- Home

- Sales and revenue

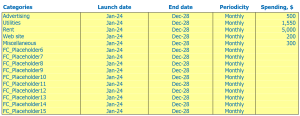

- Running costs

- Financial

Welcome to our guide to building a financial model for a bookstore! As a bookstore owner or someone interested in starting a bookstore business, being able to predict your financial performance accurately is essential. This is where a financial model comes in handy. With a well-constructed financial model, you can forecast future revenues, expenses, and profits, and understand the financial health of your business. In this guide, we’ll walk you through the steps involved in building a financial model for a bookstore, including financial projections, analysis, forecasting, and management.

Bookstore Revenue & Sales Forecast

Revenue and sales forecasts are an integral part of any bookstore financial model . It helps in estimating expected revenue based on assumed sales figures. A good financial model should forecast revenues and sales for at least three years in advance after the bookstore’s business plan is established. The accuracy of these Bookstore Financial Projections is critical to the bookstore’s success.

The revenue and sales forecast should be based on factors such as the financial analysis of the bookstore market, the expected level of competition, and the resources available to the bookstore. Additionally, the estimate should include assumptions about specific items such as the bookstore’s financials , inventory turnover rate, and variable and fixed costs within a given time frame.

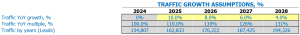

A bookstore financial planning expert will also include the bookstore’s projected growth rates, expected customer numbers and purchases in the early years, and assumed seasonality effects on sales. Launch date, walk-in traffic projections, and ramp-up time are also part of the analysis of how Bookstore Financial Management can position the bookstore to take advantage of market conditions.

The success of the financial model lies in its ability to project accurate numbers that will guide the Bookstore’s financial performance over the years. The bookstore financial forecast should include Bookstore financial metrics like gross margin, revenue growth, and annual growth rate. These projections will allow bookstore managers to make better decisions.

Library launch date

A bookstore launch date is a crucial aspect of bookstore financial planning because it determines the timeline for your bookstore’s success. Choosing the right date can make a difference in your bookstore’s financial performance.

It is important to consider the time of year when choosing your launch date. Seasonality can play a vital role in the success of a bookstore business plan. For example, opening your bookstore in December may be profitable during the holiday season, but not in the summer when customers are on vacation.

Scheduling your launch date on a weekend rather than a weekday can increase your revenue. Most people are off work and have more time to visit your bookstore, which translates to more sales. On the other hand, launching on weekdays may lead to lower participation, which leads to fewer sales.

Tips & Tricks:

- Choose a launch date that is at least 2-3 months away. It gives you enough time to prepare for the launch and get everything in order.

- Launch your bookstore at a special occasion or local event to attract more customers.

- Consider launching with a giveaway or promotion to attract more customers and build buzz around your new business.

Ramp-up time

When starting a new business, it’s important to be realistic about your expectations. Ramp-up time to sales plateau is a crucial factor to consider when forecasting your bookstore’s sales. This refers to how long it will take your business to reach a consistent level of sales after opening.

If you don’t factor the ramp-up period into your financial projections , you may end up overestimating your initial sales and underestimating your expenses. This can lead to major financial problems down the road and even cause your business to fail.

The ramp-up period for your bookstore will depend on a variety of factors, including your location, target audience, competition, and marketing strategies. In general, the ramp-up time for a bookstore usually ranges from 6 to 12 months.

Tips & Tricks:

- Research your local industry to get a better estimate of your specific ramp-up time.

- Be patient and don’t panic during the ramp-up period. Stay focused on your long-term goals.

- Try different marketing tactics to see what works best for your business.

Conclusion, it is crucial to consider ramp-up time when creating your bookstore business plan to ensure that you have an accurate picture of the financial viability of your business and make informed decisions to a sustainable future.

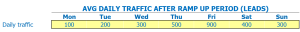

Walk-in traffic entries

After the ramp-up period, the average daily traffic-in for a bookstore varies by day of the week. For example, on Mondays the bookstore tends to receive an average of 100 Walk-Ins, while on Saturdays the average number reaches 300. This information is crucial when building a financial model for a bookstore, as it can help predict future income and expenses.

The daily dating traffic growth factor can vary for each day and each year. On Mondays, the growth factor can remain relatively stable, increasing only a percentage point or two each year. But on Saturdays, with increasing popularity, the growth factor can reach 10% per year. By entering these walk-in traffic projections into the bookstore’s financial model, the bookstore’s financial plan can be adjusted accordingly.

Tips & Tricks:

- Consider the impact of seasonal factors on walk-in traffic, such as holidays and school breaks.

- Track and analyze customer data, such as visitor demographics and buying habits, to better understand and predict future walk-in traffic.

- Partner with other local businesses and events to increase marketing efforts and attract more walk-in traffic.

In conclusion, accurately predicting and planning bookstore walk-in traffic is critical to successful financial management . By incorporating walk-in traffic data into a financial model, bookstore owners can better understand what drives their business and make informed decisions that drive financial performance .

Bookstore visits for sales conversion and sales inputs

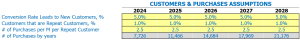

For any bookstore business plan, it is crucial to have a clear understanding of the bookstore’s financial performance. Financial projections, analysis, statements, planning, forecasting, management, measurement and modeling should be considered. However, the most important inputs that drive financial performance are bookstore visits in sales conversion and repeat sales.

Let’s take an example: a bookstore receives 1,000 visitors per month. Of these visitors, 200 become new customers. This is a 20% conversion rate of visitors to new customers. Moreover, of these 200 new customers, 20% or 40 customers, make a repeat purchase the following month. Therefore, the repetition rate amounts to 20%.

The average purchase value for a new customer is . For a repeat customer, the average purchase is . Therefore, the repeat customer value per month is ,200 (40 customers who make a repeat purchase multiplied by ).

This assumption is so important when considering financial modeling in terms of creating a bookstore financial plan. A higher conversion rate and repeat rate indicate that your bookstore is successful in converting visitors to new customers and retaining existing customers. This results in a better financial forecast for the future.

Some tips and tricks to improve the financial performance of your bookstore

- Organize book clubs and events to attract more visitors and potential new customers

- Create a loyalty program and offer incentives for repeat sales

- Provide exceptional customer service to retain existing customers

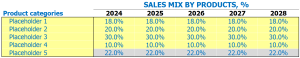

Bookstore sales mix entries

In our bookstore store, we sell a variety of products from five different product categories: fiction, non-fiction, children’s books, textbooks and stationery. Understanding the sales category by mix by product is crucial to creating a successful bookstore financial plan .

Capturing sales mix assumptions at the product category level makes it easier to understand how our store is doing in terms of category sales. For example, we might assume that fiction books will represent 40% of our sales, our fiction books 30%, children’s books 15%, textbooks 10% and stationery 5%. These assumptions provide a baseline for our financial projections.

For each of the five years included in our financial forecast, we will enter the sales mix by product category assumptions, as shown in the following table:

| product category | Year 1 (%) | Year 2 (%) | Year 3 (%) | Year 4 (%) | Year 5 (%) |

|---|---|---|---|---|---|

| Fiction books | 40% | 40% | 40% | 40% | 40% |

| non-fiction books | 30% | 30% | 30% | 30% | 30% |

| Children’s books | 15% | 15% | 15% | 15% | 15% |

| Manuals | 10% | 10% | 10% | 10% | 10% |

| Stationery store | 5% | 5% | 5% | 5% | 5% |

Tips & Tricks:

- Use historical sales data to inform your sales mix assumptions.

- Periodically revisit and update your sales mix assumptions to reflect changes in consumer preferences or merchandise trends.

- Ensure that the combination of sales by product category assumptions is realistic and aligned with your store’s goals and overall bookstore financial performance metrics.

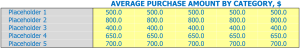

Bookstore Amount of entries amount

In our bookstore, we carry a variety of products ranging from fiction to non-fiction, coffee table books to manuals and even stationary items. Each product falls under a specific category, which makes it easier for us to enter assumption entries at the product category level rather than individually.

For example, for the fiction category, we assume an average sale amount of per book, while for coffee table books, we estimate it to be . We also consider the sales mix of each product category and divide it further each year to calculate the average sales amount per product category per year. This calculation is then used to estimate the average ticket size.

Tips & Tricks

- Classify your products to make estimating entries more manageable.

- Update the average sale amount per category per year to stay accurate.

- Regularly review the sales mix to adjust the average ticket size calculation.

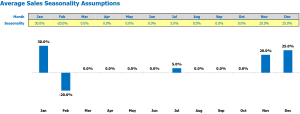

Seasonality of bookstore sales

Seasonality is a vital consideration for the bookstore business plan. Seasonality refers to the regular fluctuation in demand for bookstore products and services over time. Understanding your customers’ seasonal shopping habits and market trends is key to effectively tailoring your store’s product offerings and promotions.

Seasonal factors may vary from calendar year to calendar year. You must enter the percentage deviation from the average monthly sales per day to determine the seasonal factors needed to update your store’s sales projections. For example, if your store’s average sales for January are 00 per day and your average daily sales for the year are 00, your seasonal factor for January is 71.4%.

Tips & Tricks:

- Review historical sales data to identify trends in customer buying habits.

- Understand the specific drivers of seasonality in your market, such as holiday shopping and weather patterns.

- Use forecasting and modeling tools to track seasonality and adjust your business plans accordingly.

Bookstore financial planning requires a detailed analysis of seasonality factors to accurately forecast financial performance. Understanding these factors will allow store owners to align their resources and promotions with the requirements of their target customers.

Forecast of bookstore operating expenses

Operational expense forecasts are an essential part of the bookstore’s financial planning. These forecasts determine the expected expenses running the bookstore and include the cost of goods sold by products %, employee wages and salaries, rent, lease payment or mortgage, utilities, and other operating expenses.

| Operating expense categories | Amount (per month) in USD |

|---|---|

| Cost of Goods Sold by Products% | ,000 – ,000 |

| Salaries and wages of employees | ,000 – ,000 |

| Rent, lease or mortgage payment | ,000 – ,000 |

| Public services | ,000 – ,000 |

| Other running costs | ,000 – ,000 |

| Total | ,000 – ,000 |

By having a financial forecast like this, bookstore owners can create a solid business plan financial plan and understand the current and potential future status of their bookstore through bookstore financial analysis. Keep the bookstore’s financial statements up to date and make adjustments whenever necessary to improve the bookstore’s financial performance.

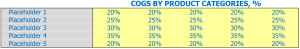

Bookstore Cost of Goods Sold

Bookstores are required to keep track of all business expenses, and COGS is a key element in financial statements. Bookstore is the cost to acquire or produce the items it sells.

COGS includes direct costs, such as the cost of books, supplies, and labor, and indirect costs, such as rent, utilities, and other overhead. The percentage of COG varies for different product categories. For example, books typically have a COG of around 50%, while bookmarks and other accessories have cogs of around 70%.

Tips & Tricks:

- Keep track of all business expenses, including direct and indirect costs.

- Review your COGs regularly to ensure profitability.

- Compare your cogs to industry averages to gauge performance.

- Use financial tools like projections, forecasts and modeling to plan for the future.

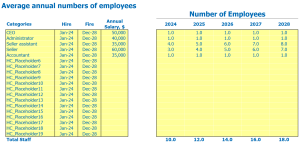

Salaries and wages of bookstore employees

When it comes to running a bookstore, the financial management of salaries and employee wages is crucial for success. To begin with, it is necessary to define the positions necessary to effectively run the store. For example, a small independent bookstore may need a store manager, a bookseller, and a cashier.

- Consider hiring part-time employees to save costs

- Factor in overtime pay and other payroll expenses such as taxes and benefits

- Compare wages to industry standards in your area

Tips & Tricks:

Once the necessary positions have been identified, it is important to determine when these people will be hired. For example, a new store manager may need to be employed before opening day to ensure a smooth launch.

The next step is to figure out how much each person should earn each year. For example, a store manager may earn ,000 per year, while a bookseller may earn ,000 per year. It is important to be realistic but also competitive with industry standards in your area.

Finally, it is important to calculate the number of full-time equivalent (FTE) staff required each year. For example, a small, independent bookstore may need 1.5 feet (equivalent to one full-time employee and one part-time employee) to run the store and provide customer service.

Bookstore rental, lease or mortgage payment

Bookstore financial planning includes calculating the expenses that are part of running a bookstore. One of the biggest expenses is the cost of store space. Bookstores can choose to rent, lease, or buy space depending on what fits their budget and goals.

- Rent: Bookstores can rent space for a monthly payment. Payment depends on factors such as store location and size.

- Rental: Bookstores can rent space for a longer term rental arrangement. Payment is fixed for the agreed rental period and is usually less than the rental cost.

- Mortgage Payment: Bookstores can purchase space by taking out a mortgage. The bookstore owns the space but must pay a fixed amount for the loan.

Tips & Tricks

- Research the location of the store to get an idea of the average rent or mortgage payment nearby.

- Consider the bookstore’s long-term goals while deciding on the payment model.

- Tive into financial requirements and projections when calculating costs.

Library utilities

Utilities are a major expense for any bookstore business, and planning for and managing them effectively is key to ensuring financial stability.

Bookstore utilities are expenses related to electricity, heating, cooling, water and sewage. These expenses can vary depending on the size and location of the bookstore, weather conditions and energy prices in the area.

To plan for these expenses, bookstore owners must make certain assumptions in their financial projections, such as assuming a specific increase or decrease in utility costs each year.

Tips & Tricks:

- Consider investing in energy-efficient appliances and low-flow fixtures to reduce water and electricity consumption.

- Regularly check for leaks or damage to avoid unexpected costs.

- Stay informed of energy market trends and seek competitive prices from utility providers.

Library of other running costs

When building a financial model for a bookstore, it is important to consider all of the costs involved in running the business. In addition to the obvious expenses like rent, salaries, and inventory costs, there are also a number of other running costs that need to be considered.

These could include expenses such as marketing and advertising costs, insurance premiums, legal fees and utilities such as electricity, gas and water. Other running costs may also include office supplies, travel costs and website development costs.

It is important to anticipate and budget for these expenses, as they can have a significant impact on the company’s financial performance. By considering all of the potential costs associated with running a bookstore, you can ensure that your financial projections are accurate and realistic, and that you can make informed decisions about how to manage your finances in the future.

Financial forecasts of the bookstore

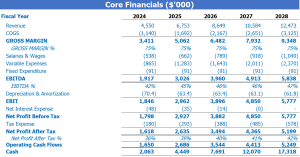

When creating a financial model for a bookstore, financial forecasting is essential. Financial forecasting involves predicting future financial performance based on historical data and current trends. In a bookstore financial model, forecasting involves analyzing metrics such as revenue, profit margins, and inventory turnover rates. The Profit and Loss and Sources and Uses report are important parts of creating financial projections to determine the future financial performance of the bookstore. Using financial forecasts in a bookstore business plan is crucial for successful financial planning, monitoring, and management.

Ritability Bookstore

Once we have created revenue and expense projections for our bookstore, we can check the profit and loss (P&L) statement, trace our revenue back to net profit. This will help us visualize our profitability , showing metrics like gross profit or EBITDA margin.

It is essential to play financial analysis and plan the financial performance of our bookstore. This will help us identify strengths and weaknesses and adjust our strategy accordingly. We may use financial statements, such as balance sheets or cash flow statements, to track our financial metrics and to screen for potential risks.

Tips & Tricks

- Compare your bookstore’s financial metrics with industry standards to gauge its performance and potential.

- Try to minimize your costs and expenses, maximizing your revenue streams and profit margins.

- Consider implementing a strong financial management system to regularly monitor the financial health of your bookstore.

By adapting a financial forecasting and modeling system, we can estimate future scenarios and adjust our business plan accordingly, ensuring our library’s long-term financial success.

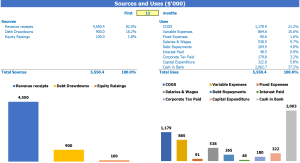

Sources of libraries and use of the graph

The Sources and Uses of Funds in Financial Model in Excel for Bookstore provides users with an organized summary of where capital will come from sources and how that capital will be spent in the uses . It is important for the total amounts of sources and uses to be equal to each other. Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

When creating a bookstore financial plan, it is important to consider various elements such as financial metrics, financial forecast, financial analysis, financial performance, and financial statements . With these elements in mind, bookstore financial projections should be set up and updated regularly to align with business goals and objectives.

Tips & Tricks:

- Be realistic with your financial projections, always consider your industry and market forces

- Use financial modeling tools to test different scenarios and identify potential weak points in the financial plan

- Review financial statements regularly and analyze data to make informed business decisions

A detailed Bookstore Business Plan section should also be included when presenting to potential investors or stakeholders. This section should provide a clear picture of the company’s financial situation and future plans. Bookstore financial management is critical to the success of any business and should be given the attention it deserves.

Building a financial model for a bookstore is an essential part of effective financial planning and management. By using financial statements, analyzing financial metrics, and making accurate financial projections for your bookstore, you can create a comprehensive financial plan that helps you achieve your goals and objectives. It’s a process that requires a lot of time, effort, and attention to detail, but the end results are so worth it. By following the tips and guidelines outlined in this article, you can ensure that your bookstore business plan is accurate, reliable, and effective.