Related Blogs

- Using cash flow to increase profitability

- How to get out of debt and increase your finances

- Financial Modeling – A Beginner’s Guide

- Master Finacial Modeling: Learn best practices and principles

- How to create an income statement for your business

Financial planning is one of the key factors in the success of a business . Regardless of the size of the company, whether it is a small startup or an enterprise level organization, it is crucial that we know the direction the company is heading and what financial actions possibilities are needed to achieve financial growth.

Download the Excel template! Learn even more ⟶

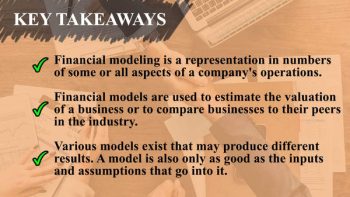

Financial modeling can be one of the most indispensable tools of financial analysts. It is a tool used to provide a clear representation of a company’s expected financial performance. Its importance is rooted in its ability to enable better financial decisions within a business. It involves the mathematical representation of crucial financial and operational data that can be used to assess how companies should react to particular economic events.

It contains the many different aspects of financial accounting and is structured around the three main accounting financial statements – The income statement, the balance sheet and the cash flow statement. These spreadsheets detail the company’s past financial data, forecast its future financial performance, and determine its risk and return figures.

What are the uses of financial modeling

There are many beneficial uses of financial modeling depending on what the organization aims to achieve. For most corporate finance activities, such as selling the business or acquiring more debt, financial models are very useful and usually the first analysis prepared.

In addition, financial models are used for different purposes, including:

- To better understand how an organization should react to certain financial and economic situations.

- Helps estimate the amount of money the business needs to borrow for operational expenses or growth.

- Determine the risk level of the project as well as the preparation that needs to be done.

- Resolve company financial issues such as slow growth, declining market share and high attrition rate.

- Enterprise value assessment for initial public offering or sale of businesses.

- Benchmarking for investment purposes.

What is the financial modeling process

Now that we have a clear understanding of what financial modeling is and its uses and purposes, we will dive into the process of financial modeling. Although there are several financial modeling platforms available, in practice the most widely used financial modeling platform is to use Microsoft Excel.

Although there are many financial modeling software tools available in the market today, most financial analysts still prefer the right way to customize financial models through the use of Excel.

The financial modeling process follows these few standard steps:

- Walk: Enter three to five years of historical financial information.

- Walking: Interpreting historical performance.

- Walk: Develop assumptions about future performance.

- Walk: Use the assumptions to forecast and link it to the income statement, balance sheet and cash flow statement.

- Walk: Perform a discounted cash flow analysis.

- Walk: Do a sensitivity analysis.

- Walk : Perform an audit and test the model.

3 tips to automate your financial models

According to a report by EY Finance Navigator, there are approximately 56 million available markets available for financial modeling software, which is the reason why there is an influx of different financial modeling software in the market.

While it may be true that Excel is still the financial modeling platform of choice by most financial analysts, the emergence of financial modeling software gives analysts the dilemma on whether to continue using Excel or migrate to more advanced financial modeling software. customizations, Excel has an advantage as it can be built from scratch, structured and formatted according to the requirement of the organization. However, it is error prone.

Download the Excel template! Learn even more ⟶

In contrast, financial modeling software scores when it comes to standardization, error prevention, and accuracy. It is also better when it comes to risk and sensitivity analysis. Another advantage of financial modeling software is that it can handle diverse and complex data sets, which Excel also has limitations.

For those who are still considering automating their financial models or sticking with traditional Excel, here are some tips on how to skillfully automate your financial models .

Reassess the purpose of your financial model

The decision to automate your financial models comes down to a number of factors, like the cost of the software, the market size of your industry, the insights you want to derive from it, and most importantly, the purpose of the financial model. If your business handles diverse and complex data and your focus is more on risk management analysis, it is advisable to use financial modeling software rather than traditional Excel.

Study emerging trends

By now, it’s easy to admit that many business intelligence tools and financial modeling software have their limitations. There are areas they mark on excel and there are areas they don’t. But we are talking about the current scenario and current development speed, these tools could evolve and improve their functionality. There are fintech resources that we can follow so that we can be updated on current trends.

Find the software that’s right for your business

There are many financial modeling software available in the market with varying degrees of functionality. Software with a high level of accuracy is ideal for risk management and sensitivity analysis, while others can scale diverse and complex datasets. Choose the software that would best solve all your financial insight problems and help you make better financial decisions.

To automate or not is the question

The traditional way of financial modeling may have the upper hand now, but with technology seemingly having the answer to almost everything these days, it’s only a matter of time before these financial modeling software and intelligence tools business can cope with and make the job of analysts easier. Until then, let’s move on to what technology offers.