- Home

- Sales and revenue

- Running costs

- Financial

Office Supplies Store is a profitable business best suited for those who have a passion for providing excellent customer service. However, before you go all out and open an office supply store, you should have a clear financial plan in place to ensure your business is both successful and sustainable. A financial model is an essential tool to help you achieve this. In this blog post, we will guide you on how to build a financial model for an office supply store. Here are the critical components of a financial model for an office supply store:

- Office supply store revenue model

- Financial plan for the office supply store

- Office supply store business plan

- Office Supplies Supply Flow Projection

- Office Supply Store Profit and Loss Statement

- Office Supply Store Break-Even Analysis

- Office supply store sales forecast

- Office supply store start-up costs

- Office supply store marketing strategy

- Office Supply Store SWOT Analysis

Ferces Office Supplies Supplies and Sales Forecasts

One of the key components of an office supply store financial plan is a realistic revenue model that accurately forecasts sales. This is often created through a comprehensive sales forecast that includes launch date, ramp-up time, walk-in traffic and growth assumptions, customer and purchase assumptions, and seasonality of sales. sales.

Without an accurate and complete revenue projection, it can be difficult for an office supply store to properly plan and manage their financial resources, which can lead to cash flow issues and an inability to achieve profitability. Therefore, it is essential that office supply store owners take the time to develop a strong revenue model as part of their overall business plan and financial strategy.

Office supply store launch date

The launch date for your office supply store is very important because it sets the tone for the whole business. Choosing the right date can make or break your success in the market. It is crucial to carefully consider different factors such as competition, seasonal variations and consumer behavior.

The office supply store financial model template helps you estimate the start month for your business. However, you can choose to launch your business at any time.

If you plan to launch in the middle of the year while the financial model begins in January, you should prepare and plan activities and costs related to the launch of office supply store activities so that everything is in place when you start to operate.

Tips & Tricks:

- Conduct market research to identify the best launch date that aligns with the behavior of your target customers.

- Incorporate your office supply store’s financial plan, including sales forecast, cash flow projection, profit and loss statement, and break-even analysis, when determining the launch date.

- Create a comprehensive marketing strategy that will help you promote your business and attract customers from the launch date.

- Perform a SWOT analysis to identify any internal or external factors that may affect your business and adjust your launch date accordingly.

Office Supply Store Ramp Up Time

Sales forecasting is an essential step for any business, but it is especially important for an office supply store. Understanding sales ramp-up time is critical to creating an accurate sales forecast. The ramp-up period is the time it takes for your store to reach a steady level of sales, and it’s different for every business.

What is the ramp-up period for your business? This is how long your business will need to reach the sales plateau. In your industry, this can take several months, depending on the market and location. For example, if you start your office supply store in a highly competitive area with several other similar stores, it may take longer to increase sales than if you start a location with little competition.

Tips & Tricks

- Research the market and competition in your area to understand the duration of the ramp-up period.

- Create a solid financial plan that includes cash flow projections, profit and loss statements, and break-even analyzes to help you understand how long you can sustain the business during the ramp-up period.

- Develop a robust marketing strategy to help you attract customers during the ramp-up period and beyond.

- Perform a SWOT analysis to identify your strengths, weaknesses, opportunities and threats so that you can mitigate risks and capitalize on opportunities during the ramp-up period.

By understanding the sales plateau ramp-up time for your office supply store, you can create a more accurate sales forecast and develop a financial plan that explains the ramp-up period needed. By following these tips and tricks, you can increase your chances of success and build a profitable and sustainable business.

Office Supplies Store Walk-In Traffic Intarts

After the ramp-up period, our office supply store averaged 50 walk-in customers per day on weekdays. However, we noticed a significant variation in walk-in traffic depending on the day of the week. On Mondays and Tuesdays we averaged 40 customers per day, while Wednesdays and Thursdays averaged 55 customers each day. Finally, Fridays were our busiest days, with an average of 70 customers per day.

Having accurate walk-in traffic data is essential to building a financial model for an office supply store. Knowing the average weekday appointment traffic helps us determine how much inventory we should buy, how much staff we should have on hand, and what our sales forecast should look like. Without this data, we could not make informed business decisions.

Our sales plateau in the coming years, but we expect a growth factor of 5% every year in the future. Using this information, our financial model can accurately calculate future weekday walk-in traffic numbers for five years.

Tips & Tricks:

- Collect walk-in traffic data daily to get a fuller understanding and don’t miss a thing

- Segment customer data based on weekdays to identify sales trends and create accurate sales forecasts

- Periodically run the data to ensure it is up-to-date and accurate

In conclusion, walk-in traffic data is an essential part of an office supply store’s financial plan. It helps in making informed decisions and creating accurate predictions for the future.

Office supply store visits for sales conversion and repeat sales entries

When analyzing the success of an office supply store, one of the most important factors to consider is the number of visitors who turn into new customers. Based on an analysis of sales forecasts, the typical conversion rate from visitors to new customers is around 20%.

Another crucial element to consider is the percentage of repeat customers. Repeat customers can be an important source of revenue for stores, and on average, they can account for at least 40% of a store’s sales. Each repeat customer will purchase office supplies at a rate of approximately 0 per month, depending on the type and quantity of items they need.

It is essential to consider these values when developing a financial plan for an office supply store. Calculating conversion rates and repeating activities helps produce an accurate profit and loss statement, cash flow projection, and break-even analysis.

Tips & Tricks:

- Use customer loyalty programs to encourage repeat business

- Implement strategic marketing campaigns focused on driving conversion rates

- Offer a wide range of products and services to meet the needs of new and repeat customers

Office Foods Store Sales Mix Intarts

Your office supply store sells a range of different products, each belonging to a specific product category such as paper products, writing instruments, furniture, electronics, etc. It is important to understand the mix of sales by product categories in order to make informed financial plans.

Entering sales mix assumptions based on product categories is much easier to understand. Here is an example of a sales mix for a five-year forecast:

- Paper products – 40%

- Writing instruments – 25%

- Furniture – 15%

- Electronics – 10%

- Other – 10%

Advice:

- Make sure you have identified all relevant product categories for your store

- Based on past sales data, adjust percentages to reflect expected changes in demand or supply

- Use your sales mix assumptions to create financial plans such as a profit and loss statement and a cash flow projection

- Perform a SWOT analysis to determine potential threats and opportunities for your business

- Create a marketing strategy to track the contest.

Office Supplies Store Average Sale Amount of Admissions

Our office supply store sells a variety of products that belong to different categories such as writing instruments, paper products, office accessories and technology products. It is easier to enter assumptions at the product category level than at the product level. For example, instead of entering a hypothesis for each pen, we enter a hypothesis for the entire category of writing instruments.

One of the assumptions to be entered for each product category is the average sales amount per year. For example, the average sale amount of writing instruments for the first year may be .50 per unit while for the second year it may be .75 per unit. The average sale amount for each product category is then used in the estimation of the average ticket size (ATS).

- Office supply store sales forecast: Use the sales forecast to estimate the level of sales for each product category.

- Office Supply Store Profit and Loss Statement: Use the template to create a profit and loss statement for the office supply store.

- SWOT Analysis of Office Supply Store: Perform SWOT analysis to identify strengths, weaknesses, opportunities and threats for office supply store.

Tips & Tricks:

Seasonality of office supply store sales

Understanding sales seasonality is crucial for an office supply store because it can help plan for changes in demand and adjust inventory and marketing strategies accordingly. Sales seasonality refers to the sales pattern throughout the year and may be affected by holidays, weather and other external factors.

To calculate sales seasonality, one can use historical data to identify sales patterns throughout the year. For example, a store might find that sales are highest during the back-to-school season in August and September, and during the holidays in November and December.

Tips & Tricks:

- Pay attention to seasonal trends in your industry and adjust your marketing and inventory plans accordingly.

- Monitor weather conditions and adjust your product offerings accordingly.

- Use historical sales data to make informed decisions on inventory and marketing budgets.

To account for seasonality, an office supply store should create a sales forecast that takes into consideration the percentage deviation from average monthly sales per day. This can help determine expected revenue and assist with budgeting and cash flow projection. By understanding sales seasonality, an office supply store can create a solid financial plan and business plan that includes break-even analysis, profit and loss, and start-up costs. Additionally, performing a SWOT analysis and developing a solid marketing strategy can help increase revenue and maintain a successful business in a competitive industry.

Office office Store Operational Ferges Forecast

As part of the financial model for an office supply store business plan, the Operational Expense Forecast is a major component. The forecast considers major operating expenses, including cost of goods sold by products %, employee salaries and wages, rent, lease payments or mortgages, utilities, and other operating expenses.

| Cost of goods sold by products % | ,000 – ,000 |

| Salaries and wages of employees | ,000 – ,000 |

| Rent, lease or mortgage payment | ,000 – ,000 |

| Public services | ,000 – ,000 |

| Other running costs | ,000 – ,000 |

| Total | ,000 – ,000 per month |

Operational expense forecasting is crucial as it helps in determining office supply store break-even analysis and cash flow projection. An accurate projection can help business owners make informed decisions for their marketing strategy and overall financial plan.

Supplies Office Store Cost of Goods Sold

In order to determine your Cost of Goods Sold for your office supply store, you will need to make certain assumptions. These include the cost of the products you sell, shipping costs, packaging and any other costs directly related to the products themselves.

For example, if you sell pens, your cost of goods sold would include the cost of the pens themselves, any shipping costs associated with bringing them to your store, and any packaging costs incurred during delivery. packaging pens for resale.

Your overall cost of goods sold will be different for each product category. For example, your cost of goods sold for paper products will differ from your cost of goods sold for electronic products.

In general, a good rule of thumb is to keep your cost of goods sold at 60% or less of your total revenue.

Tips & Tricks:

- Create detailed spreadsheets for each of your product categories to accurately track your cost of goods sold.

- Consider renegotiating supplier contracts to help reduce your cost of goods sold.

- Regularly review and update your commodity cost assumptions to ensure they remain accurate and relevant to your business.

By carefully monitoring your Cost of Goods Sold and taking steps to keep them low, you can ensure that your office supply store remains profitable and successful over the long term.

Office Supplies Store Salaries and Wages for Employees

When starting an office supply store, it is important to consider wages and salaries of staff members. This includes what positions you will need to fill, when you will need to hire them, and how much they should be paid each year.

First, you’ll need to decide what positions you want to have in your store, such as a cashier, sales associates, or a manager. Once you’ve determined the positions, you’ll need to decide when each position should be filled, whether it’s at the start of your store or later.

Next, you will need to decide how much each person should earn each year. For example, a cashier might start at ,000 per year, while a sales associate might earn ,000 per year. A manager could earn ,000 a year. Finally, you will need to calculate the number of full-time equivalent (FTE) staff you will need to cover your business operations for the year.

Tips & Tricks:

- Consider hiring part-time employees to help reduce costs

- Look at industry averages to make sure you’re offering competitive salaries

- Be sure to consider employee benefits such as insurance and paid time off

By considering employee salaries and wages during the planning process, you’ll be able to include them in your financial plan, cash flow projection, profit and loss, sales forecast, and break-even analysis.

With a solid understanding of your staff needs and costs, you can develop a marketing strategy that supports your business plan and SWOT analysis, setting you on the path to achieving your supply store revenue model goals. Office.

Slow Store Office Supplies, Lease or Mortgage Payment

When creating a Financial Plan for an office supply store , one of the biggest expenses will be the rent, lease, or mortgage payment for the physical storefront. For example, if the office supply store is located in a busy and popular commercial district, rental costs may be high. However, if the store is located in a less professional area or in a cheaper city, the costs will be lower.

In the office supply store business plan , it is important to consider the costs of building the storefront. This can be done by researching different search and rental options in the area, or estimating a mortgage based on the purchase price of a building.

For the Office Supplies Flow Projection and Income Statement , the cost of the storefront should be factored into the expenses each month, along with other costs such as inventory and salaries. The Break-even analysis should also take into account the monthly cost of storefronts.

When creating a sales forecast or marketing strategy , store location and associated costs should also be considered, as this can impact foot traffic or the ability to attract customers.

Tips & Tricks:

- Consider negotiating with the landlord or realtor for a lower rent or lease payment.

- Research different areas or cities to reduce rent costs.

- Tive on any additional costs for alterations or building maintenance.

Office supply store utilities

When estimating the financial services of an office supply store business plan, it is important to consider the utility expenses that come with running such a business. Utilities expenses include electricity, water, gas and all other necessary services needed to run the business.

Utility assumptions will vary based on size of leased space and hours of operation. For example, an office supply store that operates seven days a week will have a higher utility cost than one that operates only five days a week. Additionally, a larger store will likely require more electricity to light and cool the space, leading to higher utility bills.

Tips and tricks

- Consider energy-efficient lighting options to help reduce electricity costs.

- Implement a recycling program to reduce waste disposal costs.

- Schedule regular maintenance checks on all equipment to ensure they are operating efficiently.

Having a detailed understanding of utility assumptions will help to accurately project office store cash flow projection, sales forecast, break-even analysis, profit and loss statement and overall financial plan of the company.

Office supplies store other running costs:

When developing a financial plan for an office supply store, it’s important to consider not only the obvious expenses such as inventory and rent, but also the other operating costs.

These could include costs associated with marketing strategy such as advertising, website design and SEO optimization. Other expenses may include software subscriptions, legal fees, insurance, and salaries for administrative staff who help manage the company’s finances.

It can be easy to overlook these expenses when creating a budget or cash flow projection, but they are critical to business success. Without a marketing strategy, for example, the store may struggle to generate enough sales to cover its expenses, and without an administrative staff, the store’s finances may become disorganized and difficult to manage.

Office supply store financial forecast

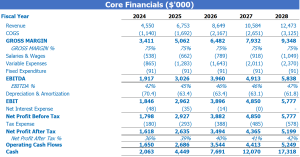

An office supply store’s financial plan is critical to its success. A Statement of Income and Sources and Uses Report should be included. These financial reports will be the foundation of the office supply store’s business plan , which will help you determine the necessary start-up costs and sales forecasts. The cash flow projection, break-even analysis , and marketing strategy will also be vital parts of your financial forecast. Moreover, the SWOT Analysis will help you identify the strengths, weaknesses, opportunities, and threats in the market, creating a better financial forecast.

Profitability of office supplies

Once we have created revenue and expense projections for an office supply store business plan , we can check the profit and loss (P&L) from revenue to net profit. This will help visualize “profitability”, such as gross profit or EBITDA margin. It is essential to keep track of the office supply supply flow projection and sales forecast regularly.

- Be sure to account for all office supply store start-up costs and track them closely.

- It is important to determine the office supply store revenue model and create a solid financial plan for your office supply store .

- Conduct a SWOT Analysis to identify strengths, weaknesses, opportunities and threats to your business.

- Develop a strong office supply store marketing strategy to attract and retain customers.

Tips & Tricks

Regularly reviewing the office supply store’s profit and loss statement and conducting a break-even analysis can provide valuable insight into the financial health of the business. Making informed decisions based on these results is crucial to improving store profitability.

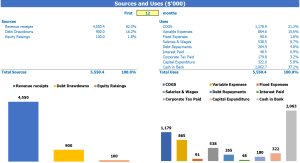

Store office supplies and chalkboard uses

Sources and uses of funds in the financial model in Excel for Office Supplies Store provides users with an organized summary of where capital is coming from sources and how that capital will be spent in uses. It is important for the total amounts of sources and uses to be equal to each other. Disclosure of sources and uses is particularly critical when the company is considering or going through recapitalization, restructuring, or mergers and acquisitions (M&A).

This chart is also essential for creating a comprehensive office supply store financial plan, including office supply store start-up costs, office supply store sales forecast, office supply store revenue model Office, Office Store Cash Flow Projection, Office Supply Store Profit and Loss Loss and Office Supply Store Breakdown Analysis. Office Store Marketing Strategy and Office Stores SWOT Analysis can also build on the sources and use the chart as a starting point to identify areas of opportunity to improve the bottom line.

Tips & Tricks:

- Update your sources regularly and use the chart to reflect changes in your company’s financial situation.

- Use the chart as a starting point for developing a comprehensive financial plan.

- Seek advice from financial experts or experienced entrepreneurs to ensure the accuracy and completeness of your sources and uses of a statement.

In conclusion, a financial model is essential to the success of any business, especially an office supply store . By building a financial plan and projections, you can determine your start-up costs , develop an income statement , conduct a break-even analysis , and predict your future sales and income. Adding a SWOT analysis and a marketing strategy to your financial model can complement your insights and help you make more informed decisions. By following these steps, you can create a complete financial model for your office supply store and pave the way to a profitable and successful future.