Wanting to invest in real estate is awesome.

Wanting to make money with it is even better.

To achieve both, the course is strewn with pitfalls…

…find the right location, the right property, at the right price:

so many obstacles that could prevent you from taking action.

Today, I come back in detail to 3 points which seem to me to be essential to have analyzed before investing.

My goal: that you buy a profitable and quality property, while sleeping on both ears.

Let’s go.

Listen:

I’m not going to remind you of the obvious: the district where you want to invest is essential to the success of your investment . Well, you already know that.

On the other hand, I can show you how to quickly get an idea of a location that you do not know.

The trick is to use INSEE’s public reports on housing to find out the truth on the ground .

Indeed, the statisticians of this organization spend the majority of their time writing reports that (almost) no one reads.

Today is your chance to thank them for their hard work: by digging through their annual housing reports, you can form a solid opinion on the attractiveness of a neighborhood in a matter of minutes.

Percentage of tenants vs owners, average length of stay, number of rooms, average age, etc.

…everything is there.

It is an incredible source of information, completely free .

And for once, I can bet you that almost no one has the idea of going to dig into the files of INSEE.

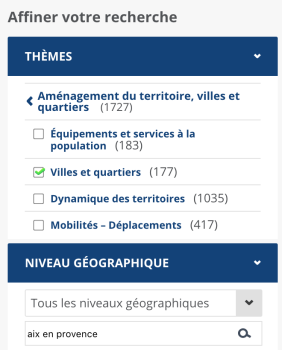

To access this valuable information, everything happens in the Living Conditions – Society section of the organization’s website:

By going to the appropriate category, the treasure opens little by little.

As we want to obtain information about a district, start your search in the Statistics section on a municipality, a department… The site should ask you to enter the location you want to study.

We are almost there. The data is then displayed to you by year. In Aix-En-Provence, the most recent data is for 2011.

Here, for example, we can see that vacant homes make up 8.4% of the stock, which is significantly above the national average. There is therefore a first red light on an investment in this area.

I also learn there that small dwellings are in the spotlight – more than 33% have between 1 and 2 rooms. I can deduce for example that the population is surely students, to live in such concise apartments. Indeed, Aix-En-Provence is one of the Top 10 student towns in France.

Thus, I know particularly where to place myself if I have to invest in this area: small housing.

We continue.

Here, I see that most people in Aix move around a lot: nearly 40% stay in their homes for less than 4 years. It is not negligible.

Thus, with INSEE, we were able to establish a diagnosis of the type of housing sought in our area, the rental vacancy and the typology of the city. The magic of these studies is that they are much more complete than that: from crime to infrastructure, through the level of average income, everything goes.

To access the rest of the studies, the procedure is essentially the same as described above. Everything is played in the menu on the left.

It’s an incredible wealth of information, which is more completely free.

Of course, the INSEE reports do not replace an on-site visit – but they can allow you in a few minutes to form an initial opinion on a geographical area.

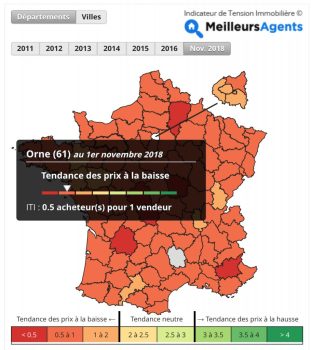

In addition to this, you can use another tool: the real estate tension indicator.

Overall, it allows you to assess the trend in real estate market prices, city by city. The Best Agents site, responsible for this indicator, gives you the number of existing buyers, for each seller in the area.

Arriving on their site, it is very clear:

By leaving the mouse over each of the departments, you obtain the exact ratio of buyers present for 1 seller. A good way to take the temperature of a department or a city.

Although studying the market and checking the rental demand is an excellent way to make a quality investment, there is really only one thing that matters in real estate: the money you earn.

And to assess profitability, for a long time investors each used their own Excel model.

Efficient, but the data had to be entered manually for each property studied, which can become very time-consuming in the long run.

To overcome this defect, the Internet revolution has given rise to automatic yield calculators such as Rental Yield.

I have already reviewed & explained it in detail in my previous article, and in particular on its incredible positive point: the integration with Bon Coin and SeLoger in order to determine gross returns on the fly when consulting ads. It’s an incredible time saver.

Today, I don’t want to talk about Rental Yield, but rather about its competitors.

Indeed, although it is very popular, it is good to spend its investment in several simulators .

For what ? Because some put more emphasis on taxation by asking for your taxable income; or even to check that there are no errors.

In addition to Rental Yield, other profitability simulators exist and are little known.

This article is an opportunity to highlight one.

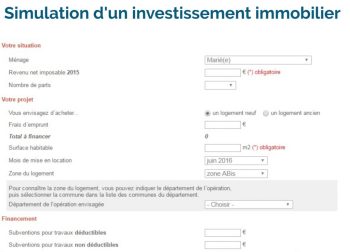

And not the least: it is the official simulator emanating from a State entity, the National Association for Information on Housing (ANIL)

The advantage of this simulator is to take into account the taxation by asking you for your taxable income, and above all no assumption of amount is made: it is up to you to fill in all your expenses and your income for your investment.

Using it therefore takes a little more time, but it allows you to be really precise about the data entered, and therefore to obtain profitability as close as possible to reality.

Thus, by going to the ANIL website, the simulator floods you with fields to fill in:

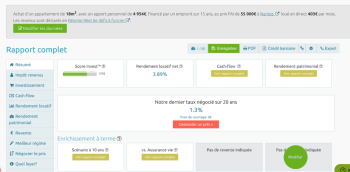

By entering my information, I immediately have access to the cash flow table, and its graphical representation, at your choice:

Thus, this (fictitious) investment will require me to save several thousand euros per year – which is not negligible.

Thus, I recommend using this indicator once you are on your short-list of 3 – 4 properties , which you have already visited, but for which you would like to verify the profitability in an official way, before taking action. . This is the tool you need.

Thus, with this ANIL simulator, which complements that of Rental Yield, you are sure that your profitability calculations are correct – this is essential if you want to earn money and make a profitable real estate investment.

The last big pillar to rely on to make sure you make money is taxation.

Often neglected, it is fundamental: even if you generate a strong positive cash flow, it would be silly to have to return it to the State at the end of the year through your income tax.

The goal is to keep as much money as possible for yourself.

With the tax authorities, 2 great leeway: the land deficit and the choice of the tax system.

When the difference between the property income and the deductible expenses of a property is negative, we say that we obtain a property deficit. The advantage of this deficit is that it can be carried forward over 10 years, and that it can be charged to the overall income for the year.

For example :

These 3,000 euros are directly attributable to property income for the next 10 years.

You can then allocate the 6,000 euros of deductible expenses to the rest of the overall income for the year, which has the mechanical effect of reducing the taxable income on the tax form.

Thus, taxation on property income will be nil over the year and will also lead to a reduction in taxable income. This is the magic of the land deficit.

In addition to this tool, you can further optimize your taxation by choosing an appropriate tax regime.

For small areas, furnished rentals offer a tax loophole making it possible to greatly optimize taxation: it is the status of Non-Professional Furnished Lessor (LMNP), which authorizes the deduction of property income from certain charges (as we have seen above), but also the depreciation of the asset.

Within the LMNP, there are two options: the Micro-BIC tax regime or the real regime.

In Micro-BIC, you benefit from a 50% reduction on your receipts, but you cannot create a deficit. It is therefore interesting if your expenses are less than 50% of your property income. It should also be noted that this scheme is only applicable if your property income does not exceed 32,900 euros.

Instead of the Micro-BIC, you can opt for the real scheme. There, many charges are deductible (work, loan interest, taxes, trustee fees, etc.) including the depreciation of the property. It is therefore a perfect choice if your expenses exceed 50% of your property income.

For those who would like to know more, the excellent book by Maître Le Boulc’h explains in detail the tax mechanisms of furnished rentals.

Other tax regimes exist, in particular for bare rental. BOFIP, the bible in the field, can guide you.

Thus, making sure to make a profitable investment is based on 3 main pillars: an in-depth statistical study to form a clear opinion of the district, particular attention paid to the figures, and finally to an optimal choice of taxation in order to keep a maximum of your property income in your pocket.