Introduction

Cooperative banks play a crucial role in a country’s financial system as they often focus on providing services to underserved communities. According to the latest statistics, the cooperative banking sector is growing at a steady pace globally. However, valuing a cooperative banking business is a complex task that requires in-depth analysis of several factors. In this blog post, we will discuss some of the considerations and methods that can help you evaluate a cooperative banking business.

Evaluation Considerations of Cooperative Banks

- Market Trends and Economic Conditions: Current market trends and economic conditions play a crucial role in evaluating a cooperative banking business. It is important to consider factors such as interest rates, inflation, and economic policies that can impact bank performance.

- Analysis of financial statements: Analysis of financial statements is essential to determine the financial health of a cooperative bank. Key financial ratios like profitability, liquidity, and solvency can provide insight into the bank’s financial performance.

- Industry and Competitive Landscape: Understanding the competitive landscape and industry trends can help you assess how cooperative banking is performing against its peers. Factors such as market share, customer acquisition and customer retention are key in this context.

- Management team and strategy: A strong management team and an effective strategy can have a positive impact on the valuation of a cooperative bank. It is important to examine the bank’s leadership team, management practices and strategic initiatives to understand the bank’s growth potential.

Commonly used cooperative bank valuation methods

- Discounted Cash Flow (DCF): This valuation method estimates the present value of future cash flows that the bank is expected to generate.

- Price-to-earnings (P/E): This method uses price per share and earnings per share to determine the bank’s valuation.

- Price to Book (P/B): The P/B ratio estimates the value of the bank by comparing its market price to the book value of its equity.

- Dividend Reduction Model (DDM): This method uses expected dividend income to determine the intrinsic value of bank shares.

- Company Comparable Analysis (CCA): This method compares the financial and operating measures of Cooperative Bank to those of similar companies in the industry.

Valuing a cooperative banking business requires a combination of quantitative and qualitative analysis to gain a full understanding of its potential. By considering the factors and methods discussed in this post, you can arrive at a fair and accurate valuation of a cooperative banking business.

[right_ad_blog]

Comparison of valuation methods

Valuing a cooperative banking business can be a complex process, as there are different methods and factors to consider. Some of the commonly used valuation methods include Discounted Cash Flow (DCF), Price to Earnings (P/E), Price to Book (P/B), Dividend Reduction Model (DDM) and comparable company analysis (CCA (CCA ).

| Evaluation method | Benefits | The inconvenients |

|---|---|---|

| Discounted Cash Flow (DCF) |

|

|

| Price to Profit (P/E) |

|

|

| Price per book (P/B) |

|

|

| Dividend Reduction Model (DDM) |

|

|

| Comparable Business Analysis (CCA) |

|

|

Considerations

Market trends and economic conditions

When evaluating a Cooperative Bank Worth, it is important to consider market trends and overall economic conditions. For example, the way the economy is going has a direct impact on the bank’s financial performance. During periods of recession, consumer purchasing power declines, leading to reduced demand for loan products. Additionally, higher unemployment rates mean that more individuals will default on their loans, which is bound to have an impact on the bank’s financial performance.

As you begin your Cooperative Banks Assessment be sure to examine the overall economic picture, including market growth, trends and changes that could impact the bank’s performance.

Here are some tips to consider:

- Review the bank’s financial statements and look for any correlation between its performance and its economic indicators such as inflation rates, GDP growth and unemployment rates.

- Analyze the bank’s loan portfolio to identify the industries or sectors most affected by a particular economic trend.

- Consult industry reports, regulatory data and market data to help understand how the overall economy is proceeding and what effect it is having on the valuation of the cooperative financial institution.

Combining the Cooperative Bank Performance Assessment with an analysis of market trends and economic conditions, will give you a better understanding of how the bank operates and how it is likely to perform in the future. Remember that measuring Cooperative Banking ‘s value is not an exact science, and it often involves a combination of quantitative and qualitative assessments.

Analysis of financial statements

When evaluating a cooperative banking business, it is essential to consider the financial statements of the institution. The analysis of financial statements helps in evaluating the performance of the cooperative bank, which provides insight into the value of the bank.

Tips for evaluating the financial statements of a cooperative bank

- Look at profitability ratios such as return on equity (ROE), return on assets (ROA), and net interest margin (NIM).

- Analyze liquidity ratios like current ratio and loan to deposit ratio (LDR) to establish the ability of the cooperative bank to meet its obligations.

- Check efficiency ratios such as net interest income (NII) to interest free expense ratio, operational efficiency ratio and loan loss provisions (LLP) to measure the operational efficiency of the cooperative bank.

- Examine solvency ratios such as Capital Adequacy Ratio (CAR), Disposition Coverage Ratio (PCR), and Non-Performing Assets Ratio (NPA) to assess the financial stability of the cooperative bank.

By analyzing the financial statements of the cooperative bank, an investor can determine the financial health of the institution, identify areas of strength and weakness, and make informed decisions regarding the valuation of the organization.

Industry and Competitive Landscape

When evaluating a cooperative bank, it is important to consider the industry and the competitive landscape. Cooperative banks are financial institutions that operate on a cooperative basis, with ownership and control shared by its members. This unique business model can present both valuation opportunities and challenges.

An important factor to consider is the overall performance of the cooperative banking sector. This may include factors such as market growth, regulatory changes, and consumer behavior trends. Understanding these larger industry trends can help inform your valuation perspective and assess the health and potential growth of your cooperative bank.

Additionally, it is important to consider the competitive landscape of the cooperative banking sector. This may include direct competitors, as well as alternative financial institutions that may be vying for similar customers. Assessing the competitive environment can help identify your cooperative bank’s unique strengths and weaknesses and help inform your overall assessment.

Advice:

- Research market trends and regulatory changes affecting the cooperative banking sector.

- Identify direct and indirect competitors in your region or target market.

- Consider the unique strengths and weaknesses of the cooperative banking business model compared to other financial institutions.

Business analysis of the cooperative bank

When assessing the value of a cooperative bank, it is important to conduct a thorough analysis of the financial and operational performance of the business. This may include evaluating factors such as income, expenses, assets, liabilities, and cash flow. In addition, it is important to assess the effectiveness of the cooperative bank’s operations, including the performance of its management team and board of directors.

Another factor to consider when analyzing the value of a cooperative bank is the quality of its loan portfolio. Co-operative banks often have a unique focus on customer service and member support, which can result in a greater emphasis on lending to local businesses and individuals. Accordingly, assessing the quality of the loan portfolio and identifying potential risks is an important part of evaluating a cooperative bank.

Advice:

- Review financial statements, including balance sheets and income statements, to assess the financial health of the cooperative bank.

- Assess the effectiveness of Cooperative Bank operations, including the management and performance of the Board of Directors.

- Assess the quality of the Cooperative Bank’s loan portfolio and identify potential risks.

Calculation of the value of the cooperative banking enterprise

One method of valuing a cooperative bank is to calculate its enterprise value. Enterprise value is a measure of the total value of a business, including equity and debt. To calculate the enterprise value of a cooperative bank, you will need to sum up the market value of the bank’s equity, add the value of any outstanding debt, and subtract the cash and cash equivalents held by the bank.

Another important consideration when calculating the value of the business is to identify any potential synergies with other financial institutions or partners. Cooperative banks often have a strong community presence and focus on collaboration, which can present opportunities for partnerships and joint ventures. Identifying these potential synergies can help inform your overall assessment and provide insight into the cooperative bank’s potential future growth prospects.

Advice:

- Calculate the enterprise value of cooperative bank by adding stock value, debt value and subtracting cash and cash equivalents.

- Identify potential synergies to other financial institutions or partners that may impact the overall assessment.

- Consider opportunities and potential future partnerships when evaluating the assessment.

Management team and strategy

Before valuing a cooperative bank, it is essential to analyze the management team and the strategy of the institution. The team should have a set of competent, experienced and qualified professionals who can effectively manage the operations of the bank. Additionally, the bank’s strategy should be growth or consolidation oriented and should align with current market trends and consumer preferences.

Commonly used cooperative bank valuation methods:

Several methods are used to determine the value of a cooperative bank. Here are the commonly used ones:

- Peer Analysis – This method assesses the value of a bank by comparing it to similar banks in the industry.

- Discounted Cash Flow Analysis – This method estimates the present value of a bank based on its expected future earnings.

- Asset based valuation – This method values the bank based on its assets and liabilities.

- Dividend Cut Model – This method looks at the bank’s expected dividends and growth prospects to determine its value.

Advice:

- Use more than one assessment method for an accurate assessment.

- Consider factors such as the bank’s market share, customer base, profitability, and assets when valuing a bank.

- Perform a SWOT analysis of the bank to help identify its strengths, weaknesses, opportunities and threats.

- Consult banking and finance industry professionals for assistance with the assessment process

Performing a thorough appraisal of a cooperative bank is crucial in determining its value. The evaluation process consists of analyzing various factors that can affect the performance and profitability of the bank. By doing so, you can accurately determine a bank’s worth and make informed decisions based on the information.

Assessment methods

How to Value a Cooperative Banking Business

The valuation of a cooperative bank can be a complex process consisting of several valuation methods. The value of a cooperative bank can be determined by evaluating its financial statements, stock value, assets and liabilities, performance benchmarks and market trends. In this blog post, we will specifically discuss the discounted cash flow (DCF) valuation method and how it is used to assess the value of a cooperative banking business.

Discounted Cash Flow (DCF)

The DCF method is a widely accepted valuation approach used by financial experts to determine the present value of future cash flows. In this method, we project future cash flows over the lifetime of a cooperative banking business and then determine the present value of those cash flows using a specified discount rate. The result of the DCF analysis is the enterprise value of the cooperative banking business.

Advantages of the DCF method:

- It considers the time value of money, which means that future cash flows are discounted to their present value.

- It focuses on a company’s cash-generating ability which provides more accurate business value.

- It is based on future cash flows rather than historical earnings, which makes it more forward-looking and objective.

Disadvantages of the DCF method:

- The projection of future cash flows may not be accurate, which could result in an incorrect valuation.

- It requires a significant amount of data and effort to estimate future cash flows, which could be time consuming.

- The discount rate is subjective and may vary from analyst to analyst, which could lead to different values for the same cooperative banking firm.

Let’s take an example of XYZ Cooperative Bank. XYZ Co-operative Bank’s projected annual cash flow for the next ten years is 0,000, 0,000, 0,000, 0,000, 0,000, 0,000, 0,000, 450,000 $, 0,000 and 0,000. The discount rate used for the analysis is 10%. Putting these values into the DCF formula, the enterprise value of the cooperative banking business XYZ is calculated at approximately ,944,812.

However, it is essential to remember that valuation methods like the DCF should not be the only approach used to determine the value of a cooperative banking business. Rather, multiple valuation methods should be used to arrive at a fair and accurate valuation. The DCF method is a useful tool and can be used in conjunction with other valuation methods for a comprehensive cooperative bank business analysis.

Price to Earnings (P/E)

Price to Earnings (P/E) ratio is a commonly used valuation tool for cooperative banks. It is calculated by dividing the price of each share by earnings per share (EPS). The P/E ratio is a measure of how much investors are willing to pay for every dollar of profit generated by the cooperative bank.

Benefits

- The P/E ratio is easy to calculate and widely used.

- It is a quick way to compare the rating of different cooperative banks.

- It provides insight into investor sentiment and market expectations.

The inconvenients

- The P/E ratio can be influenced by many factors, including macroeconomic conditions, interest rates and investor sentiment.

- It does not take into account a cooperative bank’s growth prospects, dividend policy, risk profile or other factors that may affect its long-term earnings potential.

For example, if a cooperative bank has a P/E ratio of 15x, that means investors are willing to pay for every of profit the bank generates. A higher P/E ratio may indicate that the market has high growth expectations for the cooperative bank, while a lower P/E ratio may indicate that the market has concerns regarding the future earnings potential of the cooperative bank. .

Price per book (P/B)

One method for valuing a cooperative banking business is to use the Price-To-Book (P/B) method. This method compares the bank’s market value to its book value, which is the value of its assets less liabilities.

Benefits:

- Simple to calculate and easy to understand

- Can be used for profitable and unprofitable banks

- Considers the tangible assets of the bank

The inconvenients:

- It does not take into account the bank’s future earnings potential

- It does not take into account intangible assets such as brand value

- Book value may be overstated or understated due to accounting practices

For example, let’s say a cooperative bank has a market value of million and a book value of million. Using the P/B method, we calculated the P/B ratio as 1.25 ( million divided by million). This means investors are willing to pay .25 for every of the bank’s book value.

It is important to note that the P/B method should not be used in isolation to determine the value of a bank. It should be used in combination with other valuation methods to arrive at a more accurate assessment of the value of the cooperative bank.

Dividend Reduction Model (DDM)

The Dividend Reduction Model (DDM) is a commonly used and popular method to assess and assess the value of a cooperative bank. It is based on the assumption that the intrinsic value of a company is equal to the present value of all its future dividends. Essentially, it takes into account the dividends paid by the Bank and calculates the net present value of these dividends using a discount rate.

Benefits:

- Easy to understand and use

- Based on hard data such as past dividends and estimated growth rate

- Can be used for mature and growing businesses

The inconvenients:

- Relies on estimates and predictions of future dividends and growth rates, which may be subjective and potentially inaccurate

- Does not consider the value or risks associated with assets, liabilities or non-dividend paying

- Assumes that dividends will continue to be paid at the same rate indefinitely, which may not be the case

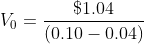

Consider an example of how to calculate the appraised value of a cooperative bank using the DDM. Suppose a cooperative bank has a dividend yield of 3% and is expected to grow at a rate of 4% per year. The bank paid a dividend of per share the previous year. Using the DDM formula, we can calculate the bank’s estimated value:

Or:

- V0 is the bank’s estimated value

- D1 is the expected dividend for the next year = x (1 + 4%) = .04

- r is the discount rate = 10%

- g is the expected growth rate = 4%

Plugging these values into the DDM formula, we get:

Therefore, the bank’s estimated value is .33. This means that if the bank were to pay out .04 in dividends per share and grow at a rate of 4% per year, the bank would be valued at .33 per share.

Comparable Business Analysis (CCA)

A comparable business analysis (CCA), also known as peer group analysis or relative valuation, is a widely used approach to evaluating a cooperative banking business. This method consists of comparing the financial ratios of the Cooperative Bank to similar companies in the industry to estimate its value.Benefits

- Provides a more accurate valuation as it is based on real market data.

- Relatively easier to understand and implement compared to other assessment methods.

- Allows for a range of estimates by comparing with different companies in the same industry.

The inconvenients

- Based on the assumption that comparable companies have similar business models, similar risk levels and similar financials.

- Ratings may not be applicable if there are no comparable companies in the industry.

- Market trends may not always align with the underlying value, which could lead to misinterpretations of data.

An example of ACC implementation might be evaluating a cooperative bank by comparing it to other cooperative banks of similar size in the region. By looking at the price to earnings (P/E) ratio of these companies and comparing it to the P/E ratio of the co-operative bank in question, we can determine whether the co-operative bank is undervalued or overvalued relative to its peers. Overall, the ACC can offer valuable insights into the competitive advantages, possible growth opportunities, and risks specific to a cooperative banking business. However, this should only be one of many methods used to assess the value of cooperative banking.

Conclusion

Valuing a cooperative banking business is a complex task that requires in-depth analysis of various factors. Choosing the right valuation method and considering market trends, analysis of financial statements, industry and competitive landscape, and management team and strategy can help arrive at a valuation. precision of a cooperative banking enterprise. Conducting thorough research and analysis can help investors make informed decisions and maximize their investment returns.