- Home

- Sales and revenue

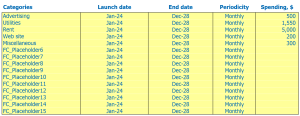

- Running costs

- Financial

Welcome to our blog post on how to build a financial model for a children’s store. As a business owner, it’s important to have a solid understanding of your finances in order to make informed decisions and lead your business to success. Whether you are opening a children’s clothing store, a children’s toy store, or a youth sports store, this post will provide you with useful information on developing a Children’s Store Financial Plan that will help you manage effectively. your finances. We’ll cover everything from Kids’ Budget Projection to Store Revenue Forecast for Toddlers , and many more. So let’s get started!

Ferces and sales of children’s stores

Revenue and sales forecasts play a crucial role in any children’s store financial plan. As part of the financial model, it helps predict future sales, revenue, and other financial aspects important to the business. Forecasts are based on several factors, including launch date, sales ramp-up time, walk-in traffic, growth assumptions, customer and purchasing assumptions, and sales seasonality. All of these factors contribute to the correct revenue estimate and sales forecast for the children’s store financial statements.

Launch date of the children’s store

Choosing the right launch date for your kids store is crucial for your success. It’s not just about picking a random day and hoping for the best. You need to consider a variety of factors, such as seasonality, marketing campaigns, and competition.

The Children’s Financial Model Template can help you determine the best launch month for your business. This tool takes into account various financial projections and allows you to plan ahead, even if you launch in the middle of the year.

Tips & Tricks:

- Consider launching during holidays or back-to-school seasons to take advantage of increased customer demand

- Research your competitors and avoid launching at the same time as a major competitor

- Create a strategic marketing campaign to generate excitement and anticipation for your launch

- Pay for all additional costs associated with the launch, such as product marketing and sourcing

Ultimately, choose a launch date that aligns with your business goals and allows you to create a solid foundation for success. With the right planning and strategy, your children’s store can thrive and become a valuable resource for families in your community.

Child Rise Time

When launching a children’s store, it is important to accurately forecast sales. A key part of doing this is understanding the ramp-up time to sales plateau – the time it takes for your store to reach its full sales potential. Neglecting this crucial period could result in overestimating sales projections and ultimately failing to meet financial targets.

Your business ramp-up period will depend on a variety of factors, such as your market, location, and advertising efforts. In the children’s retail industry, the ramp-up time can vary between three and six months. However, it is important to note that some companies may experience a shorter or longer ramp-up period.

Tips & Tricks:

- Conduct market research to determine your target market, competition, and potential sales.

- Have a solid advertising and marketing plan in place to generate interest and drive traffic to your store.

- Offer unique products and exceptional customer service to build brand loyalty and increase sales.

By accurately predicting your ramp-up time, you can set realistic financial goals and make informed decisions to help your kids store thrive.

Children’s Storage Traffic Gentes

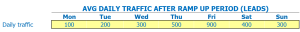

After the ramp-up period, we noticed that Monday and Tuesday had the highest date traffic of any weekday for our children’s clothing store profit model. On average we had about 25 Walk-Ins on Monday 20 Tuesday 15 Wednesday 10 Thursdays and 30 Fridays. This observation helped us project sales for each day of the week, which is essential for our children’s store budget projection.

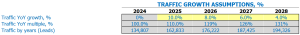

As we developed our financial analysis of the youth store, we kept in mind that the average traffic growth factor in the years in the future is usually 3%. For example, in year two, our Monday and Tuesday appointments increase to about 26 and 21, respectively. In year three, it increases to 27 and 22, and so on. With that in mind, we calculated future walk-in traffic for the future on weekdays for five years, which helped create our toddler store revenue forecast.

Tips & Tricks:

- Consider location-specific factors such as weather and holidays to get a more accurate projection.

- Frequently monitor walk-in traffic to identify any changes in your projection assumptions.

- Take advantage of slower weekdays by offering promotions to encourage more foot traffic.

Understanding daily walk-in visitor traffic per week is a critical assumption when building a financial model for our kids store financial outlook. It assists in the calculation of our children’s bookstore revenue estimate and youth sports store financial valuation, allowing us to make informed decisions on our children’s store cash flow analysis . By forecasting future walk-in traffic, we can predict sales, expenses, and profits for any weekday five years into the future.

Store visits for kids for sales conversion and sales inputs

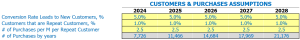

When building a children’s store financial plan , it is important to consider the conversion rate of store visitors into new customers, as well as the rate of repeat customers. Let’s illustrate this with an example:

A newly opened children’s toy store saw 500 visitors in the first month, 50 of whom made a purchase, resulting in a 10% conversion rate. For the second month, the store had a total of 600 visitors, 80 of whom made a purchase, resulting in a conversion rate of 13.33%. Store management concluded that the increase in conversion rate was due to the introduction of a customer loyalty program.

Regarding the rate of repeat customers, assume that 30% of the store’s monthly customers are repeat customers. This means that for the first month there were a total of 15 repeat customers, and in the second month there were 24 repeat customers. If each repeat customer makes an average of 2 purchases per month, the repeat customer’s store revenue would be 0 for the first month and 2 for the second month.

Tips & Tricks:

- Offering customer loyalty programs can increase the conversion rate of store visitors into new customers.

- Tracking the rate of repeat customers and their buying habits is vital to building an accurate Kids Budget Projection .

Understanding the percentage of visitors converting to new customers and the percentage of repeat customers is crucial when building a kids clothing store profit model or any other stock financial statement. By incorporating these assumptions into the financial model, Store Revenue Forecast and Store Revenue Forecast for Toddlers can be estimated more accurately.

Additionally, analyzing this data can provide insight into areas where the store needs to improve, such as increasing the conversion rate or retaining loyal customers. Overall, paying attention to these metrics is an important assessment in terms of building a financial model for kids’ stores .

Children’s store sales mix starters

Product categories:Clothing, toys, books, sports equipment, party supplies.

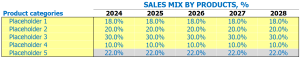

In our children’s store, we offer various products in different product categories. Understanding the mix of sales by product categories for each of the projected five years is critical to creating a financial plan. Assuming the mix of sales by product categories would give clarity on how each product’s sales are performing across categories.

For example, suppose the children’s store sells a jacket in the clothing category. The jacket has a sales mix of 20% for the first forecast year, which means it is expected to sell 20% of the total apparel products sold. Therefore, entering sales mix assumptions on the product category leverage would simplify the estimation process.

Here is the sales mix by product category assumptions for the next five years:

- Clothing: Year 1 – 20%, Year 2 – 25%, Year 3 – 28%, Year 4 – 30%, Year 5 – 32%

- Toys: Year 1 – 40%, Year 2 – 38%, Year 3 – 35%, Year 4 – 34%, Year 5 – 32%

- Books: Year 1 – 12%, Year 2 – 15%, Year 3 – 18%, Year 4 – 20%, Year 5 – 22%

- Sports equipment: Year 1 – 10%, year 2 – 12%, year 3 – 13%, year 4 – 15%, 5 – 16%

- Party Supplies: Year 1 – 18%, Year 2 – 10%, Year 3 – 6%, Year 4 – 1%, Year 5 – 1%

Tips & Tricks:

- Update the sales mix assumptions if there is a new trend in the market or if there are changes in the products in the categories.

- Ensure sales mix assumptions are accurately estimated by analyzing sales trends from the previous year.

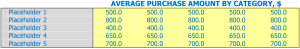

Children of the average amount of average sale entries

Our children’s store offers a wide assortment of products, including clothing, toys, books, sports equipment and party supplies, each belonging to a specific product category. To simplify data entry, we assume an average sale amount for each category and adjust them by years if necessary.

For example, the children’s clothing store category has an average sale amount of per item, while our children’s toy store has an average sale amount of . The average ticket size is calculated using the sales mix and the average sales amount of each group. This allows us to make financial projections based on category trends rather than individual product movements.

Tips & Tricks: To improve the accuracy of your average sale amount assumptions, consider benchmarking against other similar stores in your area. Additionally, try to stay up to date on industry trends to anticipate changes in consumer demand and adjust accordingly.

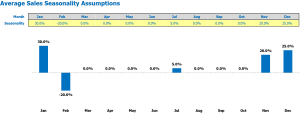

Seasonality of children’s store sales

Seasonality is a common phenomenon in various industries, including the retail sector. For children’s stores, seasonal factors have a significant impact on sales. These factors could vary for different niches such as children’s toy stores, baby stores, or children’s clothing stores.

Consider an example of a children’s party supply store. The sales seasonality for this store might look like:

- January: -50%

- February: -20%

- March 10%

- April: -5%

- May: 10%

- June: 20%

- July: 30%

- August: 25%

- September: 20%

- October: 15%

- November: 0%

- December: -30%

As you can see, the store is experiencing a drop in sales during the first quarter of the year. This is because the festive season is ending, and there are no significant events or festivals during this time. However, as we head towards the end of the second quarter, sales are starting to pick up, mainly due to summer parties and events.

Tips & Tricks:

Understand your niche:

Seasonality factors vary greatly between different niches. Be sure to carefully analyze your niche’s sales trends before setting any seasonal factors.

Periodically adjust:

As the market landscape changes, so do sales trends. Be sure to periodically adjust seasonal factors to stay relevant.

Use historical data:

Historical data could help you identify trends and sales patterns. Use this data to set seasonal factors for your children’s store.

Forecast of operating expenses for children’s stores

In order to create a complete financial model for your children’s store, it’s important to consider your operational expense forecasts. This includes cost of goods sold by products %, wages and salaries of employees, rent, lease or mortgage payment, utilities and other operating costs.

| Costs | Amount (per month) in USD |

|---|---|

| Cost of goods sold by products % | 6,000 – 12,000 |

| Salaries and wages of employees | 10,000 – 15,000 |

| Rent, lease or mortgage payment | 5,000 – 10,000 |

| Public services | 1,000 – 2,000 |

| Other running costs | 2,000 – 5,000 |

| Total | 24,000 – 44,000 |

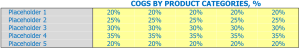

Children’s store cost of goods sold

Cost of Goods Sold (COGS) is a crucial factor to consider when creating a financial plan for any children’s store. It refers to the cost of producing or purchasing the products sold.

COGS assumptions for a children’s clothing store, for example, might include the cost of fabric and materials, manufacturing, and shipping. For a baby store, COGs may include the cost of purchasing baby products from suppliers or manufacturers.

The COG percentage for each product category may differ depending on the nature of the product. For example, the COGS percentage for clothing and accessories may be higher compared to toys, which have lower associated costs. A youth sports store would have significant cogs, especially if it sells technical sports equipment.

Tips & Tricks

- Try to keep COGs low to increase profit margin.

- Benchmark the COGs of other successful children’s stores to establish realistic assumptions.

- Explore ways to reduce COG, such as sourcing materials from a new supplier or changing the manufacturing process.

By accurately estimating the cost of goods sold for your children’s store, you can create a realistic financial plan to predict your project income, expenses, and profits in the future.

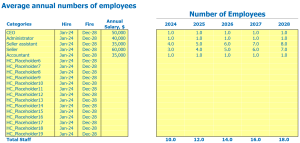

Salaries and wages of children’s employees

A children’s tour store , we believe in fairly compensating our employees while keeping our budget projections in mind. We have carefully considered the salaries and wages of each staff member to create a financially viable Children’s Store Financial Plan .

Our staff members include:

- Store manager

- Business associates

- Cashiers

- Associates in stock

We plan to hire the store manager and stock associates within the first month of opening, while sales associates and cashiers will be hired closer to our anticipated busy season. Salaries and wages for each position for the 12 month period are as follows:

- Store Manager: ,000 per year

- Business Associates: /hour, 2 full-time equivalents (FTEs) required annually

- Cashier: /hour, 2 FTEs needed annually

- Associates in stock: /hour, 1 FTE needed annually

Tips & Tricks:

- Consider hiring seasonal or part-time employees to save on payroll expenses during slower months.

- Offer incentives such as employee bonuses or discounts to increase staff morale and loyalty.

Rental, lease or mortgage payment for children

When it comes to opening a children’s store, one of the biggest expenses you’ll need to consider is rent, lease, or mortgage payments. Depending on the location, size, and type of store you want to open, your payouts could vary significantly. For example:

- A children’s bookstore in a mall might have a monthly rent of ,500.

- A large children’s toy store in a popular shopping district may have a lease for ,000 per month.

- A toddler clothing store in an upscale area may have a mortgage payment of ,000 per month.

Tips & Tricks:

- Do your research to find the best location for your store that fits your budget and target audience.

- Consider negotiating your rent, tenancy or mortgage terms to help lower your payments.

- Include additional expenses such as utilities, insurance, and property taxes in your budget plan.

Children’s store utilities

Utilities play a vital role in the financial plan of any children’s store. These are necessary expenses that cannot be avoided. Utilities include electricity, water, gas, telephone and internet. These are recurring costs that will impact the store’s budget and profit margin. The assumption is that expenses will remain constant and any increase may negatively affect the financial outlook of the children’s store.

For example, a financial analysis of the youth store assumes that there will be a constant cost of electricity and water for the store’s lighting and fitting rooms. A budget projection for the children’s workshop assumes that telephone and Internet expenses will remain stable for online sales and communication. A revenue forecast for the toddler store assumes that heating expenses will remain constant during the winter.

Tips & Tricks

- Reduce utility costs by upgrading lighting systems to energy-efficient LEDs

- Invest in products that reduce water use in toilets

- Negotiate contracts with utility service providers for better rates and packages

In conclusion, utilities are an essential part of any financial statement for children’s stores. Assumptions must be made and tips and tricks followed to control these variables to achieve a successful profit model and cash flow analysis.

Children store other running costs

In addition to the direct costs associated with stocking inventory, there are several other costs you need to consider when building a financial model for a children’s store. These costs, which are usually included in operating expenses , can have a huge impact on your bottom line.

An example of “other” cost is rent. Whether you’re renting a small storefront, sharing retail space in a larger complex, or running your business exclusively online, you’ll need to allocate some of your operating budget to renting or paying mortgage payments. Another example of these costs is marketing expenses. This includes advertising, promotions and building a strong online presence through social media marketing and email campaigns. A third example is the cost of utilities, including electricity, water and internet.

You’ll also need to factor in the cost of any necessary equipment or software, such as point-of-sale systems, inventory management tools, and accounting software. Finally, don’t forget about insurance, which is essential to protect your business against financial loss in the event of theft, flooding or other covered losses.

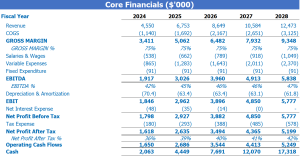

Children’s store financial forecast

Developing a financial model for a children’s store requires careful planning and analysis. A critical part of this process is creating a financial forecast that accurately predicts the future performance of the store. Financial forecasts typically include a profit and loss statement, a sources and uses report, and a cash flow statement. By carefully preparing these financial statements and projecting future income and expenses, store owners can make informed decisions and manage their budget to maximize profits.

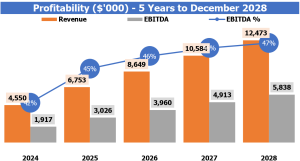

The profitability of children’s stores

Once we have constructed projections for revenue and expenses for a children’s store, it is important to analyze the resulting profit and loss (P&L) statement. This will allow us to assess the store’s profitability, including factors such as gross profit or EBITDA margin.

For a children’s store financial plan, it is important to take a thorough look at each item in the P&L statement, as it can offer insight into where costs can be reduced and profits can be maximized. By analyzing the P&L statement from top to bottom, you can build a children’s budget projection that explains every detail.

Tips & Tricks:

- Consider adjusting prices or margins for particularly profitable or unprofitable products or categories.

- Keep careful track of inventory levels and adjust orders as needed to minimize costs and maximize profits.

- Regularly review and adjust marketing and advertising budgets to ensure you are getting the best return on investment.

After you’ve done a kids store financial analysis or similar assessment of your kids store’s revenue forecast, take the time to consider what changes you can make to improve profitability. By constantly monitoring and analyzing financial statements, you can gradually improve the profit model of the children’s clothing store and the overall financial health of the business.

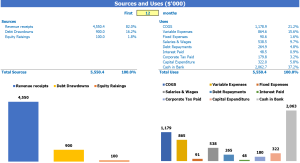

Children store sources and use graph

The sources and uses of funds in the financial model in Excel For Kids Store provides users with an organized summary of where capital is coming from sources and how that capital will be spent in uses. It is important for the total amounts of sources and uses to be equal to each other. Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

When building a financial plan for a children’s store, it is important to have a thorough understanding of where your money will come from (sources) and where it will go (uses). By carrying out a detailed financial analysis of the youth shop, it is possible to determine where the most important expenses and income are. By making kid’s business budget projections and toddler store revenue forecasts, it’s possible to get a comprehensive understanding of where your business stands.

Tips & Tricks

- Take your time when creating financial statements for your baby store and make sure all expenses/income are accounted for.

- Be sure to include contingencies in the children’s clothing store profit model to account for potential expenses.

- Performing an inventory valuation in your children’s store financial outlook can give you valuable insight into which items are selling well and which are not.

- Estimating children’s bookstore revenue should take into account factors such as shipping costs and book return policies.

- When evaluating your youth sports youth financial rating, consider both short-term and long-term goals.

- Perform a comprehensive children’s supply store cash flow analysis to ensure your business has enough capital to operate successfully without taking on too much debt.

In conclusion , building a financial model for a children’s store requires careful attention to all aspects of the business. From revenue projections to expense budgeting, there are many variables to keep in mind. By using the right financial statement templates and forecasting tools, business owners can better understand the economics of their children’s store. Incorporation Children’s store financial plans , Youth store financial analysis , Children’s budget projection , Toddler store revenue forecast , Baby store financial statements, Children’s clothing store profit model , Outlook Children’s Toy Store Financials , Children’s Bookstore Revenue Estimation , Youth Sports Store Financial Evaluation , and Children’s Supply Store Cash Flow Analysis Can help build a solid financial model for a children’s store. children.