quality products, good customer service and excellent shopping experience to encourage customers to come back.

Knowing the average monthly expenses of a repeat customer is also crucial for the aftermarket store’s financial forecast. For example, if a customer spends an average of per month and the repeat sales rate is 20%, the predicted revenue from repeat sales would be per customer per month. This information can be used in spare parts break even analysis, spare parts cash flow analysis, spare parts break even point analysis, spare parts store income statement and the balance sheet of spare parts stores.

Therefore, considering conversion and repeat sales inputs when building a financial model and plan for the aftermarket store is important to ensure accurate financial projections and financial planning.

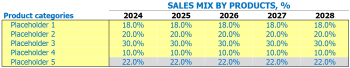

Spare Parts Store Sales Mix Starters

Your spare parts store sells different spare parts store products and each product belongs to a specific product category. Entering the sales mix assumption on the product category lever will be much easier to understand.

For example, suppose the store has the following product categories: engine parts, brake parts, suspension parts, electrical parts, and body parts. Additionally, the store has the following percentage assumptions for each forecast year:

- Year 1: engine parts (40%), brake parts (20%), suspension parts (20%), electrical parts (10%), body parts (10%)

- Year 2: engine parts (35%), brake parts (20%), suspension parts (20%), electrical parts (10%), body parts (15%)

- Year 3: engine parts (30%), brake parts (25%), suspension parts (20%), electrical parts (10%), body parts (15%)

- Year 4: engine parts (25%), brake parts (25%), suspension parts (20%), electrical parts (10%), body parts (20%)

- Year 5: engine parts (20%), brake parts (25%), suspension parts (20%), electrical parts (15%), body parts (20%)

Tips & Tricks

- Be sure to update your sales mix assumptions regularly based on market trends and customer preferences.

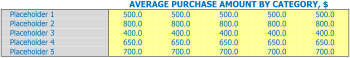

Spare Parts Store Average Sale Amount of Entries

Your spare parts store sells a variety of products, and each product belongs to a specific product category. To simplify data entry and forecasting, assumptions are made at the product category level instead of the individual product level.

For example, if you sell auto parts, you can categorize them into categories such as brakes, tires, and engine components. Then, for each category, you would enter an assumption for the average sales amount per unit for each year of your financial projections. This way, you estimate revenue for each category as a whole rather than for each individual product.

To calculate the average ticket size, you’ll use the Sales Mix and Average Sales Amount for each product category . If you know that, on average, customers buy 3 brake pads and 2 sets of tires per visit, you can use these numbers to calculate the average ticket size for customers who visit your store.

The average sale amount for each product category can vary widely and understanding how to calculate and use this information is essential in your aftermarket, financial planning.

Tips & Tricks

- Be sure to update your assumptions regularly based on historical sales data and market trends.

- Consider creating subcategories within your product categories to further refine your sales forecast.

- Use past sales data to identify your most profitable product categories and adjust your inventory and marketing strategies accordingly.

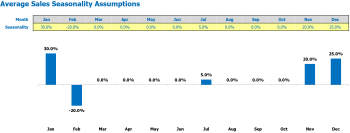

Seasonality of spare parts sales

Understanding sales seasonality is essential for any business, including an aftermarket store. This term refers to fluctuations in sales that occur over a period of time, whether daily, weekly, monthly or yearly. These fluctuations are influenced by factors such as holidays, weather, regional events and market trends.

For an aftermarket store, seasonal changes in demand can be significant. For example, customers may need auto parts more frequently during the winter months when cars are more prone to breakdowns. Additionally, the summer months can experience a higher demand for air conditioning parts. Understanding seasonal sales patterns is essential to accurately forecasting and making good financial projections for the store.

Assuming a monthly average daily sale of 00, you should be able to make monthly seasonality changes. These assumptions should reflect how the deviation percentage varies in each month.

Tips & Tricks

- Analyze historical data to accurately identify seasonal patterns

- Use financial planning tools to project sales based on a chosen revenue model

- Adjust inventory levels based on estimated changes in demand

By analyzing sales seasonality and incorporating these seasonal factors into your financial forecast , you can identify growth opportunities, adjust your inventory levels, and estimate monthly cash flow.

When putting together your spare parts store business plan , it is essential to perform a break-even analysis to determine the point at which you will cover all the costs associated with running the store. This analysis should also include a profitability analysis , a revenue statement and a balance sheet. This project forecast profits and losses for the store.

Overall, understanding the seasonality of sales is essential for any aftermarket store owner, and it is essential to make sound financial projections for aftermarket stores based on these seasonal patterns.

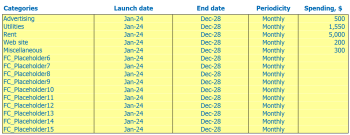

Spare parts Storage of operational expenses

In a Store Replacement Parts Financial Model , operational expenses provide a crucial role as it helps in estimating the expenses associated with the day-to-day operations of the store. Operating expenses mainly include the cost of goods sold by products %, salaries and wages of employees, rent, lease or mortgage payment, utilities and other operating expenses. Forecasting operational expenses allows management to control their finances and make informed decisions for the future.

| Operating Expenses | Amount (per month) |

|---|---|

| Cost of goods sold by products % | 00 – 00 |

| Salaries and wages of employees | 00 – 000 |

| Rent, lease or mortgage payment | 00 – 00 |

| Public services | 00 – 00 |

| Other running costs | 0 – 00 |

| Total | 800 – 500 |

Accurate financial planning through operational expense forecasting is necessary for an aftermarket store as it allows management to make informed decisions and control their finances.

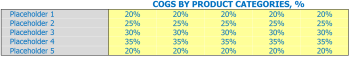

Spare Parts Store Cost of Goods Sold

When creating an aftermarket store business plan , it is important to consider your aftermarket store revenue model and how it affects your financial planning. One of the most important factors in determining your store’s profitability is the cost of goods sold (COG).

COGS represents the direct cost of producing the products you sell. This includes the cost of the purchase’s inventory, freight costs, and additional expenses required to deliver the products to your store. Depending on your business, COGs can represent a large percentage of your total spend, and it’s important to accurately forecast and track these costs.

Suppose your aftermarket store specializes in selling auto parts. Your COGS is calculated by adding together the cost of buying inventory, freight, and other costs associated with delivering products to your store. If you sell brake pads for and the COGS is , your profit margin is 15 or 60 percent of the selling price.

Tips & Tricks:

- Predict COGs by analyzing past sales and inventory data

- Track COGs to identify trends and adjust pricing and inventory levels accordingly

- Consider negotiating with suppliers to reduce COGs

To accurately forecast and track the cogs, you’ll need to perform a Spare Parts Store Cash Flow Analysis , Spare Parts Profitability Analysis , and Spare Parts Store Financial Forecast to understand your Spare Parts Store revenue status. spare parts and your inventory of spare parts stores . By keeping a close eye on your inner workings, you’ll be able to make more informed business decisions and ultimately increase your profitability.

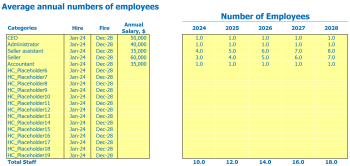

Spare Parts Store Salaries and Salaries of Employees

When it comes to financial planning for an aftermarket parts store business plan , creating a budget for employee wages and salaries is crucial. The success of the store relies heavily on the expertise and dedication of its staff member.

The store will need a store manager, customer service representatives and mechanics. The Store Manager will be the team leader, including customer service representatives and mechanics.

- Offer competitive salaries to attract and retain the best talent in the industry

- Use online tools to research fair wages for positions you need to hire

- Consider bonuses and performance-based compensation plans to motivate your staff

Tips & Tricks

Customer Service Representatives will handle customer inquiries, handle orders, and keep the store clean and organized. Mechanisms repair and maintain cars and motorcycles that come to the store.

Assuming the store operates five days a week and eight hours a day, four full-time employees (1 store manager, 2 customer service reps, 1 mechanic) and two part-time employees (2 mechanics) are needed .

The annual salary for each full-time employee will be ,000 for the store manager, ,000 for customer service representatives and ,000 for a mechanic. The part-time mechanic will earn per hour.

Creating a financial forecast for employee wages and salaries is necessary for the Spare parts profitability analysis .

Slow spare parts, lease or mortgage payment

One of the most critical decisions for any aftermarket parts store business is determining whether to rent, lease or buy a property. Rental involves the monthly rental costs of the property from which the store operates.

Leasing, on the other hand, involves a long-term rental agreement that can span years with fixed monthly payments. Finally, mortgage payments involve monthly payments to a bank that provided the funds to purchase the property.

Financial projections for the spare parts store

When deciding whether to rent, rent or buy a property, it is essential to create financial projections for all three scenarios. This includes calculation of aftermarket store revenue model, cash flow analysis, break-even analysis, break-even analysis, income statement, balance sheet, financial forecast and financial planning.

Tips & Tricks

- Consider the long-term goals of your business before making a decision.

- Decide whether you have the down payment to purchase a property or not.

- Research the real estate market in your area to determine the most profitable option.

Overall, the choice between rent, lease, or buy will depend on several factors such as the spare parts store’s financial projections, long-term goals, and available capital. Consider all options and consult with a financial advisor or real estate agent to make the best decision for your business.

Aftermarket Utilities

In order to accurately create the financial projections for an aftermarket store, it is crucial to understand the utility assumptions. These utilities include all costs related to the operation of the store such as rent, electricity and water.

For example, if the store’s rent is ,500 per month, this should be factored into the aftermarket store’s business plan. Similarly, if the electricity bill is estimated at 0 per month, this cost should also be included in the spare parts store’s financial forecast.

Tips & Tricks:

- Research average utility costs for similar stores in the area to more accurately estimate expenses.

- Consider alternative energy sources such as solar panels or wind turbines to reduce long-term costs.

By accurately accounting for all utility costs, spare parts cash flow analysis, break-even analysis, and break-even analysis can be more accurate. This will lead to a more accurate spare parts store revenue model, income statement and balance sheet.

Spare parts store other running costs

In addition to the direct costs of running an aftermarket store, such as inventory and employee salaries, there are also other expenses that should be factored into a financial model. These may include:

Marketing and advertising: Promotional expenses such as print or digital advertisements, sponsorship and social media campaigns.

Rent and Utilities: The cost of renting a storefront, plus utilities like electricity, water, heat, and air conditioning.

Insurance: Protecting your inventory, equipment and belongings against unexpected events such as natural disasters, theft or liable lawsuits.

Accounting and Legal Fees: Professional assistance with financial planning, revenue preparation and legal compliance.

Equipment maintenance: Regular maintenance and repairs for tools, machines and vehicles used in daily operations.

Travel and Miscellaneous Expenses: Expenses related to business travel, trade shows, training programs, or anything else deemed necessary to improve store performance.

All of these expenses must be considered when building a financial model for an aftermarket store. Accurately forecasting these expenses can help inform marketing and pricing strategies, as well as any necessary adjustments to inventory management or staffing levels.

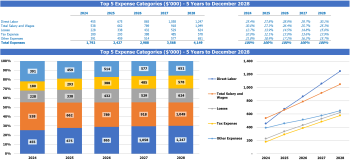

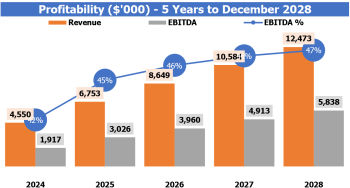

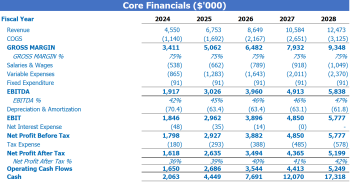

Spare Parts Store Financial Forecast

Financial forecasting is a crucial element that should be included in an aftermarket parts store business plan. It is the process of predicting future performance by analyzing and evaluating current and historical financial data. It includes projections of income, expenses, cash flow and profitability. Financial forecasts consist of documents such as an income statement, balance sheet, cash flow analysis, sources and usage report, and break-even analysis. These documents provide a clear picture of the company’s expected financial performance. Profitability analysis and financial planning play a vital role in determining the success of an aftermarket store.

The profitability of spare parts

Once we have built our financial projections for the spare parts store, such as revenue, cash flow, and break-even analysis, we can create our income statement and balance sheet. This will help us assess the overall financial health of the business and determine its profitability.

The income statement gives an overview of the income and expenses of the business, while the balance sheet shows the assets, liabilities, and equity of the business at a given time. By analyzing these reports, we can calculate crucial profitability measures such as gross profit or EBITDA margin.

Tips & Tricks:

- Reviewing financial statements regularly will help you identify revenue and expense trends and make informed decisions about the future of your aftermarket store.

Financial forecasting and planning is crucial for any successful business venture, especially in the competitive aftermarket industry. By assessing profitability through the P&L statement, business owners can make important decisions to ensure the long-term success of their business.

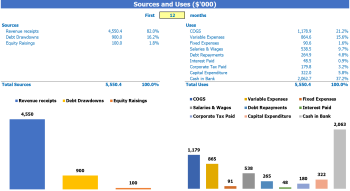

Spare parts stores graph sources and uses

The Sources and Uses of Funds in Excel’s Financial Model for Spares provides users with an organized summary of where capital comes from sources and how that capital will be spent in uses.

It is important for the total amounts of sources and uses to be equal to each other. Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

Tips & Tricks:

- Regularly update your financial projections for spare parts to ensure accuracy.

- Use multiple revenue streams to diversify your aftermarket parts store revenue model.

- Incorporate a detailed aftermarket parts store business plan into your financial forecast.

- Perform spare parts cash flow analysis to determine potential cash shortages or surpluses.

- Perform a spare parts break-even analysis to measure the profitability of the business.

- Perform a spare parts break-even analysis to determine the sales volume required to break.

- Regularly review your aftermarket store’s income statement and balance sheet to monitor the financial health of the business.

- Use financial planning tools to help with aftermarket store financial forecasts.

Financial planning is essential for the success of any business, including an aftermarket parts store. Building a financial model that includes Financial Projections, Revenue Model, Cash Flow Analysis, Breakeven Analysis, Revenue Statement, Balance Sheet, Breakdown Analysis and Financial Forecast will help you plan for the future, make informed decisions and guarantee profitability. By following the steps in this article and considering industry trends and economic conditions, you can create a business plan that sets you up for long-term success.